TikTok Shop Watch #1: Southeast Asia

How well can Bytedance replicate its e-commerce success in Southeast Asia?

Image source: TikTok

Content

Introduction

About a year ago, and a few months after TikTok Shop officially launched in the US, we published an extensive report on TikTok Shop: The long and winding road of TikTok Shop. We explored how TikTok Shop had fared in Indonesia and the UK. TikTok Shop largely failed in the latter market because of its excessive focus on live commerce and poor management of cultural differences. TikTok refocused on Southeast Asia but also faced various challenges in that part of the world.

Now that TikTok Shop is launching in Europe, has been active in the US for about 16 months and all eyes are on whether the app will be banned or sold in that market, we thought it was time for an update. Has it shown more success in the US than in the UK? And how is it doing in Southeast Asia?

There is much information to share on TikTok Shop’s developments in 2024 and its prospects now that it recently launched in several European countries. Therefore, we have decided to split this report into multiple parts. In this first part, we will examine the developments and status of TikTok Shop in Southeast Asia. In the second part, we will discuss the US and European markets. In the third and final part, we explore the various sales models TikTok uses around the world and look at the level of success of live commerce in its markets. We will publish these reports over the next three weeks.

While your business interests might not be focused on the Southeast Asian market, this first part should still interest you since TikTok uses the region as a test area. In this region, Bytedance will try out strategies implemented in Douyin years ago. As such, it will show where TikTok Shop might go in other parts of the world.

The first chapter with statistics for Southeast Asia is free to read for all subscribers, the rest of the report is available to paid subscribers only.

Please note that some of the data in this report can be conflicting since they come from different sources that can use different definitions for metrics.

We hope you enjoy this report.

Cheers,

Ed Sander – Research Editor

TikTok Shop in Southeast Asia

By 2024, TikTok's e-commerce business had been launched in 9 markets worldwide, including six Southeast Asian countries (Indonesia, Vietnam, Thailand, Malaysia, The Philippines and Singapore), the United States, the United Kingdom and Saudi Arabia. Among these markets for TikTok e-commerce, the Southeast Asian countries performed exceptionally well, with their total merchandise volume exceeding that of other regions. The best countries in Southeast Asia have an average daily sales of about $40 million. Meanwhile, in other countries, TikTok has performed poorly or failed to enter successfully for various reasons (we will get back to that in part 2 of this series).

TikTok also withdrew from Brazil and Mexico (where it recently relaunched). While it wanted to focus resources on existing markets, it faced risks with tariff policies (Brazil), political instability (Mexico), and government investigations (Europe). Therefore, TikTok decided not to enter these high-risk emerging markets but to focus resources on relatively stable regions with high growth potential, such as Southeast Asia, the United Kingdom, and parts of the United States.

Understandably, Bytedance chose Southeast Asia as its first region for expanding TikTok Shop. The number of consumers is enormous, the e-commerce market is growing fast and comparable to China 10-15 years ago, and the geographical distance is relatively small. Moreover, TikTok's main user groups are concentrated in Southeast Asia, with Indonesian users accounting for nearly 70% of the region's users.

The total e-commerce market in Southeast Asia is worth $114.6 billion, with Indonesia making up 46.9% of that. Vietnam and Thailand are the fastest-growing markets, with growth rates of 52.9% and 34.1%, respectively, while Indonesia is more mature, with a growth rate of 3.7. [1] According to research firm Cube Asia, the net merchandise value will double to over $300 billion in 2029. Influencer-led marketing is contributing about one-fifth of online sales in the region. [2]

Gross Merchandise Value

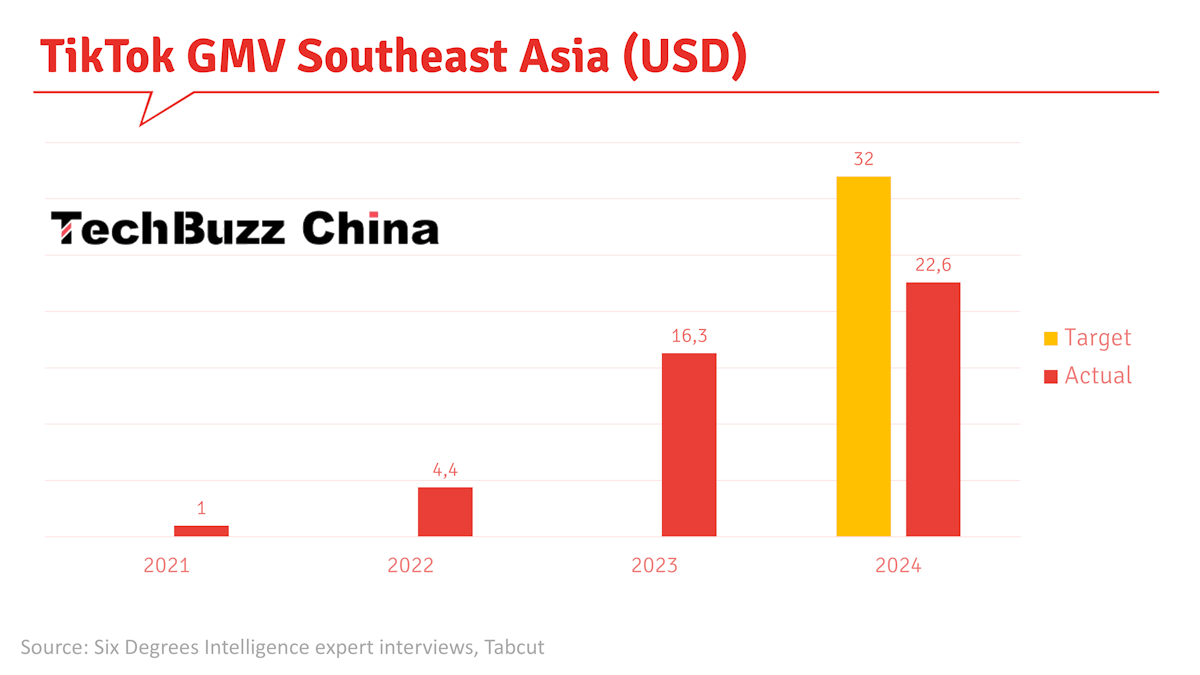

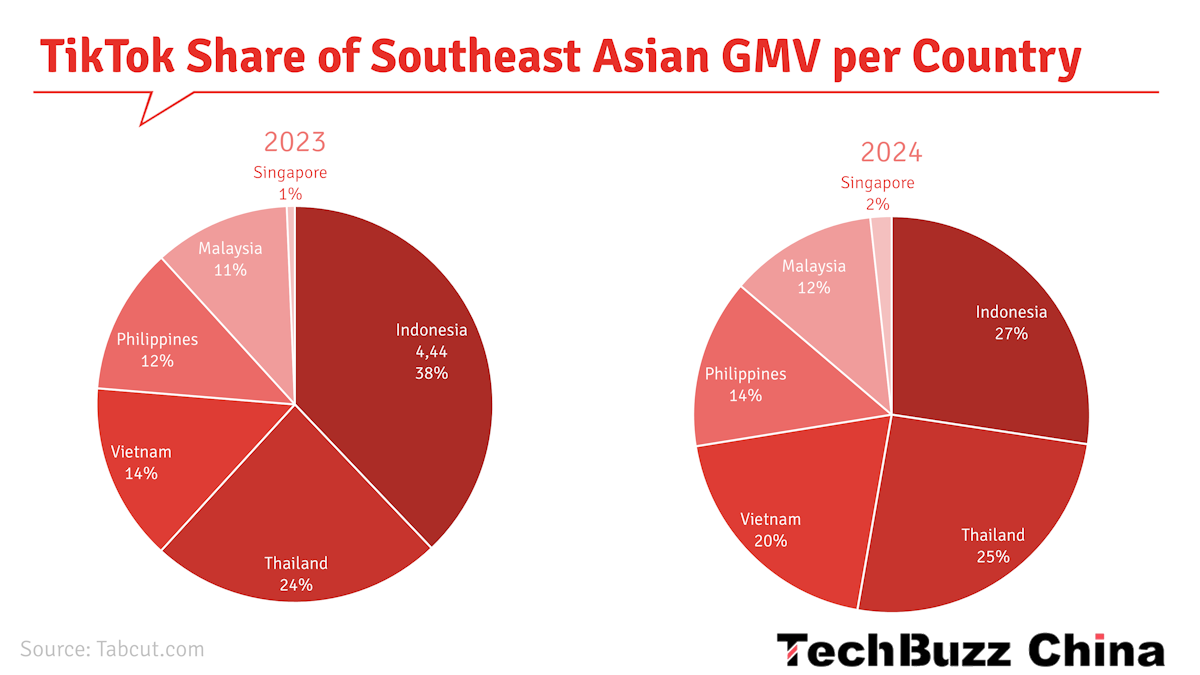

TikTok launched in Southeast Asia in February 2021, with Indonesia being its first market. Our December 2023 report described its early success in the region. In 2022, TikTok Shop was launched in Thailand, Vietnam, Malaysia, Singapore, and the Philippines, and the Southeast Asia GMV reached $4.4, which was 90% of global GMV. [3]

In 2023. TikTok's global e-commerce GMV TikTok Shop almost quadrupled its GMV to $16.3 billion. [5] Southeast Asia again contributed more than 90%. That same year, TikTok launched TikTok Mall (search-based ‘shelf e-commerce’), which reached 37% of GMV, a higher share than Douyin Mall has in China. [3]

The Southeast Asian e-commerce market performed strongly in the first half of 2024, especially in household goods, cosmetics and women's clothing categories. Specifically, sales of household goods reached $2.3 billion, cosmetics sales were $1.7 billion, and electronic products sales were $830 million. Overall, the total merchandise transaction volume of Southeast Asian e-commerce in the first half of 2024 was approximately $12.7 billion.

By mid-2024, daily orders reached the number in the table below.

Source: Former ByteDance TikTok e-commerce strategy manager, June 2024

In the first nine months of 2024, TikTok Shop’s revenue grew by 111% YoY. [7]

According to Tabcut, the 2024 GMV in SEA ended up being $22,6 billion. [9]

These are all impressive figures, but they didn’t meet TikTok’s own expectations. Initially, TikTok’s Southeast Asian e-commerce market was expected to expand to $32 billion by 2024. The main reasons for the possible failure to achieve the annual target include poor sales performance after the end of Ramadan and poor results of spring marketing activities. Also, Indonesia’s GMV needed to recover from a 2-month ban on TikTok Shop in Indonesia in Q4 2023 (see ‘Indonesia’).

Source: Tabcut [9]

Other KPIs

Currently, Southeast Asia has become TikTok Shop's main source of income. In the Southeast Asian e-commerce market, TikTok has advanced from a market share of about 13.2% in 2023, a significant increase from 4.4% in 2022. [6] Together with Tokopedia, TikTok now has a 30% market share in SEA, second only to Shopee (48%). [3]

Note: 2024 includes Tokopedia.

On a country level, Shopee has a market share of 35-45% in various markets, while TikTok's market share is only 5-15%. To increase its market share and catch up with its competitors, TikTok plans to increase its market share to about 25% by enhancing user interaction and optimising its operations.

TikTok's strategy in the Southeast Asian e-commerce market has several notable features. First, with more than 90%, local merchants occupy most of the platform's GMV. Due to the impact of tax policies, cross-border e-commerce lacks competitiveness - especially in Indonesia - TikTok mainly relies on local businesses. However, in the other five Southeast Asian countries, both cross-border and local merchants can be found on the platform.

TikTok's strategy focuses on attracting large sellers to cover 90% of competitor merchants. The platform considered multiple factors in its development, including content sustainability, merchants' production capabilities, and influencers' cultivation.

In terms of orders, the average order amount in the region is between $4.5 and $6. Singapore has the highest average order value, more than $20, while the average order value in other markets is about $4 to $5.

TikTok's current e-commerce user conversion rate is 20%, which is still far from the 40-50% in the Chinese market.

Regarding consumer behavior, it found that consumers in Southeast Asia generally have low brand loyalty and awareness. However, the Singapore market is again an exception: Singaporean consumers show high brand loyalty and willingness to buy.

The return rate in Southeast Asia is higher than that in China, mainly because cash on delivery is widely used in the region. In China, the return rate is about 20%, while in Southeast Asia, this rate is usually higher. This model has led to an increase in the proportion of unpaid orders, which has brought challenges to TikTok's business development in the region. Despite this, TikTok's performance in Southeast Asia is still quite good, especially in the two important markets of Indonesia and Thailand.

In 2024, TikTok has shifted its strategic focus from growth to improving financial outcomes. The platform is now prioritizing the development of a more profitable business model to recover its investment. The primary objective has become enhancing profitability.

Please note: the rest of this article, containing information on competition, the Indonesian market, logistics, products, local services, merchant costs and margins, challenges and outlook, is only available to paid subscribers.