Temu: from $0 to $3 billion in 10 months

...while pressuring staff, merchants and logistics partners.

Table of Contents

Things that caught our attention

Things that caught our attention

"Spending on Temu … was 20% higher than more established fast-fashion retailer Shein in the US in May, according to Bloomberg Second Measure, which analyzes billions of credit and debit card transactions." (Source)

Latepost reported that Douyin has given up this year's target of RMB 100 billion GTV in food delivery because of disappointing progress in the first half of 2023. Q1 GTV was only about RMB 250 million. It is now teaming up with more 3rd party delivery providers. (Source, link in Chinese) Techplanet reports Douyin still has added a dedicated section for (self-operated) food delivery in its app. It is still taking takeaway seriously. (Source, link in Chinese) We wrote about Douyin's local services business in general and food delivery specifically in March.

Daniel Zhang is stepping down as CEO of Alibaba Group to lead the Alibaba Cloud company and ready it for its IPO. (Source) We wrote about Alibaba Cloud in March.

There’s lots of buzz about Alibaba’s Michael Evans saying that Tmall will come to Europe and is running a pilot in Spain. (Source) Evans is actually referring to Miravia (miravia.es), which was launched in December 2022. We tweeted about the platform in April and Techbuzz China team member Ed wrote about it on ChinaTalk.nl in January.

Key takeaways

Since its U.S. launch in September 2022, Temu has expanded to around 20 countries. Its estimated GMV in the first half of 2023 exploded to $3 billion, helped by aggressive social media campaigns and expensive Super Bowl advertising. Its gamification has been showing mixed results.

When Temu shifted its focus from clothing to standardized household and personal care products, it substantially increased its average order value.

In the early months, about half of Temu’s suppliers were manufacturers (who can create products cheaply), the other half were traders (often trying to get rid of excess inventory). 20% of the manufacturers were also operating on Pinduoduo. The others were companies that had previously already been trading cross-border, selling goods on Amazon and Shopee. Temu will use the cheapest supplier.

Temu uses a ‘fully managed’ marketplace approach. Merchants agree on a selling price to Temu and ship goods to its warehouse. Temu sets the consumer price and handles all shipments to the consumer, as well as marketing and customer service. Since the model comes with advantages for Temu, merchants and consumers alike, other cross-border e-commerce players have started copying it.

Temu is putting pressure on staff, logistics partners and merchants. It is shifting more costs to merchants and increasing the pressure to lower prices through a bidding system. Staff works under a merciless horse-racing culture.

Temu has been using the logistical services of J&T Express. J&T is accepting this loss-making business because it is building market share because of an upcoming IPO.

Even though Temu has significant gross margins, it will still lose money since it sees 20-30% logistical costs and 30% marketing costs (incl. customer acquisition), plus taxes, custom duties and storage costs. In total, Temu’s current loss rate is 60%.

AliExpress is no longer focusing on the U.S. and its market share seems to have been taken by Temu. Most of Temu’s other business is coming at the expense of Shein and from small offline shops. Amazon remains a very suitable sales channel for white-label products and native Chinese e-commerce brands like Anker. Therefore the target audience of Amazon highly overlaps with that of Temu. Temu’s product category structure now largely resembles that of Amazon and Shein.

For details on these key takeaways, please subscribe to get full access to the article.

Free subscribers can read part of the full article.

Introduction

Since it launched in the U.S. in September, Temu, Pinduoduo’s cross-border e-commerce platform has taken the internet by storm. Marketplace Pulse recently reported that either Temu or its fellow Chinese webshop Shein was the number one downloaded app in half of the fifty largest economies in the world. Temu was the most downloaded app in all countries it had formally launched in, driven by aggressive promotional campaigns on social media like Facebook, YouTube and Instagram.

In December we published the Techbuzz China Insider article Temu - Pinduoduo's Cross-Border E-commerce Platform. The article gathered all information from expert interviews in the Six Degrees database available at the time.

A lot has happened since. Temu already went through several changes and more information about its business model, operations, successes and challenges has become available. In this article, we’re giving you an update and new proprietary knowledge from the Six Degrees database and Chinese language media.

Freya Zhang, Ed Sander & Rui Ma

(click on the images above for information on the Tech Buzz China team)

The early months

Since launching in the U.S. in September 2022, Temu has made remarkably strong and fast progress. In the first month after its launch, it spent RMB 1 billion (~$140 million) on marketing. According to data analysis firm Apptopia, Temu has also paid for more than 900 app store search terms to get to the top of listings. The investments paid off: in 2 months, it surpassed the popular Chinese webshop Shein in the shopping app charts. Temu would stay at the top of the app charts until OpenAI launched its mobile ChatGPT app in mid-May.

Pinduoduo initially downplayed the fact that Temu was their product. But in November, the importance of Temu became clear when Pinduoduo upgraded its corporate identity to ‘Pinduoduo Holdings’: ‘a multinational commerce group that owns and operates a portfolio of businesses, including Temu, an e-commerce marketplace for North American consumers, and Pinduoduo, a leading social commerce platform.’

According to Sensor Tower, Temu had 41 million unique visitors between November and December 2022. On this metric, it had also overtaken Shein, which had 36.6 million in the U.S. in the same period. And that’s all within 4 months of Temu’s launch …

Enter gamification

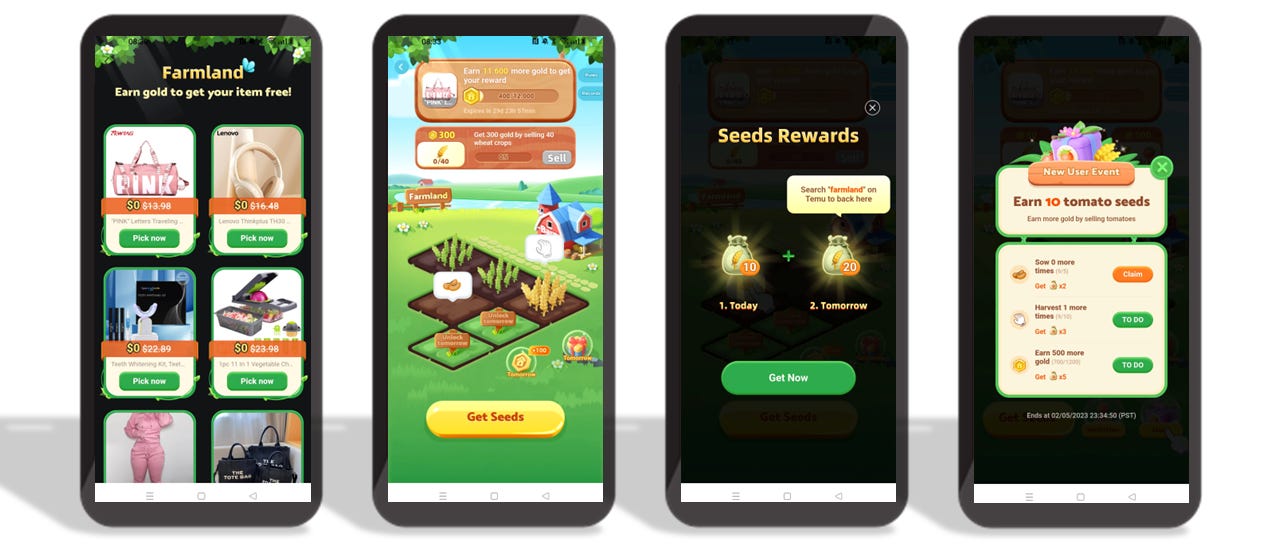

By the end of 2022, Temu had started rolling out gamification in its app. By January, it was continuously adding new games. Among these were Daily Gift Box, Earn Credits, Free Gift, Cash Rewards, Redeem Cash, Lucky Flip, Fishland and Farmland.

These games followed the same pattern as those in Pinduoduo. Users can earn free products, discounts and even cash payouts. Initial progress in the game is easy but to actually claim a reward users will need to recruit friends to the app, watch product feeds or log in multiple times a day. All of this is meant to bring down acquisition and retention costs for Temu.

Users can get cheaper products by inviting friends. In one game, users can buy a product for a very low price after inviting two friends to download the app. In another game, users get a 30% discount coupon, to be used on any product, after inviting one user.

But the most important game in this stage is without a doubt the ‘price cut’ tactic also used in sister-app Pinduoduo (as 砍一刀). A user picks a free gift and asks friends to help reduce the price of an item. The more friends join (and download the app if they are not yet using it) the lower the price. But the invited users do not benefit. At the end of 2022, quantitative data showed that the effect of Temu’s ‘price cut’ was poor. Less than 1% of sales came from these products and the conclusion was that Western consumers were not willing to inform others that they wanted to buy cheap products.

By February, the Temu games had been promoted to the app’s home screen. Interestingly enough, two of the three Techbuzz China team members have seen the games disappear from the app, while a third could still access them through the profile menu.

As in Pinduoduo, there is also the option to earn free cash. When this gamification started, a user could get $20 and $80 in coupons when recruiting 7 new users, a threshold that was later lowered to 5 users. Chinese users in the U.S. could even get $20 paid directly to their WeChat account. On Facebook and Instagram, users would exchange invitation codes to receive this cash.

The approach of investing heavily in discounts and subsidies on products to attract new users and then having these users recruit friends and family through gamification is basically copying the successful model Pinduoduo used when it launched some 7 years ago.

This is a smart strategy to grow the user base at relatively low acquisition costs. In the U.S., the normal customer acquisition cost for webshops is $30-$35. According to 36Kr, the cost of acquiring a single user through Facebook in the US was $35 in the first half of 2022.

In the early months, Temu’s customer acquisition costs, which consist of advertising, product subsidies and coupon discounts, were as high as $42. But now, Temu gets people to download the app for $5 and spends a total of $10-$25 to complete a first order. By comparison, Shein’s acquisition costs are estimated to be $25-30, with subsidized logistics costs being 20%.

The large discounts and viral campaigns resulted in a conversion rate of 10%, far higher than the industry average of 2%.

In 2022, the 30-day repurchase rate on Temu was 10%, which is relatively low in the sector (Shein’s is more than 30%). More recently it has climbed to 20% and according to some sources even 35%. But some of these sales were generated by promotional leaflets in shipping packages and coupons for repurchases. Thus, sustainability of these metrics is in question.

Apps like Temu, which use recommendation algorithms to make personalised product feeds based on purchased and browsed products, need to gather a large user base quickly. That’s another reason for the heavy investments in customer acquisition. As such, it follows the same strategy of heavy advertising on popular social media we've seen before with TikTok.

Into 2023

In January 2023, Sensor Tower reported the following figures:

20 million total worldwide downloads

16 million Monthly Active Users (MAU)

10 million transacting customers, 90% of which came from the U.S.

The Temu app's 7-day retention rate increased from 14% in November to 22%

Average order value had increased from $20-$25 in November (with 3-4 items per order on average) to $35 (Temu was aiming to further increase this to $50)

By this time, the Temu staff had been told to shift focus from customer acquisition to increase the spending of consumers. In January it became obvious that Temu was trying to activate its inactive users and wanted customers to spend more. After several months of silence, Temu started an aggressive emailing campaign. Five months later, one of the Techbuzz China team members is still receiving up to four emails over the span of a few hours on a test account.

In the third week of January, Temu’s GMV exceeded $50 million, and its monthly GMV was approaching $200 million, which was roughly the same as the total GMV of the four months it had been active in 2022. This positive progress made Temu decide to raise its GMV target for 2023 from $3 billion to $5 billion.

Meanwhile, the marketing budget for September 2023 – August 2023 was nearly doubled from the original RMB 7 billion (~$1 billion). In January Temu placed almost 9,000 ads across Meta’s platforms, promoting deeply discounted items like $5 necklaces, $4 shirts and $13 shoes.

According to a16z, Temu was seriously outperforming Wish, AliExpress and Shein customer retention in the first four months.

The Super Bowl

By early February, Temu had 5 million Daily Active Users (DAU), according to Sensor Tower. In the first five months since its launch, Temu had achieved a total $500 million GMV, and in January alone, GMV was about $200 million. While most Chinese merchants were only selling a few orders per day, by this time, several Chinese merchants claimed to see 20,000 to 30,000 daily orders through Temu.

On the 12th of February, during the Super Bowl broadcast, Temu broke two records when its ‘Shopping like a billionaire’ advert aired in the first and third quarter of the game. It became the youngest brand to ever advertise during the Super Bowl (Temu had only been 5.5 months old) and paid the highest fee per second ever (allegedly $14 million for two 30-second ads).

With its choice for one of the most viewed U.S. TV broadcasts, Temu took another page from the history of its sister app Pinduoduo, which had previously advertised during China’s New Year’s Gala, the country’s most-watched TV program, to recruit new users.

Accompanying the Super Bowl commercials was a game called ‘Shake & Cheer’, in which $10 million was given away. While it followed games that have been quite common in China during Chinese New Year’s Gala broadcasts, it must have seemed strange and unnecessarily complicated to U.S. consumers.

A few days prior to the Super Bowl, Temu had launched in its second market, Canada. Perfect timing since many people in Canada also watch the game.

Prior to the Super Bowl, Temu had advised merchants to increase their stock at the Temu warehouse. This proved to have been good advice. After the Super Bowl commercials, app downloads surged by 45% and Daily Active Users (DAU) by 20%. The number of packages shipped to the U.S. surpassed those of Shein, and the number of orders overwhelmed Temu’s Guangzhou warehouse.

The rapid increase of orders caught Temu by surprise. When it found its warehouse capacity overwhelmed, it issued a notice to merchants saying the warehouse needed to be ‘upgraded’ and receipt of goods (including JIT, Just in Time, receipts), the launch of new products, and first-order approvals were all temporarily suspended.

According to Intelligence Insider, Temu saw more than 70 million unique U.S. visitors in February.

Expansion into new markets

On March 13th, Temu launched its webshop in two more new English-speaking countries: Australia and New Zealand. On that same day, news broke that it would enter the UK by March 25th. It would actually take a month longer, possibly because of the warehouse capacity issues back in China.

In March Temu had 13.4 million MAU, surpassing U.S. retailer Target, while it reached 2 million daily orders and an average daily GMV of $10 million. Impressive, but still only 1/6th of Shein’s daily GMV in 2022. According to Sensor Tower, it now had 50 million total downloads and 20 million active users.

In April, Temu’s U.S. GMV was approaching $400 million. Meanwhile, the Temu team had grown to about 1,500 people strong.

At the end of April, Temu launched in several European countries: the U.K., Italy, Spain, France, Germany and The Netherlands. So far, it has only offered an English website in these countries, something that might hamper its growth potential. At the time of writing, Temu has added even more European countries and is available in 18 markets. It was also said to be preparing launches in Africa, Latin America, and Southeast Asia (a region it previously shunned) and will launch in Japan before the end of June. Temu has already purchased a large amount of Japanese air freight capacity.

Like Shein, Temu set up an office in Dublin, Ireland, serving as the legal registration for PDD Holding’s overseas business while the headquarters remain in Shanghai. Like Meta and Google, it can enjoy a friendly 12.5% corporate tax rate in Ireland. An organisational change in which PDD Holding’s CEO Chen Lei became responsible for Temu further pointed towards the priority that Temu was receiving within the organisation.

Temu wants to sell to the whole world from one store. When a store on Temu meets a minimal rating, it will automatically be synced to other countries without any work required from the merchant.

Repositioning

When Temu first launched in the U.S. in September last year, it initially tried to be an ‘overseas Taobao’, focussing on women’s clothing. But the acquisition costs for this category proved very high, and the production capacity was limited since a large portion of it had already been claimed by Shein. Shein also had many loyal users and a 90-day repurchase rate of 60%.

Temu shifted direction. It researched Amazon’s popular products and started benchmarking itself against it. Temu’s product category structure now largely resembles that of Amazon.

Comparing the homepage of Temu when it launched in September to its current homepage shows how Temu has abandoned the idea of becoming a ‘Shein clone’. Its social media ads have also shifted away from largely apparel-related content to (cute) household items.

Temu U.S. homepage September 2022

Temu U.S. homepage June 2023

When Temu shifted its focus to standardized household and personal care products it increased its average order value to $40. Meanwhile, Temu’s development focussed on the app, which brought in 80% of GMV, with only 20% of GMV coming from the desktop website.

Temu has also launched an affiliate program in which KOLs/influencers can earn money for promoting the Temu app.

Customers

Temu primarily targets users with less than $30K annual income. It sees three dominant (and overlapping) types of users in the U.S.:

(Note: the section below is only available to paid Tech Buzz China subscribers)