China 2025 Outlook: E-Commerce Trends and Electric Vehicle Leap

Shaping the Future with Innovation and Competition

Here's to a prosperous and exciting 2025!

Tech Buzz China kicks off the year with a look ahead at two transformative sectors in China: e-commerce and electric vehicles (EVs). By 2025, instant retail is set for rapid growth, though intense competition could lead to price wars, impacting players like Alibaba’s Hema (Freshippo) and Dingdong Maicai. JD.com will expand, refining its services and supply chains to stay competitive, while platforms like Pinduoduo and Alibaba will focus on balancing merchant and consumer needs. Global e-commerce players like Temu and Shein will continue to dominate, with Shein’s IPO and Temu’s strategic pricing reshaping international markets.

In the EV sector, China’s electric vehicle market is primed for explosive growth, driven by falling battery costs, autonomous driving advancements, and increasing demand for sustainable mobility. Domestic leaders, particularly BYD, will lead the charge, benefiting from strong government support and innovations in battery tech, autonomous driving, and sustainable production. Supported by government policies and investments in charging infrastructure, China’s EV market is set to define global standards for electric mobility.

Tech Buzz China’s 2025 outlook highlights the trends shaping the next phase of China’s tech-driven transformation, spotlighting an increasingly competitive and innovative market landscape.

As a new year’s present we have made this article available to all subscribers. If you want to be kept up to data about these topics and others, including industrial robots and AI in China, consider gifting yourself a paid subscription for 2025 and get full access to all articles and the Tech Buzz China archive.

Cheers,

China E-Commerce and Retail Trends

Instant Retail

Instant retail, fast home delivery of food and non-food from local stores and warehouses, has been one of the leading e-commerce growth sectors in recent years. According to the National Bureau of Statistics and Industry data, from January to August 2024, China’s instant retail scale grew by 26.2%, much higher than the growth rate of 3.4% in total retail sales of consumer goods and 8.9% in online retail sales. Instant retail is becoming a red ocean and will continue to develop rapidly in 2025.

A 10 minute overview of the instant retail sector.

Several companies have already become profitable in 2024, and more are on the brink of profitability and expected to break even in 2025. However, the heating up of this sector, comprising multiple business models operated by various companies, could trigger another price war. If it does, those with heavy asset investments and smaller margins, like Alibaba’s Hema (Freshippo) and front-end warehouse operator Dingdong Maicai, might be pushed back into the red. This scenario is not unlikely since Meituan Xiao Xiang (formerly Meituan Maicai) has plans to expand in Eastern China, which is Dingdong’s ‘territory’.

Source: 老张聊零售 WeChat Official Account

Rumours of the sale of Ele.me by Alibaba have died down. It seems Alibaba has realised Ele.me’s importance in instant retail and its core domestic e-commerce business. Therefore, it will hold on to Ele.me. The company will further expand the fast delivery of goods bought on Taobao, helping Ele.me towards profitability in 2025.

Meituan will continue expanding its lightning warehouse strategy, enabling retailers to set up ‘dark stores’ and expand the number of SKUs and the average order value. However, the lightning warehouse market is entering a fierce price war now that too many entrepreneurs have set up warehouses. 2025 will probably bring a shakeout of entrepreneurs who cannot optimise their supply chain to deliver the best selection of goods at the best prices.

Visit to a lightning warehouse during a recent ChinaTechTrip tour with Tech Buzz China research editor Ed Sander.

JD could buy the remaining shares in Dada Group and further integrate JD Now (previously JD Daojia) into its businesses. It might also open up more 7Fresh stores and related front-end warehouses, although it will not be as successful as its role models, Sam’s Club and Hema (Freshippo).

e-Commerce: attention to merchants

2024 has been a year in which many Chinese e-commerce players focussed on low prices, even more so than in previous years—partially driven by low consumer confidence and partially by the continued success of Pinduoduo. In 2024, players like Douyin and Taobao started emulating PDD’s ‘refund only’ policy, in which consumers who complain get their money back but don’t have to return the goods. Before long, many consumers started abusing this policy, and merchants’ profitability was seriously hurt.

Most of PDD’s competitors have started to reverse these policies or make the rules much stricter. Even the government has criticised the ‘refund, no return’ policies. Meanwhile, PDD has also moved towards a more friendly relationship with merchants, softening its penalty system for merchants with good reputations on the platform. This also applied to those selling on Temu.

After all the pressure on sellers, 2025 will be the year e-commerce players start paying more attention to balancing consumer and merchant needs. PDD has already announced and started an upgrade to ‘high-quality merchants’; we expect this to become a central theme in 2025. In 2023, Jack Ma told Alibaba staff to ‘get back to the internet, get back to Taobao and get back to the customer’. For Alibaba, the customer isn’t just the consumer; it is even more so the merchants since they generate revenue through commissions and advertising.

New Retail

Talking about Alibaba, Ma’s ‘get back to the internet’ referred to abandoning new retail initiatives that are not part of the company's core business. Hema (Freshippo) seems profitable after refocusing on core business units (Xiansheng and NB/Outlet). While rumours about a possible sale have quieted down, Alibaba just sold its 99% stake in Intime department stores at a loss of $1.3 billion. We originally had the sale of Alibaba’s majority stake in Sun Art, the parent company of retail chain RT-Mart, with a considerable loss as a prediction for 2025. However, the news was faster than this publication, as the sale was confirmed on January 1st.

While selling Sun Art will came with a considerable loss, it will rid Alibaba of an asset-heavy business and enormous headcount (86,000+).

RT-Mart has been diversifying into supermarkets and membership stores. The latter are mostly ‘me too’ initiatives trying to copy the success of - again - Sam’s Club. Having seen how Alibaba’s Hema X has not been a success, we don’t expect RT-Mart’s M Stores to fare much better.

With Alibaba recently selling Intime and Sun Art, we don’t rule out the possibility of it selling Hema. In fact, we expect Alibaba to sell more of the non-core businesses it acquired during the 2010s. On the other hand, Alibaba might hang on to Hema because of its role in instant retail.

Another trend worth mentioning is Pangdonglai. This supermarket chain from Henan has been all the rage recently. In a nutshell, Pangdonglai has been doing very well financially by focusing on customer service and employee satisfaction. We would summarise Pangdonglai’s approach as ‘keep the stakeholders happy’.

Looking at the approach of Pangdonglai, we can’t help but think that this emulates the approach of many Western supermarket chains, and while it might be remarkable for China, it doesn’t seem all that unique by Western standards. However, Pangdonglai has become a standard in China, with many supermarket chains like Yonghui starting test stores with the PDL approach. Miniso was so impressed that it bought a stake in Yonghui. We expect this typical me-too hype to die down in 2025.

Local services

We have written extensively about the local services fight between Meituan and Douyin in 2023 and 2024. The battle has come to a (temporary?) cease-fire, with Douyin having carved out a market share, especially in in-store business. But Douyin’s food delivery has remained disappointing. Its product offerings have not matched Meituan’s, and Douyin lacks an in-house efficient delivery army, depending on partnerships with Ele.me or the merchants' delivery partners.

Given Bytedance’s current focus on abandoning loss-making businesses, we would not be surprised if, in 2025, the company stopped its food delivery business after many failed attempts in the past years.

Live Commerce

Having reached a ceiling in the traffic it can push to live commerce, we expect Douyin to focus more on optimising shelf e-commerce (search-based e-commerce in Douyin Mall) in 2025. As advertising budgets have declined and Bytedance has experienced limited growth, it might, like Alibaba, abandon some non-core business units in 2025.

We expect the power of the ‘big KOLS’ like Li Jiaqi to further decline as fatigue with these stars sets in among their audiences. We would not be surprised if the pressure this puts them under will result in a few more scandals in 2025.

Going overseas

TikTok Shop (TTS) will roll out in more European countries, but as in the UK and USA, we expect the reception of live commerce to be lukewarm, and TTS will continue not to meet its targets. In Europe, we expect TTS to emphasise e-commerce through short videos instead.

Meanwhile, Temu will continue to raise its prices in mature markets until they reach about 85% of Amazon's price. Quality will continue to improve due to the focus on high-quality merchants. However, like AliExpress before it, Temu will struggle to convince brands to join its semi-managed and 3P models until it has shaken off its reputation for harmful quality goods. Temu might launch a version of the ‘10 billion subsidies’ program that parent company Pinduoduo launched several years ago in the domestic market. This could result in branded goods appearing on the platform through the ‘grey channel’ and forcing brands to rethink their aversion to Temu and take back control.

After ‘getting on the bus before buying the ticket’, Temu will continue improving compliance with local legislation, especially in the European Union. Meanwhile, it will try to deal with potential tariff increases in the US.

Shein will see its IPO in London but might have a lukewarm reception owing to the constant controversy surrounding it and its lack of sufficient transparency in the eyes of the market. Shein will use the new funds to fight Temu and build more production and logistical facilities in Turkey and Latin America. While Shein has not been doing as well as Temu in non-clothing categories and probably will continue to struggle, we expect these investments to make Shein even stronger in the apparel categories.

Merging Alibaba's domestic and international e-commerce business units might give AliExpress a new boost. Still, we don’t expect it to overtake Temu and Shein in growth, as AliExpress will continue to be a lower priority in the multifaceted Alibaba Group and show less agility than its competitors.

The US might see new tariffs, although the de minimis rule might not be abolished entirely, as it could also seriously hurt American businesses (including Amazon). Temu (and other Chinese cross-border players) will use manufacturing and logistics in places like Vietnam and Mexico to circumvent possible tariffs. Although there are also calls to the EU to abolish the 150 euro tax-free import threshold, we expect it to remain sluggish in taking action. This will give Temu ample time to adjust its business model to a larger share of shipments from local warehouses.

Amazon Haul will struggle to compete with Shein and Temu because its visibility is limited in the main app.

Meanwhile, Chinese brands will continue to enter foreign markets. Luckin will expand beyond Singapore and Malaysia into the US. Meituan’s Keeta might launch operations in a European country after testing the waters in Hong Kong and Saudi Arabia. However, being a company with fewer resources, Dingdong Maicai might struggle in that same Middle Eastern country after its recent launch. Miniso will expand further into the US and Europe. Helped by Temu’s semi-managed model and 3P marketplace, more Chinese brands will also enter foreign markets.

China Electric Vehicle Trends

By 2025, China’s electric vehicle (EV) market is expected to grow significantly, driven by a projected 30-40% reduction in battery costs according to the China Association of Automobile Manufacturers (CAAM), and the increasing competitiveness of domestic EV brands. This growth is fueled by advances in battery technology, government policies, and shifting consumer preferences, setting the stage for more affordable and technologically advanced EVs that will reshape the automotive landscape both in China and globally.

Key drivers of this transformation:

Battery Technology Advancements: Economies of scale, driven by companies like CATL and BYD, are lowering battery costs. Innovations in NCM (Nickel Cobalt Manganese) and LFP (Lithium Iron Phosphate) batteries are improving energy density and reducing reliance on costly materials. Solid-state batteries, currently in development, are expected to further reduce costs and enhance performance.

Charging Infrastructure Expansion: China’s charging infrastructure has seen significant growth, with private chargers driving the majority of the increase. Public chargers have grown at a slower pace. The demand for affordable electric vehicles is rising, particularly in smaller cities. East China leads in public chargers, and lower-tier cities are experiencing growth, supported by policies promoting rural charging infrastructure.

"One Leader, Multi-Strong" Market Structure: BYD remains the dominant player in China’s automotive market. Other domestic brands like Geely, Chery, and Changan are strengthening their positions through competitive pricing and technology. Emerging players such as NIO, Xiaomi, and Xpeng are also gaining traction with smart innovations and strong branding. As the market matures, BYD leads, while other brands solidify their positions, creating a competitive environment with one dominant player and many strong competitors.

The convergence of battery technology advancements, supportive policies, rising domestic competition, and evolving consumer preferences will drive China’s EV market to new heights by 2025, with global implications as Chinese manufacturers expand internationally.

Battery Cost Reduction: A Key Factor in EV Market Evolution

As the EV market continues to evolve, understanding the primary drivers behind battery cost reduction is crucial. Battery costs are decreasing due to a combination of economies of scale, breakthroughs in battery chemistry, and more efficient raw material procurement strategies. These factors are enabling automakers to lower production costs, improve vehicle affordability, and expand the adoption of EVs globally. Chinese battery leaders such as CATL and BYD are at the forefront of these developments, leveraging their scale and innovation to reduce unit costs, while their advancements in battery technologies and supply chain optimization promise to shape the future of the EV industry.

Economies of Scale

The scale of production is one of the major contributors to falling battery costs. Chinese battery giants like CATL and BYD are significantly increasing their global production capacity, leading to economies of scale. As these companies optimize supply chains and improve manufacturing processes, unit costs are dropping. For example, according to its Annual Report 2023, CATL’s increased output has led to a more than 20% reduction in battery pack costs in recent years. Furthermore, BYD announced that it has leveraged its intelligent production lines and standardized processes to reduce battery costs by approximately 15% over the past two years.

Battery Chemistry

From the perspective of battery types, companies such as BYD and CATL have been actively developing and mass-producing high-energy-density lithium iron phosphate (LFP) batteries. This has led to a significant reduction in costs, while their advantages in safety and long lifespan have become increasingly prominent. LFP batteries are particularly important as they use more abundant and cheaper materials, reducing reliance on costly metals like cobalt and nickel. These factors, along with their widespread application in the mid-to-low-end market, have collectively driven a gradual increase in the market share of LFP batteries. According to data from industry associations, the total installed capacity of domestic power batteries reached 346.6 GWh (including commercial vehicles) from January to September 2024, representing a year-on-year growth of 35.6%. Of this total, LFP batteries accounted for 247.5 GWh, making up 71.4% of the market and showing a year-on-year increase of 42.4%.

Raw Material Procurement and Optimization

Fluctuating prices of key raw materials like lithium, cobalt, and nickel significantly impact battery production costs. To mitigate this, companies like CATL and BYD are securing stable supplies through partnerships with mining firms.

CATL has invested in mining and formed joint ventures with companies such as Ganfeng Lithium (SHE: 002460, Market cap: 9.21B USD) to stabilize metal access and reduce cost volatility. BYD, in turn, is partnering with lithium producers and exploring cobalt-free technologies to minimize exposure to price swings. CATL’s involvement in lithium mining and BYD's move toward cobalt-free batteries allow them to navigate the most volatile segments of the EV value chain, ensuring more sustainable and stable production.

This focus on securing stable raw material supplies is also a key component of CATL’s broader strategy to expand its global footprint. To further enhance its global presence and access international capital, CATL has announced plans for a secondary listing in Hong Kong as early as the first half of 2025. This move will support its continued expansion into critical overseas markets, particularly in Europe and North America, reinforcing its position as a global leader in the EV battery sector.

CATL's “Chocolate Battery Swap” Solution

CATL's "Chocolate Battery Swap" solution brings a new approach to the electric vehicle industry, addressing the dual pressures of cost reduction and innovation faced by automakers. The name "Chocolate Battery Swap" comes from the design of its battery modules, which resemble the shape of chocolate, highlighting the modularity and ease of replacement. This design enhances the efficiency and scalability of battery swapping. Through standardized battery design, automakers can significantly reduce R&D, production, and supply chain costs, while focusing resources on intelligent features and differentiated competition. The solution not only improves battery compatibility but also fosters the development of a battery swapping ecosystem, driving a restructuring of industry collaboration models and promoting cross-brand, cross-model resource sharing.

CATL announced their "Chocolate Battery Swap" solution Source: 电动势

Solid-State Battery Development

According to recent industry reports, Hyundai is preparing to produce solid-state batteries promising longer range, faster charging, and higher energy density, but mass production is expected only by 2030. Meanwhile, Chinese companies are leading the way in this emerging technology. CATL is already testing 20Ah solid-state samples, while BYD continues to release new patents. Automakers like Chery, SAIC, and GAC are also advancing solid-state battery plans, with Chery aiming for a 2026 launch and SAIC set for mass production by then. FIRMLI, a Shanghai-based company founded in 2021, specializes in high-safety sulfide-based solid-state lithium batteries and materials, with technology from Shanghai Jiao Tong University. In October 2024, it began mass production of these batteries, followed by the establishment of a GWh-scale production line in Wuhu, positioning China as a global leader in the solid-state battery market.

Charging Infrastructure Expansion

According to the Autohome Research Institute, as of September 2024, China’s charging infrastructure reached 11 million units, up 50% YoY, with 2.8 million new chargers added in the first nine months. Private chargers make up 70% of the total, with a 26% increase, while public chargers grew by just 9%, indicating a slowdown in public infrastructure development. The demand for electric vehicles continues to rise, particularly for models priced under 200,000 CNY (28,000 USD), which are gaining popularity in second- and third-tier cities, where price sensitivity is higher.

Regionally, East China holds nearly 40% of public chargers, with provinces like Guangdong, Jiangsu, Zhejiang, Shanghai, and Shandong leading. Lower-tier cities are a significant growth area, supported by policies promoting rural charging infrastructure, further driven by the rising demand for more affordable EV options.

Intensifying Competition in China’s EV Market

As battery costs continue to fall and technology improves, competition in China’s EV market is intensifying. Domestic players like BYD, NIO, and Li Auto are increasingly challenging established international brands, especially in the mid-to-low-end market segments. According to CAAM, domestic brands already commanded over 70% of the market share in 2023, and projections suggest that EV sales in China will exceed 10 million units by 2025, accounting for 40% of total vehicle sales. These brands are putting unprecedented pressure on traditional international automakers like BMW, and Mercedes-Benz, particularly in terms of pricing and technological features. The growth of local competitors in China is reshaping the global competitive landscape, as Chinese brands are gaining both market share and technological credibility.

Plug-in Hybrids and Extended-Range Vehicles

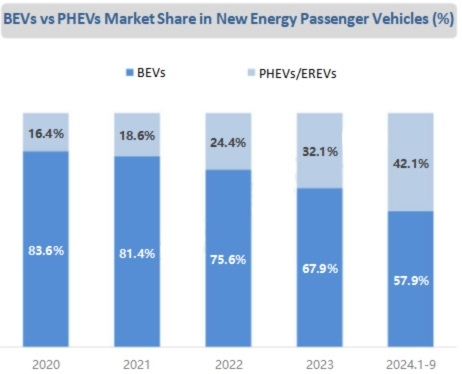

According to the latest market analysis, Plug-in Hybrid Electric Vehicles (PHEVs) and Extended-Range Electric Vehicles (EREVs) are driving the growth of China's new energy vehicle market. In 2024, PHEV and EREV sales surged 85% year-on-year to 4.5 million units, while Battery Electric Vehicles (BEVs) grew by only 16%. PHEVs and EREVs, offering longer range and lower battery dependence, now account for 40% of the Chinese market, with expectations to reach 50% by 2025. Domestic brands like BYD are leading, with their sales projected to exceed 5 million units by 2025. This growth is spurred by technological innovations in battery range and smart features, intensifying market competition.

PHEVs and EREVs are also addressing range anxiety in cold climates, with strong sales in China’s northeastern and northwestern regions. By 2025, new energy vehicles are expected to surpass internal combustion engine (ICE) vehicles, capturing 56% of the market, while ICE sales decline.

Image source: 汽车研究院

Shared Mobility

We've previously discussed how China is leading the way in the Robotaxi market and the rise of shared mobility is reshaping the EV landscape. According to the media, NIO has partnered with the European ride-hailing app FREENOW to provide its electric vehicles to taxi companies in Germany. Didi Chuxing has also collaborated with 12 automakers to advance its new energy shared vehicle services, supporting car-sharing and smart analytics systems to optimize operational efficiency and enhance user travel experiences.

NIO’s partnership with FREENOW Source: eletric-vehicles.com

According to a forecast by Oliver Wyman Forum, China's mobility services market is expected to reach $55 billion by 2030. Ride-hailing, taxis, and "car-as-a-service" are expected to account for about 90% of this market, totaling $50 billion. This surge in shared mobility is driving up demand for both BEVs and PHEVs/EREVs, with commercial vehicles in high-mileage segments like ride-hailing accumulating four times more miles than private vehicles. With low operating costs, BEVs are ideal for commercial use such as taxis and ride-hailing, consistently making up about 8% of their market. PHEVs/EREVs addressing range anxiety while offering an EV-like experience are favored by consumers, with 99.2% used as family cars.

The shared mobility market also drives the growth of the battery-swapping model. Baidu’s sixth-generation L4 autonomous vehicle has adopted battery swapping as its energy replenishment method. Unlike manual charging, battery swapping can be fully automated, requiring no human intervention and reducing labor costs. Additionally, while charging a vehicle typically takes at least 30 minutes, battery swapping takes only up to 3 minutes. For 24/7 services like Robotaxi fleets, which may need to recharge twice daily, battery swapping could add nearly an hour of extra operation time per vehicle each day. This increased uptime allows for more service availability and improved operational efficiency.

Companies like NIO, SAIC Group, Geely Auto, CATL, Didi, Hello, and Meituan have all invested in this field. Two major alliances have emerged: NIO’s Battery Swapping Alliance and CATL’s “Chocolate” Battery Swapping Alliance. These alliances aim to standardize battery swapping to reduce development and operational costs while expanding the number of swapping stations to support the ecosystem's sustainable growth. As swapping stations increase, so do the number of compatible vehicle models. According to research by CITIC Securities, the rapid commercialization of autonomous ride-hailing and taxis is expected to drive significant growth in battery-swapping demand.

Looking Ahead

On the very first day of the new year, major automakers unveiled their 2024 annual sales figures. As Tech Buzz China EV Trip tourleader Lei Xing aptly puts it: "Hitting 100,000 units a year is the threshold—if you can’t reach it, you might as well pack it up."

Image source: Lei Xing. @leixing77

In 2025, China's automotive market is expected to experience several key trends:

Market Growth: China's automotive market growth will slow in 2025, with only a 2% increase due to macroeconomic pressures, despite trade-in programs and local subsidies.

New Energy Vehicles (NEVs): NEVs are expected to surpass traditional fuel vehicles, reaching 15.7 million units and capturing 56% of the market.

Domestic Brands: Domestic brands are forecasted to hold over 70% market share, driven by NEV growth.

International Expansion:

Chinese automakers will expand globally, with exports projected to reach 5.5 million units, led by NEVs.

Localization strategies will address trade barriers.

Industry Competition:

A "multi-strong" industry structure will emerge:

BYD: Leading the market with a vertically integrated NEV supply chain.

Chery & Geely: Maintaining strong positions.

New players like Xiaomi and Huawei are accelerating their entry into the market.

Xiaomi's Performance:

Xiaomi's SU7 model achieved strong sales from March to September 2024, securing third place in the mid-to-large car segment.

Xiaomi delivered 135,000 vehicles in 2024 and aims to reach 300,000 in 2025.

Price Wars:

Ongoing price competition will pressure profit margins but may drive technological innovation.

Market maturation will reduce opportunities for new entrants and intensify competition.

Technological Integration:

Intelligent features like high-speed NOA (Navigation On Autopilot) will become key differentiators.

Cross-Industry Expansion:

Companies like Geely, GAC, and XPeng are diversifying into sectors like the low-altitude economy and humanoid robots.

Reference

Six degrees Intelligence, a leading global expert network/quantitative research firm that operates in China. Also reports from various research and consulting firms. Augmented with information from the articles below: