Staggering Hippo - Part 1: Ultimate Guide to Alibaba’s Hema (Freshippo) Store Formats

A history of hit and miss concepts.

2016 – 2017 – How it all began

2017 – 2019 – A tsunami of failed concepts

Going down – Concepts for the ‘sinking market’

Going up: Hema X Membership Store (a.k.a. ‘Store X’)

Introduction

When we publshed our two-part series on Alibaba’s faltering New Retail strategy, we promised to return to Hema (Freshippo), Alibaba’s supermarket chain, at a later date. That time is now.

We discussed Hema in Redefining Fresh: Alibaba's Freshippo and the New Frontier in Grocery Business one year ago. While that article focussed on the state of Hema at the start of 2023, we will now explore how it got there and what has happened since. We will present two extensive articles to you. The first article, which you will find below, is an updated version Ed previously published on the ChinaTalk.nl website. It is therefore available for free for all readers.

In this article, we look at Hema’s history and the many different formats it launched through the years. Many of them come with their own fascinating background stories, but overall, the story of Hema’s formats is hit and miss. The article includes many pictures Ed took through the years when visiting Hema locations, which should be helpful to those who have never seen one of those stores inside.

In the second article we will publish next month, we pick up the story in 2023 and discuss Hema’s extreme strategic turnaround and everything that happened after that.

Whether you consider Hema a success or failure based on these two articles, it has thoroughly changed the omnichannel supermarket business in China, and there’s a lot to learn from its case.

Note: Alibaba calls Hema Freshippo (yes, with one ‘h’) in English, but in this series, we’ll continue to use Hema because it is easier to differentiate the different concepts using this name.

Freya Zhang and Ed Sander, Research Editors

Rui Ma, Consulting Editor

(click on the images above for information on the Tech Buzz China team)

2016 – 2017 – How it all began

The story of Alibaba’s Hema brand actually started at Alibaba’s competitor, JD.com. A JD employee, Hou Yi, had proposed a rudimentary plan for the Hema concept to JD founder Richard Liu. Hou hoped to create an offline sales channel for JD, including supermarkets, department stores, speciality stores, cake shops and more. When Hou didn’t get any support for his ambitious plan, he packed his bags and moved to Alibaba, where he started the Hema project and became its CEO. [1] Hema was established in Shanghai in 2015 with a team of 7 people, later increased to 18 people. [1b]

Since then, Hema has grown into a chain of more than 350+ stores in 29 cities. [2] Ironically, JD.com would later launch a Hema clone called 7Fresh. It had 49 stores in 2022…

Some say that Hema’s growth is relatively slow by Chinese standards. However, given the relatively new asset-heavy brick-and-mortar store industry that it embarked upon with Hema, Alibaba has probably been relatively cautious about its investments.

An essential reason for Alibaba starting the Hema concept was the sharply rising acquisition costs of online customers for e-commerce platforms due to increasing competition. At the same time, many internet companies had started initiatives in fresh food e-commerce, among which the now defunct Miss Fresh we wrote about in Need for Speed 2: Can the front-end warehouse model ever be profitable?. Existing e-commerce players were interested in these high-frequency purchases that could be a gateway to sales for other product categories. Still, they were struggling to find a feasible business model.

And so, as part of a set of different New Retail initiatives, Alibaba launched …

Hema Xiansheng (a.k.a. Hema Fresh, Freshippo)

Hema Xiansheng is, without a doubt, the best-known format of the Hema brand. Many people who have heard of ‘Hema’ won’t even be aware of other formats. The first Hema Xiansheng store opened in Shanghai in January 2016 and received a $150 million investment from Alibaba in March 2016. In the following years, it became the star of Alibaba’s New Retail PR campaign. [2b] The concept initially kept a low profile, but when competitors took notice, Alibaba could only accelerate, and Hema was widely publicised in the period 2016-2018. Some readers will remember the iconic picture of a smiling Jack Ma holding up a king crab at a visit to a Hema store.

Hema Xiansheng was a unique concept when it launched. The only thing I’d seen in Europe that came close to it was an Eataly in Rome, a multi-floor supermarket incorporating various restaurants. But Alibaba took this concept much further and developed a supermarket with the following features, all facilitated by a special Hema app: [3]

Buying groceries in an offline supermarket.

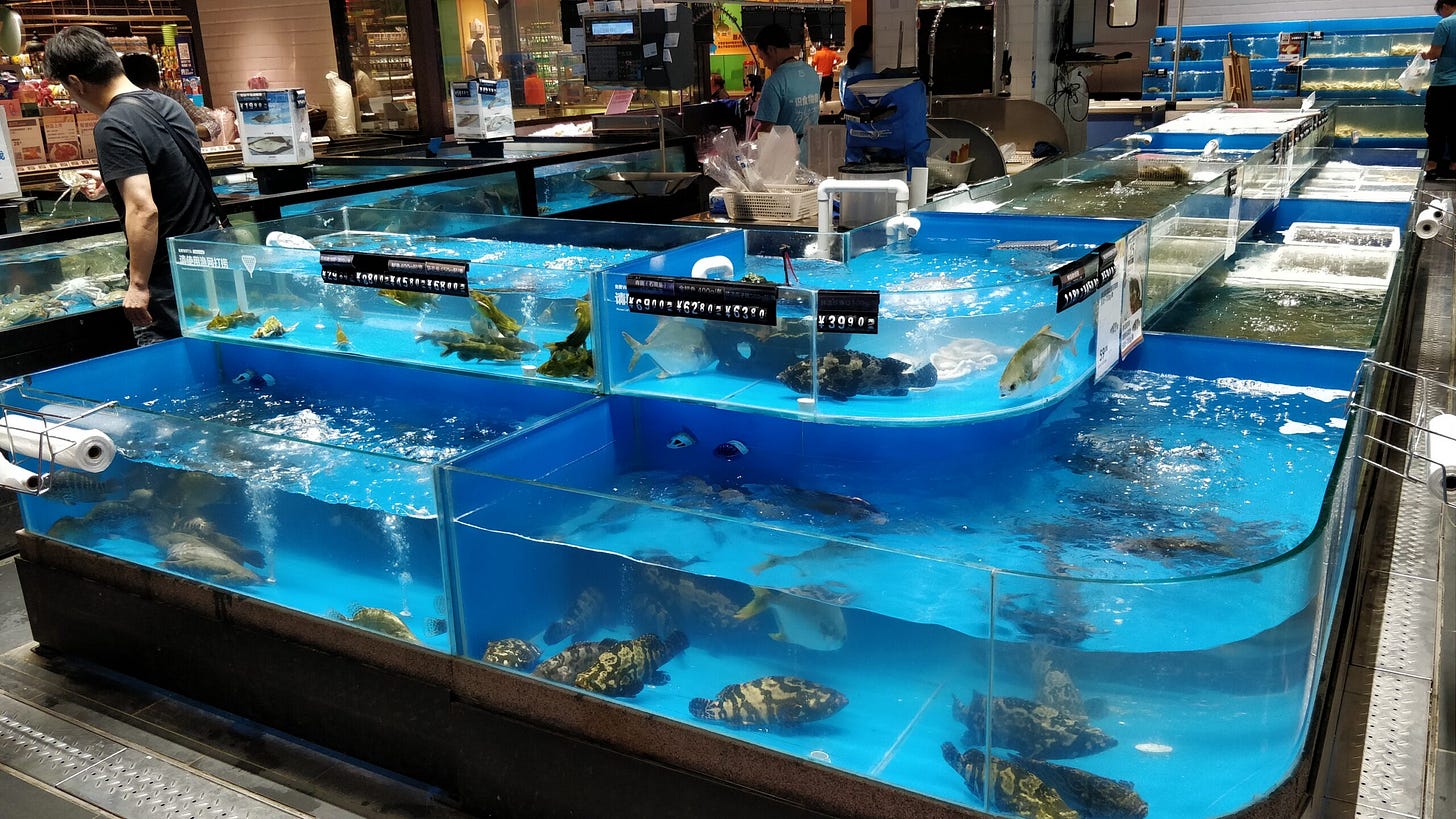

Choosing and having fresh products (mainly seafood) prepared for consumption in the store. In many Hema stores, much of the space was dedicated to catering. Hema rents out these food stalls and charges the operators a 20% commission.

You can order products on the spot in the app and have them delivered to your home later within 30 minutes. Hema makes home deliveries within a radius of 3 kilometres around the store. Nowadays, about 60% of all Hema Xiansheng purchases are done online.

For those who have visited a Hema Xiansheng store, one of the most memorable things is the conveyor belt system below the ceiling. Order pickers with handheld devices place bags with parts of a consumer order in this transport system, which takes the bags from different parts of the store to the adjacent warehouse. Fast-moving SKUs are stored in that warehouse, while the long tail of products is picked in the store.

An order for an individual customer is consolidated in the warehouse and handed over to the couriers waiting at the back of the store. As such, Alibaba created a store that is also a fulfilment warehouse for online orders. This combination of the ‘store plus warehouse’ model has become a standard for many other supermarket chains active in instant retail.

The Hema app facilitates all features at Hema, which is, of course, linked to other Alibaba apps like Alipay (mobile payment for online orders) and Taobao (e-commerce). When scanning the barcodes on the products (the store has free Wi-Fi), the consumer is offered elaborate information about the origin of the goods. This is supposed to give consumers more trust in the quality and safety. The app also provides personal recommendations based on the data that Alibaba has gathered about the customer.

In 2018, I created the video below about Hema.

In Hema Xiansheng stores, payment at check-out counters must be made using the Hema app. Annoyingly, trying to pay with the Alipay app will not work at Hema, although cash payment is sometimes an option at the service desk (but who still carries cash around in China?). By making the app near-mandatory, Hema collects a lot of SKU-level data about its customers. Coupled with all the other data that Alibaba collects on its various platforms and apps, you will understand what made ‘new retail’ so interesting for Alibaba.

But this also works the other way around. Hema can use Alibaba’s big data capabilities and information on the number of residents, age groups, past purchase amounts, and the surrounding businesses and residences to determine whether the potential customer count for a new Hema location meets the requirements. Hema Xiansheng stores are primarily located in areas with a high concentration of residential communities. [4] Alibaba could also use its large Taobao and Tmall customer base to kickstart a Hema business.

More so than other supermarket chains, Hema focuses on fresh food products, with seafood, meat and poultry, and vegetables making up over 30% of its total product categories and 50% of its sales. Since fresh products are repurchased frequently and meet consumers' basic needs, they occupy an important position at Hema. And as the sales of fresh products grew, the proportion of ancillary products and snack foods increased simultaneously.

The freshness of products is emphasised by packaging some products with a clean number that represents the day of the week. [4] In 2018, Hema got caught up in a scandal when staff at a Hema store were seen repackaging products in bags bearing the next day’s number. Hou Yi apologised, saying that the general manager in the store had been fired and that the most severe punishments would be given to anyone who violated the regulations in the future. [5]

Tuesday’s bread at Hema.

The price levels at Hema were higher than in other supermarkets, which it justified with superior quality. Hema Xiansheng targets affluent citizens born in the 80s and 90s. About 70% of its customers are 25-38 years old. ‘He Qu Fang’ (盒区房) has become a common term for the house within the Hema home delivery service area and is almost a status symbol in China. According to 2019 research, houses in these areas sold seven days faster than houses that are not in these areas. [6] However, we don’t know if this causality has been scientifically proven…

Hema calls itself a ‘membership store’, where membership means that you must be a Hema app user, although there is also an official membership program for those who pay an extra fee.

Profitable?

With Hema Xiansheng, Alibaba found a way to attract online customers with an offline store. It first lured curious but naturally suspicious Chinese consumers to the store with seafood catering and then convinced them with the product quality and reassuring information in the app. On average, each store served about 156,000 customers.

After opening a store, online orders can reach 5,000 per day in two or three months. Mature stores saw 60% of their orders originating online. [7] Hema hoped that eventually, 80%-90% of orders would be placed online, making it clear that physical stores were not Hema's primary goal (this would change in later years). While the store has its role, it mainly served as a place where the consumer gets to know the brand and product range and would then frequently order online, only visiting the physical store sporadically.

Indeed, many customers eventually migrated to ordering some or all their groceries from home in the Hema app. And it’s especially these cross-channel customers who buy both online and offline who turned out to be the most valuable.

In 2018, the average order value of an online customer was RMB 75, and an offline customer was RMB 113. Customers who only bought online spent RMB 279 per month, and those who only bought offline spent RMB 228. However, customers who purchased both online and offline spent RMB 575 per month.

In the early years, Alibaba’s investments in offline stores were not received without scepticism. Still, it claimed that Hema’s revenue per square meter was about 3 to 5 times higher than those of competitors’ stores.

But those figures said little about Hema’s actual profitability. Alibaba only shared that most individual Hema stores were profitable within 12-18 months of launch, and after 60% or more purchases came in online.

When Alibaba made various business units responsible for their own profitability in 2021, the Hema brand was one of them. In 2021, a former head of the North China fresh food supply chain shared that of the 300 locations Hema had at the time, those in Beijing and Shanghai were fully profitable. Those in Guangzhou, Shenzhen, Jiangsu, and Zhejiang were expected to reach profitability by mid-2022. By the end of 2022, Hema Xiansheng had to be profitable as a whole.

Hema Xiansheng’s gross profit was 24%—25.5% at the time. When providing free shipping, fulfilment costs accounted for 10%, but if a delivery fee was applied, costs could be reduced to 2%. Warehousing costs were 1.7%, and store rental was 2%—2.9%.

When calculating net profit, daily operating expenses of 3% needed to be considered. Labour costs are 3%, depreciation approximately 2%. After these costs are deducted, stores only run a small net profit.

In 2021, Hema tried to improve its profitability by:

Better product selection principles to ensure that products were more in line with market demand and consumer preferences.

Including suppliers into a partner system and launching the "X Zero Plan". This program allowed suppliers to receive more support through co-brand development and exclusive sales, which helped suppliers and Hema provide more competitive products.

Examples of co-branded products.

Hema also tried to increase the number of paying members, leading to a 1% decrease in sales expenses. Paid memberships would reduce the frequency of promotional activities, further optimising costs and increasing efficiency.

Hema hoped to increase its gross margin from 25% to 27% through these measures. This would reach the sales gross profit level of traditional 7-11 convenience stores and be higher than that of conventional supermarkets such as Yonghui and Walmart.

In late 2022, seven years after the brand’s launch, Hema announced its Hema Xiansheng stores were profitable. [8] A few months later, in 2023, Hema claimed the whole Hema brand was profitable. Shortly after, Alibaba announced that Hema planned to go public in the next 6 to 12 months. This never happened, as we will see in part 2 of this series.

A new growth strategy

Don’t be fooled by the news that ‘Hema opened 12 new stores on the same day’. With the brand's rising penetration in first—and second-tier cities, the speed at which new stores were opened slowed down after 2019. That year, Hema even started closing some lossmaking stores.

Clearly, Hema needed new growth strategies. One involved launching different Hema retail formats, which we will discuss below, and another involved enlarging the service area of existing stores.

Early 2023, Hema Xiansheng started pilots to expand the delivery radius from 3 kilometres in half an hour to 5 kilometres in one hour. Expanding the delivery radius is less costly than opening more Hema Fresh stores in the same city; each store costs about RMB 20-30 million to launch. [9]

Many consumers in this expanded radius are already familiar with the Hema brand. Research showed that 5.4% of Hema’s online orders come from places outside Hema’s service area. [10] If the increase in the delivery radius pays off, Hema considered launching new stores in lower-tier cities where a 3 km radius would offer too few customers.

However, customers and delivery staff have had mixed reactions to the extended delivery range. Customers complained about late delivery while couriers worried about the workload and income distribution. Some Hema Xiansheng stores have 50 to 100 delivery staff, but when orders surge due to ‘membership day’ every Tuesday and Wednesday, there are often cases of late delivery. [11]

Remarkably enough, when Hema first launched, the delivery radius was actually 5 km, but Hema soon scaled it down to 3 km after negative customer feedback. For the 3-5 km range, it now uses extra protective materials for cold/frozen and hot products. It also adjusted the order-picking layout in the stores and optimised distribution planning.

Overambitious

When Hema was launched, Alibaba’s Jack Ma said he foresaw “enormous challenges” in the future for companies that were only active online. At the time, Alibaba also suggested that it did not want to open a large number of Hema stores but mainly wanted to use Hema to show other retailers what was possible with data and the integration of online and offline. [3] As we described in The Collapse of Alibaba’s New Retail? - Part 2: Hypermarkets, Supermarkets and Convenience Stores, Alibaba did indeed roll out the Hema concept of its conveyor belts and home deliveries to RT-Mart, part of Sun Art Retail, of which Alibaba is the majority shareholder.

But Hema clearly became much more than th suggested pilot model. In 2019, Hema even announced it planned to open 2,000 stores by 2022 and would be present in 200 cities by 2030. [12] Five years later, at the time of publication, there were only 350 stores (including Hema Minis, see below) in 29 cities.

These figures tell us two things. First, if the preference of helping third-party retailers with the Hema technology over self-operation ever existed, it must have been abandoned long ago. The possible reason could lie in the failed experiment with RT-Mart in the Hexiaoma we described in The Collapse of Alibaba’s New Retail? - Part 2: Hypermarkets, Supermarkets and Convenience Stores. Second, Hema has a history of setting overambitious goals that are hard to deliver. Indeed, as we will see, the story of Hema’s early years is one of overpromising and underdelivering.

2017 – 2019 – A tsunami of failed concepts

Hema realised it needed to differentiate its retail concept to reach new regions and different consumer demographics. Not so long ago, former CEO Hou Yi said at the Hema New Retail Supply Conference that Hema wanted to reach one trillion yuan in sales and service one billion customers. To achieve that goal, having Hema Xiansheng stores in the higher tier cities would not be enough. That’s why Hema has been testing several other concepts through the years.

Under the Hema brand, Alibaba has tried 13 formats (plus several related initiatives we’ll discuss later).

All Hema formats through the years. Bold printed consumer-facing formats still exist today.

Many formats launched in 2019 tried to solve the problem of reaching consumers that the regular Hema Xiansheng stores could not reach, either geographically or because of consumers’ budget restraints. Hema Xiansheng, Hema X and Hema Mini are all targeted at the middle-class consumer, while concepts like Hema Neighbourhood and Hema Outlet serve the ‘common people’ like the elderly and people of lower income classes. [13]

In this chapter, we will closely examine the many concepts launched in 2018 and 2019.

Note: the first Hema-related concept was Hexiaoma (盒小马), a cooperation with RT-Mart which we discussed last March. We won’t repeat ourselves here; suffice it to say that Hexiaoma was meant to be a smaller version of Alibaba’s Hema Xiansheng supermarket. The stores would use Hema’s technology, offer catering stalls and focus on imported seafood and private labels. RT-Mart would be responsible for the supply chain and store management. However, the cooperation failed, and the stores quickly resembled small RT-Marts instead of small Hemas. RT-Mart eventually renamed the Hexiamoa to Xiaorunfa (小润发), ending the link to Hema.

We’ll get back to Hexiaoma when we discuss Pick ‘n Go.

Image: Sina News.

Despite its popularity, it’s not been smooth sailing for Hema Xiansheng. Between 2016 and 2019, it grew from 6 to 85 stores, but sales per square meter continued to decline from RMB 56,000 for the first store in 2016 to 20,000-30,000 for all stores in 2018. Hema decided to launch differentiated concepts for different target groups. [15]

In March 2019, former Hema CEO Hou Yi announced that several new store types would be added to the Hema brand:

Hema F2 (盒马F2)

Hema Farmers’ Market (盒马菜市, Hema Cai Shi)

Hema Mini (盒马mini)

Hema Small Station (盒马小站, Hema Xiao Zhan)

Hema Pick ‘n Go

In early 2020, Hema released the following video about these new formats.

Let’s look closely at these concepts launched in 2019, most of which have already disappeared.

Hema F2 (盒马 F2)

Hema F2, which actually already launched in November 2017, was a convenience store concept with an area of about 500 square meters and catering as the core business, including fast food, tea, snacks, lunchboxes, etc. It was targeted at businesspeople and located in office areas in business districts. The F2 stands for ‘Fast & Freshmade’ (or ‘freshade’ according to the signs in the picture below). The Hema F2 concept has disappeared from the market, never having made much of a splash.

Hema F2 (source: still from Alibaba video)

Hema Farmers’ Market (盒马菜市)

Hema Farmers’ Markets were located near large residential communities and in the suburbs. In Shanghai, I visited a Hema Market in 2019. The similarities and differences with a Hema Xiansheng store immediately struck. Clearly, this new concept under the Hema umbrella was aimed at a very different target group, namely the middle-aged, more price-conscious generation who usually shops at the traditional ‘wet market’ where individual traders display their fruit, vegetables, meat and fish on large tables.

Walking around in a Hema Market felt like shopping in a cross between a regular Hema Xiansheng store and such an old ‘wet market’. Compared a Hema Xiansheng store, you would find less trendy catering and a smaller version of the ‘seafood’ department Hema Xiansheng had become famous for and which appealed more to a younger target group. Instead, there seemed to be a greater emphasis on vegetables.

Hema Market also offered 30-minute home delivery. According to reports in the trade press at the time, future Hema Markets would also have services such as laundry, hairdressers, fitness, childcare, etc.

The few Hema Farmers’ Markets that opened have all closed.

A Hema Farmers’ Market in Shanghai in 2019.

Hema Small Stations (盒马小站)

Hema Small Stations, the first of which opened in May 2019, were stores in areas where Hema was unable or unwilling to establish a full-fledged Hema Xiansheng store. The Small Stations mainly served as a front-end warehouse and only offered delivery (no store) within a 1,5 km radius. They were comparable to other companies using the front-end warehouse model, like Ding Dong Maicai, Meituan Maicai (now Meituan Xiao Xiang) and Miss Fresh.

Regarding the front-end warehouse model, Hou Yi said: “I also use Dingdong Maicai and study them. I found that three problems cannot be solved. One is that there is no offline store. The second is the low gross profit margin. The third is the daily waste of fresh products.” [16]

Therefore, it is no surprise that Hema Small Stations wasn’t a success and was abandoned in March 2020. Some locations were upgraded to Hemi Mini stores (see below). Of all the Hema formats, this is the only one I haven’t had a chance to visit.

Note: We discussed the challenges Hema Small Stations faced in our October 2023 article Need for Speed 2: Can the front-end warehouse model ever be profitable?

Hema Mini (盒马 Mini)

Hema Mini, a community supermarket, was one of the experimental formats the company opened in June 2019. At the time, big supermarket chains like Yonghui, RT-Mart and Carrefour were all testing small store formats. The concept focused on lower prices and target groups in the suburbs of first- and second-tier cities and other areas that did not meet requirements for a regular Hema Xiansheng, such as population density.

Also, where there was no room for a large Hema store, Alibaba could roll out a Hema Mini. They would find their way to the outskirts of major cities, but they were also suitable for smaller cities in China. Thus, Alibaba hoped to eventually cover the whole of Shanghai and Beijing with Hema Mini locations, thereby greatly expanding the service area for home delivery.

There were apparent differences between Hema Mini and regular Hema Xiansheng stores:

The smaller size of 500-1,000 m2 (compared to 3000 - 6000 for Hema Xiansheng).

As a result, there is a more limited product range (1,200 – 1,500 SKUs) (compared to 6,000 - 8,000 at Hema Xiansheng).

Unpackaged vegetables are used instead of Hema’s characteristic bags with numbers indicating the day of the week.

There is no conveyor system under the ceiling (the store is small enough for order picking).

More competitively priced than some other nearby supermarkets.

A relatively large share of live and iced seafood products.

Delivery within a radius of 1.5 instead of 3 kilometres.

A much smaller surface area for catering. More sales of simple snacks.

More opportunity for cash checkout to cater to older customers.

In short, it is a stripped-down version of Hema Xiansheng. While a Hema Xiansheng store costs at least 20 million yuan to open, a Hema Mini only costs 1/10th of that. Hema Mini stores mainly aimed to compete with conventional convenience stores like 7/11. They would have a USP over these stores because they offered more fresh products, up to 40% of the assortment.

The initial plan was to completely self-operate Hema Minis, opening 100 stores per year and having them account for up 50% of Hema’s total revenue. Hou Yi even said, “The Hema Mini store is the ultimate model of fresh food e-commerce.” However, the lack of a franchise model resulted in slow expansion: it only opened 14 shops in 2019.

A Hema Mini in Shanghai 2023.

In March 2020, Hema announced that the small number of Hema Mini stores had proven that the concept could be profitable and would be rolled out. The 70 Hema Small Stations would be closed, and many would be transformed into Hema Mini stores. [17]

At the end of 2021, a former head of Hema’s North China fresh food supply chain shared that there were 50 Hema Mini stores, some of which had begun to make a profit. He expected the full format to become profitable in 2022. Economies of scale in the Hema organisation and lower costs for rental and equipment of Hema Minis were expected to help make reach profitability faster than a Hema Xiansheng.

Still, in August 2022, many Hema Mini stores in Beijing and Shanghai closed. According to review app Dianping, by October 2022, only 13 stores were in operation. [15] In early 2023, Hema Mini only made up 5% of Hema’s total revenue [18], quite a stretch from Hou Yi’s target of 50%.

One of the problems that Hema Mini has faced is intense competition. The concept is not as unique as the Hema Xiansheng stores and does not differentiate much from existing small supermarket chains. When the price at Hema Mini tends to be a bit higher, many consumers tend to vote with their wallets and will accept lower quality at other shops. Besides this, Hema Mini, which was separated from Hema Xiansheng, also had problems staffing its organisation, with frequent replacements and a lack of ambition.

With Hema Xiansheng and Hema Mini separated in the organisation, there was also the issue of internal competition. While online orders in the Hema app were geographically split into blocks, avoiding competition between the two formats, the same was not true for offline sales. After all, customers will decide for themselves whether to go to a nearby Hema Xiansheng or Hema Mini. Since Hema Mini does not offer extensive catering, it could easily lose business to a nearby Hema Xiansheng. [18]

In 2023, it was reported that Hema planned another attempt to expand Hema Mini stores in the ‘sinking market’ (lower tier cities and rural areas) and open a large number of stores.

Hema Mall (盒马里, Hema Li)

As if small supermarkets and snack shops weren’t enough, Alibaba and shopping mall chain Shirble opened ‘Hema Li’, or ‘Freshippo Mall’, in Shenzhen at the end of November 2019. Like so many modern Chinese shopping malls, the 40,000 m2 Hema Li consisted partly of shops and partly of restaurants. It had close to 60 tenants.

The idea behind Hema Li was that it could combine Shirble’s experience with offline malls and Hema’s online and digital expertise. At its opening, 100,000 products from the mall’s stores were available for online purchase. [19] Moreover, the mall was supposed to be a go-to place for weekend family outings. The mall was positioned as a ‘community mall’ and contained various household services, such as beauty salons, hairdressers, and educational enterprises for children.

After the news of its opening in Shenzhen, little was heard from Hemi Mall. A Linkshop reporter visited the mall in April 2022 and found it almost deserted, unlike the shopping streets outside (to be honest, not an uncommon sight in other malls in China nowadays). [19] Many brands had already withdrawn from the Hema Mall, and many catering locations had closed, like the former pharmacy, martial arts hall and children’s swimming pool. The ‘Hema Butler’ desk with community services had also disappeared as had the picture book museum for kids. Hema Mall in Shenzhen was a shadow of the place it used to be…

Shenzhen Hema Li’s picture book museum in 2019 (left, China Skinny [20]) and 2022 (right, source: Linkshop [19])

According to the Linkshop journalist, Hema Mall’s problem was that the surrounding area already had many grocery options in supermarket chains and wet markets. As such, Hema Xiansheng was not an important reason for people to visit the mall. Some people would only go to the Hema Xiansheng in the mall during the evening when many fresh products were discounted. The educational enterprises in the mall were also affected by the ‘double reduction’ policy that limited profit-based after-school tutoring in 2021.

Of all the Hema concepts I have visited, I was most challenged to get my head around the Hema Mall format. The Hema Mall in Beijing was like a shopping mall (as in ‘a group of stores’) within a larger shopping mall. If it weren’t for the Hema Mall sign, you would not even know you’d entered it. Besides the Hema Xiansheng store inside the Hema Mall, there was little to link it to the Hema brand. Overall, it felt like a concept meant to create revenue from services to brands and reminded me of many failed cooperations with brands in Alibaba’s Tmall Smart Shop initiative.

Hema Li in Beijing, 2023. This includes a service centre for picking up items ordered online and Hema Butler (盒马管家 Hema Guanjia) services like housekeeping and manicures.

According to Baidu Maps, there were six Hema Malls in Beijing, Shenzhen, Wuhan, Shanghai, Hangzhou and Chongqing in mid-2023.

But when my Tech Buzz China colleague Freya visited the Hema Mall in Shenzhen, she found it was no longer there. Hema had purchased the naming rights for the building for a while, but when these expired, they were changed back to Shirble. It’s therefore questionable how active the other Hema Malls still are…

From Hema Mall back to Shirble (Shenzhen, March 2023, photo by Freya Zhang)

Hema Pick ‘n Go / Hexiaoma (盒小马)

With Hema Pick ‘n Go, Alibaba opened a shop that sold (breakfast) snacks in the summer of 2019. The small 20-50 square meters shops offered about 40 different products, including the ‘jian bing’, an extremely popular breakfast pancake (see photo below). The average order value was RMB 20-30, which is relatively high compared to many hole-in-the-wall shops and street sellers that sell the same goods.

Pick ‘n Go was competing with the breakfast offerings of many established fast-food chains like McDonald’s, KFC and Burger King, which had also successfully launched Chinese breakfast options. But Pick ‘n Go claimed to have USPs in having more Chinese food types and higher ordering convenience. Customers could place an order via the Hema app and pick their food up in a locker on their way to work, avoiding having to queue during rush hour. The concept was advertised as “order food in 10 seconds on your mobile phone and sleep 10 minutes longer every day”.

As the video above shows, some Hema F2 stores also incorporated a Pick ‘n Go locker system.

Unfortunately for the writer, a big jian bing enthusiast, the store was ‘closed for maintenance’ (often a Chinese way of saying it is closing) when I visited, but photos can be found on the Chinese review site Dianping (right).

About 90% of the products sold at Pick ‘n Go were shared with Hema Xiansheng. These products were pre-produced at Hema’s central kitchens. [21]

In July 2020, after having tested the concept for a year, Hema announced that Pick ‘n Go had been ‘upgraded’ to Hexiaoma (盒小马) and that it would open 60-80 Hexiaoma stores covering the entire Shanghai subway line system, business districts and core office buildings. [10][11] This was confusing because, as we’ve seen, together with RT-Mart, Hema had been running a different kind of store, a small supermarket, under the same brand name. Clearly, something was amiss in the cooperation between the two parts of the Alibaba conglomerate.

While RT-Mart renamed the Hexiaoma to Xiaorunfa, Hema aimed to open 1,000 Hexiaoma Pick ‘n Go stores in 3 years. But in 2021, the review app Dianping only showed nine stores. [23] Meanwhile, Bailian Group and Alibaba Group had jointly invested in another convenience store named Yike EGO (逸刻EGO). In the summer of 2023, we came across a Yike location in Shanghai that offered a comparable concept to Pick ‘n Go. However, the person running the Yike store told us they no longer use the locker wall system. Therefore, it isn’t surprising that Pick ‘n Go is another Hema concept that hasn’t survived.

An unused Yike EGO locker system in Shanghai in 2023.

And there you have it; of all the concepts Hema launched from 2017 to 2019, only Hema Mini and, to a certain extent, a faltering Hema Mall, have survived. But they are nowhere near the scale that Hou Yi had envisioned.

Alibaba’s Investor Day 2020 hailed Hema as ‘the first successful new retail omnichannel model built in the world’. But someof the concepts shown on the slide would be failures…

‘Going Down’ – Concepts for the ‘sinking market’

When Hema became a separate entity in the Alibaba conglomerate, responsible for its own profitability, the time of throwing things at the wall and seeing what sticks were over. And with May 2023’s announcement that Hema planned to go public in 6 to 8 months, presenting a mix of formats that could survive became even more critical.

Hou Yi, the founder and former CEO of Hema, was convinced that there were still two ‘blue ocean’ markets in China’s supermarket sector. One related to ‘going up’ and creating brands like Sam’s Club, Costco and Hema. This has been represented by the Hema X Membership Stores that were launched in 2020 and target mid to high-end consumers. The other blue ocean related to ‘going down’ and concerned inexpensive options for ‘ordinary people’. Hou Yi had been studying ALDI and other inexpensive European supermarkets as a benchmark. [24] Hema Outlet and Hema Neighbourhood target this market segment.

We will skip over Hema X momentarily and return to that format in the next chapter. In this chapter, we will explore how Hema is ‘going down’ to what China calls ‘the sinking market’: lower-tier cities and suburban towns of large cities.

From Hema ‘Country Fair’ (盒马集市, Hema Jishi) to Hema Neighbourhood (盒马邻里, Hema Linli)

While there isn’t much to see at the physical locations of the Hema Neighbourhood stores, they have one of the most interesting background stories in the Hema family.

At the end of 2020, when the community group buying (hereafter ‘CGB’; read more about this concept in our Reports about the death of community group buying are greatly exaggerated …) craze started, Hema launched Hema Select (盒马优选, Hema Youxuan). It was later renamed to Hema Jishi (盒马集市, Hema ‘Country Fair’). After half a year, Hema Jishi couldn’t keep up with the CGB initiatives of Meituan and Pinduoduo and was only active in 4 provinces, while its competitors operated in 20.

Meanwhile, Alibaba’s Lingshoutong (Alibaba’s cooperation with convenience stores we wrote about in The collapse of Alibaba’s New Retail? - Part 2: Hypermarkets, Supermarkets and Convenience Stores), Cainiao and Ele.me were also dabbling in community group buying.

A community group buying leader still using the old Hema Jishi sign, Xi’an, August 2013.

In March 2021, Alibaba changed course and set up the MMC Business Group, which included Hema Jishi, Lingshoutong and CGB initiatives by Cainiao and Ele.me. As such, Hou Yi had to hand over the operation of Hema Jishi. Half a year later, in September 2021, MMC merged with Taobao Maicai to form Taocaicai (only to later become Taobao Maicai again, as we described in Community Group Buying: the ‘US military vs the Red Army’).

Shortly after handing over Hema Jishi, on April 28th, 2021, Hema Neighbourhood (Hema NB) opened its first store in Shanghai. Unlike the Hema Xiansheng stores, which focused on first and second-tier cities and their affluent consumers looking for convenience, Hema Neighbourhood was a strategic approach to penetrate the so-called ‘sinking market’ of lower-tier cities and suburban towns of high-tier cities.

According to sources [25], Hou Yi wasn’t happy with the handover of Hema Jishi and tried to prove its potential for community e-commerce. Hema NB integrated the CGB model of consumers placing an online order (mainly for fresh products) and picking it up the next day after 8 AM. Still, Hou Yi repeatedly emphasised that Hema Neighbourhood was not a community group buying platform. “The model is different, the operation method is different, and the way of playing is also different.” [26]

There was indeed a difference with other CGB platforms. Whereas most other CGB initiatives used community leaders and pop-and-mom shops as pick-up points, Hema NB implemented CGB in combination with self-operated physical stores that could offer more products than pure community group buying platforms. Hema NB initially relied on the Hema supply chain and could thereby provide 20,000-30,000 SKUs, including live fresh seafood. CGB competitors Meituan Select (美团优选, Meituan Youxuan) and Duoduo Maicai (多多买菜) only offered 1,000 – 3,000 SKUs, among which very few fresh meat products. Hema NBs average order value of RMB 50 was also five times higher than that of other CGB platforms.

Initially, Hema Neighbourhood only had a pick-up service, and there are no direct sales of goods in the store.

A Hema Neighbourhood in Shanghai, July 2023.

In an interview around the time, Hou Yi stated that other CGB models were unsustainable. He criticised how CGB startups got billions of dollars in funding but were not doing a decent job at logistics, using ‘20-year-old paperwork systems’ and ‘showed low efficiency and high costs’. He called Hema NB the ‘most important strategy in the next ten years’. [27]

Unlike other CGB platforms, Hema NB did not offer any subsidies. In Hou Yi’s view, ‘the low prices brought about by market subsidies are unsustainable.’ Hema NB had to compete in retail efficiency and service experience. [26] Unlike other CGB platforms, Hema NB does not use three-level distribution (central warehouse – grid warehouse – self-pick-up point).

However, the costs of Hema Neighbourhood were much higher than those of its competitors, who mainly used CGB group leaders as drop-off points, while Hema NB (mostly) runs self-operated pick-up points. Setting up a Hema NB store costs at least RMB 50,000, and Hema pays rent, staff, water, electricity, etc, while its competitors only pay 5-8% commission to CGB leaders. [26] Moreover, while Meituan and Pinduoduo could quickly eliminate underperforming CGB group leaders, setting up and closing underperforming self-operated pick-up stores was more costly for Hema.

Hema also refunded customers who did not pick up orders, while other CGB platforms only refunded in case of quality disputes and did not allow order cancellation after sorting in the main warehouse had started.

Daily sales at a Hema NB in Shanghai are RMB 8,000 – 20,000 yuan. However, in suburbs of second-tier cities, daily sales are only RMB 3,000-6,000 yuan, making it challenging to cover the costs. Even Shanghai stores with RMB 10,000 daily sales and two staff members only break even. Hema also found that when daily sales exceeded RMB 15,000, staff at a Hema NB needed to spend too much time sorting the goods that arrived from the central warehouse, negatively impacting the customer experience.

A comparison of different grocery delivery models. Source: LatePost July 2021 [27]

When selecting locations, Hema Neighbourhood would avoid being too close to a Hema Xiansheng despite the rather different positioning of the two sub-brands. Hema NB stores service about 3,000 nearby households. [27]

Hema NB wasn’t the success Hou Yi had hoped it would be. In July 2021, Hema said it would open 5,000 stores by the end of that year. It only reached 2,000. Because of high operating costs, Hema NB could not give the same subsidies as other community group-buying players, and goods weren’t cheap enough. [28]

At the end of 2021, a former head of Hema’s North China fresh food supply chain shared that Hema Neighbourhood was still in an exploratory stage and its profitability was unclear. He hoped it would break even within two years.

In November 2021, only half a year after the format’s launch, Hema NB stores in three cities (Guangzhou, Shenzhen, and Suzhou) were closed. In April 2022, Hema withdrew from four more cities (Beijing, Xi’an, Chengdu, and Wuhan). Finally, in October 2022, Hema NBs in Hangzhou and Nanjing were closed after a one-day notice. After that, only Shanghai was left. [26]

Considering how the format had been pulled from Beijing, we were surprised to see a courier wearing a purple Hema NB shirt when visiting different Hema formats in the capital in June 2023. When we approached him and asked him about it, he laughed and said: ’Oh, I don’t know. A friend gave me this shirt.’

Since then, Hema has made some drastic changes to the NB concept. In March 2022, it started offering home delivery. In July 2022, it opened its first franchise for a fee of RMB 10,000 per 3 years and a deposit of RMB 30,000.

The number of SKUs was drastically reduced to 2,000, thereby decreasing the sorting pressure on staff, and more focus was put on Hema’s private brands like ‘Hema NB’. Free delivery, when spending more than RMB 39, was changed into a standard delivery fee of 3 yuan, saving hundreds of thousands of yuan in delivery costs each month. The delivery radius was also reduced from 3 km to 800 meters. These changes initially led to a 50% drop in orders, but many customers would return and pick up their orders instead.

Management of the division was also changed.

Former Alibaba CEO Daniel Zhang had questioned the concept many times, but Hema CEO Hou Yi convinced him not to shut it down completely and keep the Shanghai stores, of which there were still 400 by the summer of 2023, 30 of which are franchisees. Not counting HQ overhead, the operating result of Hema Neighbourhood was -10%, and it aimed to break even in 2023.

Recently a Hema staff member mentioned ‘1,000 Hema locations’ on LinkedIn. When I checked the Hema website I found that aout 700 locations were actually pick-up locations in Shanghai and Jiaxing (a city southwest of Shanghai, halfway to Hangzhou). It seems Hema NB has opened up the third-party pick-up model that others like Xingsheng have also been using for their CGB business.

Hema ‘locations’ (March 2023). Source: freshippo.com.

Hema Outlet (盒马奥莱, Hema Aulai)

Hema opened its first Hema Outlet in Shanghai in October 2021, transforming a previous Hema Mini store. The Outlet stores were initially launched to offload vegetables and fruits that Hema Xiansheng could not sell the previous two days, as well as remains from Hema’s processing centres. Hema Outlet is purely offline, and its stores are extremely simple. Many products are not even put on shelves but stacked in crates on the floor in these 500 square meter stores.

Hema Outlet is almost the opposite of a Hema Xiansheng: a messy and crowded supermarket with narrow lanes where elderly customers and low-income youngsters gather between 9 and 10 AM; the main customers of Hema Outlets are retired workers and young white-collar workers. [29]

Discount stores have been a growing market segment in China, and at the end of 2022, Hou Yi led a team to Europe to study ALDI and other discounters. Ironically, ALDI is positioned as an up-market supermarket in China.

A Hema Outlet in Shanghai, July 2023.

While the first Hema Outlet stores were opened to sell leftovers from 5-6 Hema Xiansheng and Hema X stores and thereby help to decrease losses of those stores, it ran into limitations of this approach. Dependency on redundant products from Hema Xiansheng would limit the expansion of Hema Outlet. On days when Hema Xiansheng had exceptionally good sales, for instance, on membership days, Hema Outlets had less to sell a few days later. The 350+ Hema Xiansheng stores could supply 70 Hema Outlets, and there are already close to 170 Outlets in 16 Chinese cities by the time of publication.

What’s more, when the operating capabilities of Hema Xiansheng improved, resulting in fewer unsold products, their supply to Hema Outlets started to dwindle, while at the same time, demand at the Outlet stores was growing. Hema Outlet had to set up its own procurement system. [29]

Selling the offloaded products has also created dissatisfaction with some Hema Xiansheng customers who saw the evening discounts at their stores disappear as the expiring products were wheeled off to Outlets. [30]

To solve these issues, Hema Outlets were upgraded to real discount stores in September 2022, not only second-rate stores selling redundant Hema Xiansheng and Hema X products but also self-purchased products and private labels. As a result, two distinct types of Outlets have emerged: Hema Fresh Outlet (盒马生鲜奥莱), the original ‘offload’ stores, and Hema Outlet (盒马奥莱). The Hema Xiansheng Outlets will eventually be phased out. [29]

Whereas a Hema Xiansheng has 6,000-8,000 SKUs, a Hema Outlet only has 3,000, among which a maximum of 1,000 private label products, ‘Hema Neighbourhood (NB) Selection’, and some products at regular market prices. While the Hema NB business unit independently develops the private labels, they are often sourced from the same suppliers as those for Hema X and Hema Xiansheng. Hema claims that thanks to the Hema supply chain, Outlets can offer better quality than regular vegetable markets.

Hema NB private label products, August 2023.

According to figures disclosed by Hema, in mid-2023, Hema Outlet’s private label products currently account for about 15%-20% of sales. Hou Yi once said that Hema’s target for private labels’ eventual share of sales is 50%. [31]

Regarding product pricing, Hema Outlet hopes that its private label products are about half the price of competing products, while branded products are 20-30% lower than competing products. [29] The price level lies below that of community group buying, which is supposed to be the cheapest form of fresh food e-commerce. Hema Outlet also attracts middle-aged price-conscious consumers who were previously targeted by Hema Farmers’ Market (Hema Cai Shi).

Products in Hema’s Everyday Fresh range are sold 40-60% cheaper than at Hema Fresh. Some prepared food is sold for 2-4 RMB the day before expiry. The closer to the expiry date, the lower the price will be. Of any specific product, Hema Outlet often only sells the most popular brand and the private label as choices.

Price differences: Today’s (7) silken tofu at Hema Xiansheng, yesterday’s (6) silken tofu at Hema Outlet.

An average Hema Outlet store is 600-700 square meters large and only needs a budget of RMB 1 million to open, 1/20th of a small Hema Xiansheng, while the average staffing of a Hema Outlet store is 25 shop assistants, which is higher than the industry average. [29] Many Hema Outlets were Hema Mini stores before they were given a second life.

A Hema Outlet in Beijing, August 2023.

Each Outlet should achieve RMB 150,000 daily sales and 15% gross profit. Hou Yi said that despite the low gross profit, the ‘small profits but quick turnover’ model increases the efficiency of outlet stores more than seven times that of ordinary hypermarkets. [32] Judging from the foot traffic in a few Hema Outlet stores I visited, that does not seem to be an exaggeration (for a change).

There were fears of cannibalisation since Hema Outlet stores are often close to Hema Xiansheng stores (sometimes even next door). However, after the experiences with Hema Neighbourhood, there have been no more restrictions on locations since October 2022, and only the overall brand result counts.

The Outlets don’t offer home delivery as it is less relevant to the primary target group of elderly people who have a lot of time. Hema Outlets, therefore, has not yet opened an online business. It is, however, said that Hou Yi believes that the online operation of the Hema system is very mature and that Hema Outlets can be connected if the offline stores are also mature. At that time, Hema Outlets will be connected to the Hema app, but the delivery radius will be shorter than the 3-5 kilometres Hema Xiansheng offers. [29]

A Hema Outlet in Hangzhou, August 2023.

An Outlet store must be in a community with at least 40,000 residents. After the limited success of Hema Mini and Neighbourhood, Hema Outlets are the new hope for the ‘sinking market’.

In his typical bravura, Huo Yi announced that Hema Outlets would open 20,000 to 30,000 stores nationwide. ‘This is the future of Hema.’ [36]

Hema planned to open 100 Hema Outlets by the end of 2022. [32] In the now familiar over-ambition or underperformance of Hema, there were 68 Outlet stores across 14 cities in China in early July 2023. [34] At the time of publication, this has grown to 170 in 16 cities. [2]

Hema wanted to open many new Outlet and Neighbourhood stores in Shanghai’s suburban towns and aimed to have ‘full coverage’ of Shanghai by the end of 2023. [35] At the time of publication, there were about 113 Hema Outlet/NB stores in Shanghai. [2]

Going up: Hema X Membership Store (a.k.a. ‘Store X’)

While none of the new 2019 formats have succeeded, and most have completely disappeared, Hema X is a concept that has still expanded in recent years. These membership warehouse stores are larger than a regular Hema Xiansheng (about twice the size) and comparable to Metro, Costco, Sam’s Club, or cash & carry stores. Alibaba claims that members of the store receive wholesale prices.

In 2018, Hema launched its X Membership Plan for Hema Xiansheng customers at an annual fee of RMB 258, expanding it from Shanghai to Beijing, Xi’an, and Chengdu the next year. Hema X continues that membership fee, which offers peripheral services such as free deliveries, VIP customer support, a car wash, pet grooming, car repair, and optician services. Hema X also offers half-day delivery within a radius of 20 kilometres.

The first Hema X store opened in Shanghai in September 2020. According to Hema, the 18,000 square meter Shanghai store turned profitable within two months of opening, and members spent an average of RMB 1,000, outpacing purchases at a conventional store. [37]

In this video from 2021, Alibaba explained the Hema X format, which is targeted at highly affluent young shoppers. Note, though, that when we visited the Shanghai store in June 2023, hardly any people were there. It is said to be busier during the evenings and weekends.

Understandably, Hema invests in membership stores as, according to Euromonitor, they are the only mainstream offline store formats in China that maintains a healthy growth of almost 20%. Sales of the format more than doubled to $3.7 billion in 2022 from $1.8 billion four years earlier. [38] Meanwhile, according to incomplete statistics from the Retail Research Centre of Lianshop.com, 34 supermarket companies, including Lianhua Supermarket, Hongqi Chain Store, Yonghui Supermarket, Zhongbai Group, Greenland Best, and Jingdong Qixian closed more than 680 stores in 2022. Among them, Wal-Mart closed 27 stores. [39]

Last year, a report by Bain & Company and Kantar Worldpanel predicted that the number of Chinese consumers in warehouse-style membership stores will increase by 30.3% year-on-year, and the purchase frequency will increase by 12.8%. Walmart’s Sam’s Club opened six stores in 2022 and planned four more in 2023, bringing their total to 44 in 5 cities, servicing 4 million members. [38]

In November 2022, Hema said the Hema X Membership Stores’ year-on-year growth was 247% (although it remains to be seen what that means in absolute numbers).

At Hema X, you will find large-volume packages of products, many of which are presented under Hema’s private label MAX. At the time of its launch, 40% of the Hema X assortment consisted of private labels, including MAX. 10% of these came from foreign factories. Hema uses a strategy of ‘go outward, go upward’, meaning that it sources the best products from abroad and r tries to source them locally, lowering consumer prices and improving the quality.

A Hema X Membership Store in Shanghai, June 2023.

While there are some temporary promotions (we were able to visit the store by using a one yuan ice cream deal on Douyin), you don’t get access to Hema X without a membership. We witnessed the chagrin of many non-members who tried to get in. In 2022, a thriving business rented out Hema X memberships on Taobao. You could rent someone’s QR code to enter the store for one yuan. You were charged a RMB 5 handling fee if you needed to buy something. One merchant had rented his QR code out 90,000 times in total. [40]

On an average day, a Hema X store sees RMB 1.2 – 1.5 million in sales. But this can reach RMB 3 – 4 million during holidays, weekends or special promotions. Impressive, but not quite the RMB 10 million that Costco reaches during peak weekends. The difference is caused by Hema’s limited experience in product selection and procurement. Sam’s Club has been active in China since 1996, and while Costco only opened its first China store in 2019, the company itself was founded in 1983. [41]

In 2021, Alibaba wrote [37]: “The future of the stores looks bright, given China’s adjustment to its strict family planning policy. Last month, China officially loosened its reinforcement of the two-child policy following a nationwide population census, allowing Chinese couples to have up to three children.” That might have been the case, but all the loosening has had no impact so far, and birth rates continue to decline. And marriage rates are down as well. As such, I hope Hema X’s future doesn’t depend too much on large families.

There is also a ceiling to how much Hema X can expand. Because of its size and target group of mid to high-income consumers, it only makes sense to open them in the large first-tier cities. On average, Hema X members visit the store 1 to 2 times weekly and no more than eight times monthly. [40]

At the end of 2021, a former head of Hema’s North China fresh food supply chain shared that the profitability of the Hema X format depended on increasing the number of paying members, customer purchase volume, and customer unit price. In addition, Hema X member stores still had room for improvement in product selection logic, crucial to attracting customers to repurchase and increasing penetration.

In 2021, Hou Yi said that Hema planned to open 10 Hema X stores that year. [42] But, as we’ve seen before, Hou YI’s ambition tends to be ‘a bit’ overblown. By the end of 2021, there were three Hema X stores, and at the time of publication, there were 10 Hema X Stores in Shanghai (6), Beijing (2), Nanjing (1) and Suzhou (1).

In the past 11 months, only one new Hema X store was opened. But seven months after this store and Beijing launched with much fanfare, it has recently been announced to be closing down already. According to a staff member because of lack of sufficient customers. The store, in Beijing’s central business district, seemed unsuitable for the office workers in the area. [52]

Th Beijing store is not the only one with a less-than-optimal location choice. Another store, in Shanghai, is being relocated and should open again later this year. [52]

Nevertheless, in interviews, the management of popular competitor Sam’s Club has named Hema X the ‘only real competitor they are facing’ in China because of Hema’s robust supply chain. [38]

Related Hema concepts

In addition to all the concepts we have discussed so far, we should mention a few related concepts to complete the picture.

Robot.He Restaurants (Robot.He 机器人餐厅, Jiqiren canting)

In 2018, when robot restaurants were all the hype, Hema introduced Robot.He. At these restaurants, customers scanned a QR code and ordered food on their phones, which then arrived at their table in robots that are much like logistical AGV robots (Automated Ground Vehicles).

Hema opened the first Robot.He in 2018 at Nanxiang Oriental Weiye Plaza in Shanghai. While Hema claimed it broke even in four months, it only ever opened one more Robot.He (at Shanghai’s National Convention and Exhibition Centre). There were a lot of complaints about the unclean dishes and tableware, poor sanitation, slow serving and very average tasting dishes. Many visitors were attracted by the gimmick but left disappointed. [45] Yours truly included.

Robot.He restaurant in Nanxing, Shanghai, March 2019.

I visited the concept a few times in 2019 and found it underwhelming. The menu was quite limited, and while the robots worked, stopping at your table and opening their covers, it did feel a bit like eating in one of those highly automated warehouses.

The Robot.He in the National Convention and Exhibition Centre has been closed. Two-thirds of the space of Robot.He at Nanxiang Oriental Weiye Plaza (seen in the pictures above) has been converted into a Hema Outlet …

Hema Yunchao (盒马云超) a.k.a. Freshippo B2C

Hema has built a strong reputation in a large part of China, even if no Hema store is nearby. This has led to Hema Shopping Service (盒马代购, Hema Daigou). ‘Daigou’ is a common concept in China that involves somebody buying goods on behalf of another person in exchange for a service fee. In the past decennium, it has been one of the main ways the Chinese got their hands on foreign luxury goods and products like baby formula, until the government started to crack down on the practice.

A similar service has evolved for Hema with ‘agents’ buying on behalf of consumers and sending them the goods. Hema Daigou, not a service offered by Hema, became popular across cities and provinces. Many consumers across the country willingly pay for the extra shipping costs to have these products, mostly Hema’s private label or joint-brand products, send to them. [46] The service fee of Hema Shopping agents is typically 5-10%. Hema most have seen this development, which often resulted in many complaints about the quality of the goods that arrived, and must have thought they would be able to do a better job themselves.

In April 2020, Hema launched a flagship store on Alibaba’s B2C webshop Tmall as part of its key development goals. [47] For cities with no Hema Xiansheng, Hema offered ‘Hema Yunchao’ (盒马云超), which can be translated to ‘Hema cloud supermarket’. Hema Yunchao offered 20,000 SKUs, and in 2020, it was said to have 100,000 daily orders in 14 cities.

When you are out of the delivery range of Hema stores, the app will tell you there is no physical shop in your area and ask you if you want to try Hema Yunchao, which delivers products the next day.

In April 2023, Hema Yunchao expanded its services from cities with Hema stores to the whole country. In the next step, Yunchao planned to expand its offering of Hema’s imported goods assortment, including flowers, across the entire country. [46] With Yunchao, Hema targets consumers looking for a ‘quality way of’ life but doesn’t have Hema stores near them (yet).

Offering e-commerce delivery without using the store + warehouse model within a 3-5 km radius will require the company’s high cold chain capabilities. This will be accomplished by the multi-temperature supply chain system Hema has invested tens of billions of yuan into in the past years. This includes operational logistics centres in Wuhan and Chengdu and eight more that the company planned to build around the country. Since grocery retailers are highly fragmented and regional in China, Hema may become the only retailer with such nationwide coverage. Hema also built five fruit processing centres close to major wholesale markets in Beijing, Guangzhou, Zhengzhou, Chengdu, and Jiaxing. [46]

Hema also reverse-customises products, taking only 30 – 45 days to adjust according to market trends. Combined with Yunchao, it can offer localised versions of products. [46]

On November 27, 2022, at the CCFA New Consumption Forum – 2022 Supermarket Development Strategy Summit Forum, former Hema CEO Hou Yi said that starting 2023, “Hema will serve one billion consumers with one trillion sales as the goal in the next ten years”. Considering how the Hema Xiansheng stores will have a limited reach and the Hema NB division will also have its limitations, it seems that the only feasible way to reach one billion consumers in China is by counting the potential reach of Hema Yunchao.

Hema business units

Hema’s organisation has three vertical units. Hema Fresh and Hema MAX focus on first and second-tier cities, while Hema NB targets the ‘sinking market’. Hou Yi was personally in charge of Hema NB, showing his determination to break into this market. He claimed Hema Outlet stores would be the most important strategic project for 2023.

Not so long ago, Hema reorganised its organisation into three business units according to the structure below.

This structure tells us a lot about how Hema sees its future.

The main business, Hema Xiansheng, is combined with Hema Mini to form one business unit aimed at middle-class Chinese in first and second-tier cities. Although they largely target the same audience, the megastores of Hema X are operated by a separate division. Finally, there’s the Hema NB division that targets the ‘sinking market’ with community store Hema Neighbourhood and discount store Hema Outlet.

Hema Mini is seen as an extension of Hema Xiansheng for areas where establishing a Xiansheng is not an option. While the company tries to rebuild its Hema Neighbourhood network from Shanghai, Hema Outlet has become one of the three main concepts (together with Hema X and Hema Fresh). [43]

Source: [41]

It’s interesting to see how some of the main concepts differ in characteristics:

Source [41]. (3R = Ready to Cook, Ready to Heat, Ready to Eat)

Hema X plans to increase the share of standardised products to 45% because they have a higher average sales price than fresh produce.

The three concepts, Hema Outlet, Hema Xiansheng, and Hema X, grew 555%, 25%, and 247%, respectively, in 2022. Hou Yi has said that Hema Outlet even outperformed Hema Fresh stores. Considering that Outlets were just launched in October 2022, that high growth is not such a big surprise, though.

In a mid-2023 press release [44], Alibaba mentioned that in “2022 China’s Top 100 Chain Stores,” published by the China Chain Store & Franchise Association, Hema ranked eighth among the top 100 chain stores, entering the top 10 for the first time and sixth among the top 100 supermarkets in Mainland China.

Procurement: Integration of competition?

Each year, Hema signs supplier contracts, performs performance evaluations and issues supplier management requirements. It selects new suppliers and eliminates old suppliers. Hema tries to minimise supplier replacement and cultivate core suppliers that grow together with Hema.

After 2022, Hema planned to achieve unified procurement management by the headquarters. It would return regional procurement to the headquarters and reduce regional procurement personnel. Suppliers would be streamlined, and supply chains would need to cover the entire country.

In the Alibaba ecosystem there are many businesses involved in groceries. These include primary offline businesses such as RT-Mart and other supermarkets and convenience store partnerships we discussed in The Collapse of Alibaba’s New Retail? - Part 2: Hypermarkets, Supermarkets and Convenience Stores. On top of that, there are (semi-)online channels like Hema, Tmall Supermarket, Taobao Maicai, etc. Effective synergy in the supply chain can help save procurement costs as the volumes of these channels can be combined. Fulfillment costs can also be reduced, for instance in the case that Tmall Supermarket delivered goods from RT-Mart locations instead of central warehouses.

Sometimes, the target audiences differ. While RT-Mart targets traditional consumers, Hema is aimed at the online middle class. At the same time, these businesses overlap and have been fiercely competing with each other throughout the years. This presents a dilemma. Further integration on the consumer side could result in these businesses losing their individuality and positioning.

Supply chain integration is further complicated by the differences in required inventory management of the various businesses. For instance, Hema Xiansheng focuses on fast, instant retail, requiring sufficient safety stock. However, community group buying concepts use next-day delivery, and goods are purchased after the consumers place orders, making inventory management relatively simple. Quality levels in these concepts also differ: while Hema strives for high-quality goods, community group buying aims for ‘acceptable’ quality for its price-sensitive consumers.

Into 2023

We have discussed no less than 12 different formats of Hema’s business in this article. But this doesn’t seem to be the end of it. In 2023, Hema announced plans to open two new formats: [48]

Hema Premier: a boutique Hema supermarket targeting the high-end elite. In October 2023, Hema was expected to open its first 5,000-square-meter experimental store with prefabricated dishes as the core offering in a mall at Shanghai’s Zhongshan Park. [50]

FOD, Food Operation Delivery: a warehouse-style shopping mall comparable to Metro’s self-service wholesale model (cash & carry for small and medium enterprises) for business customers.

Hema was also working on plans to open a supply chain for canteens of companies and institutions under the name Hema To B (盒马To B), delivering processed ingredients produced by the central kitchen. Hema will co-develop the “weekly menu” with the canteen chef, plan the ingredients needed for a week in advance, and enhance the reliability of the canteen supply chain. Hema then plans to move part of the food processing work in the canteen to the central kitchen to improve the operational efficiency of the canteen and reduce management costs. [49]

This new project won’t be simple because this sector requires support from political and business relations, comes with high qualification standards and is a segment where competitors like Yonghui, Caishixian, and Fuping Yunshang have already been active. [49]

But 2023 and 2024 had much more in store for Hema. Not only would it attempt a change into a discount formula; we also saw plans for an IPO change into a possible sale of the Hema supermarkets and the resignation of Hou Yi. In a few weeks, we will tell you about this continuing supermarket soap opera. Stay tuned!

Sources

The information in this article has been collected from the sources below, augmented with learnings from expert interviews from Six Degrees Intelligence, a leading global expert network/quantitative research firm that operates in China.

[1] 牛刀财经 2023-06-06, [1b] 新经济IPO 2024-03-12, [2] Freshippo.com on 2024-05-25, [2b] Linkshop 2024-03-16 (now deleted), [3] ChinaTalk.nl 2017-11-16, [4] Tech Buzz China 2023-06-09, [5] CGTN 28-11-22, [6] 盐财经, 2023-04-03, [7] Huxiu 2018-09-17, [8] SMCP 2023-01-03, [9] 生鲜榜, 2023-03-29, [10] 36Kr, 2023-04-03, [12] Retailnews 2019-07-26 [13] Linkshop 2023-04-18, [14] ikanchai.com 2019-10-04, [15] 钛媒体 2022-10-20, [16] 金角财经 2023-07-11, [17] Jiemian 2021-01-21, [18] Tech Buzz China 2023-06-09, [19] Linkshop 2022-04-13, [20] China Skinny 2019-12-03 , [21] digitaling.com 2020-08-25, [22] 连锁产业观察 2020-07-15, [23] Sina Finance 2021-01-18 [24] 36Kr 2022-08-16, [25] Latepost 2023-01-17, [26] 钛媒体 2022-10-20, [27] LatePost, 2021-07-20, [28] Techplanet 2023-05-29, [29] 第三只眼看零售 2023-02-06, [30] 银杏科技 2023-04-21, [31] 金角财经 2023-07-11, [32] 新消费日报 2022-10-31, [33] 生鲜榜, 2023-03-29, [34] Alizilla 2023-07-03, [35] Technode 2023-01-04, [36] 牛刀财经 2023-06-06 [37] Alizilla 2021-06-18, [38] 36Kr, 2023-07-27, [39] 新零售 2023-03-10, [40] 36Kr 2022-08-16, [41] Tech Buzz China 2023-06-09, [42] LatePost, 2021-07-20, [43] Techplanet, 2023-05-29, [44] Alizilla 2023-07-03, [45] Sina Finance 2023-06-14, [46] 36Kr, 2023-04-03, [47] FBICGroup 2020-04-23, [48] Latepost, 2023-05-19, [49] 第三只眼看零售 2023-06-30, [50] Linkshop 2023-05-14, [51] 新消费日报 2022-10-31 [52] Yicai Global 2024-05-20

Images by Tech Buzz China’s Ed Sander unless stated otherwise. These images may not be reproduced without prior consent by Tech Buzz China.