Reports about the death of community group buying are greatly exaggerated …

… but the roads are strewn with corpses of startups and Big Tech initiatives.

Tech Buzz China is partnering up with Six Degrees to host a Happy Hour for investors looking to meet each other in advance of the Berkshire Shareholder Festival! We'll have snacks and drinks and we are super excited to meet you! It's on Friday May 5th, 3-6 PM in Downtown Omaha! Sign up here!

Things that caught our attention

Chapter 1: A recap - The rise and fall of community group buying

The arrival of the big players

Chapter 2: Meituan and Duoduo, the last two standing

Please note that Chapter 2 is only available to paying subscribers.

Things that caught our attention

Alibaba's Spanish cross-border website Miravia, launched in December, seems to be off to a good start. Check out our Twitter thread here.

In our deep-dive article on AIGC in China we summarized the proposed AIGC law, referencing the translation by China Law Translate. If you want to know more about this legislation, check out this article by China Law Translate’s Jeremy Daum.

The Hurun 2023 Global Unicorn List was released yesterday with Bytedance (#1), Ant Group (#3), WeBank (#6) and Cainiao (#10) in the top 10 of most valuable unicorns. The USA has 666 unicorns on the list, China has 316. [Source]

Douyin sees strong growth in F&B content and e-commerce (133% YoY). [Source] Check out the deep-dive we wrote about Douyin's Local Services last month here.

In the past months we wrote about the Rebirth of Xiaohongshu and Douyin’s initiatives in local services. Now the two topics seem to merge as Xiaohongshu is also starting a group buying business.

Talking about Xiaohongshu, The China Project reported how, after the platform put a lot of effort into getting male users on its originally female-dominated platform, many existing users have seen increased harassment. To read more about the changing demographics on Xiaohongshu, check out our deep-dive of February.

Key Takeaways

While the field was initially flooded with independent players, the entry of internet giants have killed pretty much all but OG CGB innovator Xingsheng, who is nonetheless in the process of cutting back operations

The industry is projected to grow GMV by 50-60% in 2023 compared to 2022. New market expansion will contribute 30%, while 70% will come from enhancing existing businesses

Even amongst the internet giants only Meituan and Pinduoduo continue to operate at scale, with Pinduoduo’s Duoduo Maicai pulling away from Meituan and ending 2022 at 1.5x the GMV. Neither, however, were profitable, with Meituan having the worse margin profile. The entire sector’s top goal, therefore, is currently striving for cost reduction and increased efficiency

However, they have their work cut out for them, as the business model has several key challenges that are very difficult to resolve: balancing price and quality, limited target audience, and limited cost savings, even when armed with big data

Duoduo Maicai’s advantage comes from the fact that 45% of its users come from the Pinduoduo platform, which is 400mm DAU strong

Despite losing the lead to Duoduo after achieving 120Bn GMV in 2021, Meituan has done well in optimizing its product categories and relentless operational improvements

Growth for CGB will ultimately come from the lower-tier markets, although operations will also be very costly. Currently, Meituan Select and Duoduo Maicai only have an 8-9% penetration rate in county and township markets

Introduction

It’s been a while since Tech Buzz China wrote about Community Group Buying in March 2022. Therefore, we will start with a history of this e-commerce trend up to early 2022 in Chapter 1. Next, we explore what happened in the past 12 months in Chapter 2.

Chapter 1 provides a guide to community group buying for those unfamiliar with the concept. This chapter is based on a series of Dutch articles Ed wrote in 2021 and a keynote he has given in recent years and is free for all subscribers. If you are already familiar with CGB, we suggest you skip directly to Chapter 2, which shares proprietary findings from the Six Degrees Intelligence database about the subject as well as recent developments, mostly taken from Chinese language media. Chapter 2 is only available for paying subscribers.

Chapter 1: A recap - The rise and fall of community group buying

Many Chinese live in so-called xiao qu, or gated, (typically) multi-building apartment complexes. In addition to housing for thousands of residents, many xiao qu also have their own restaurants, shops, and even kindergartens.

A typical xiao qu in Xi’an.

The community leader

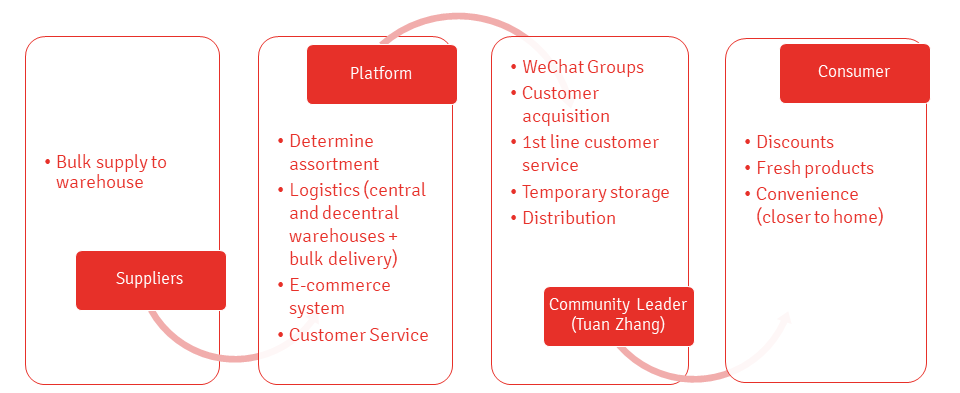

In 2018, a new internet trend emerged, which lent itself perfectly to such xiao qu: community group buying (社区团购shequ tuangou, after this referred to as 'CGB'). The principle is simple: an internet platform enables users to buy products in bulk for a lower price. The platform facilitates the flow of goods from manufacturer or farmer to consumer, eliminating retail and sometimes even wholesalers. Community leaders (团长, tuan zhang) collect orders for these bulk purchases within their community. These community leaders are usually housewives who want to earn some extra money, or the pop-and-mom mentioned above shops in a xiao qu.

Community leaders receive a commission for their work as intermediates. Depending on the platform, it ranged from 5% to 20% of the sale price, earning them an average of 200 yuan daily initially.

You might think: 'If those community leaders get a commission, how can this model be more interesting for the platforms than selling via retail?'. The community leaders do more than just distribute goods within the residential community. They acquire new customers, promote offers, provide first-line customer service, and more. Due to the social aspect, conversion rates are also above average; people are more likely to buy from people they know who belong to the same neighborhood group.

The community leader usually shares special deals with people in the residential community via one or more WeChat groups (which have a maximum number of members of 500). Group members then place orders with the community leader or directly in WeChat mini-programs. The platform delivers the orders the next day (from a grid warehouse in the same city) to the community leader, who stores the goods and then informs the customers. These usually pick up their orders themselves, but some community leaders also deliver the orders to the homes of good customers. A community leader typically has a big refrigerator or freezer to keep the products fresh.

Community leaders are often given a target upon registration that they must achieve within a certain period to retain their role on the platform. At one of the platforms, Niwonin (later acquired by Nice Tuan), this target was 30,000 yuan per month in 2019, to be achieved within three months. [9] On average, community leaders on that platform sold 40,000 RMB per month in that year.

The customers

Consumers who use CGB are generally women between the ages of 30 and 50. CGB is especially popular outside the big cities, where consumers have more time and are more price-conscious. Because the community leader is someone from their neighborhood and they often know them personally, they often rely on their recommendations.

While a community leader often actively recruits customers, consumers can also directly register on a platform. In that case, a consumer chooses a community leader in his area via mini-programs in WeChat and then sees the products that this person offers.

The people who buy together via CGB live near each other. In contrast, someone you purchase a product with on Pinduoduo can be a stranger from a completely different part of China.

Left: Community leader promoting its products and mini program in a WeChat chat group. Middle: CGB app Xingsheng with chosen community leader/delivery address. Right: customer profile page in the Xingsheng app with chosen community leader/delivery address.

The platforms

CGB mainly supplies fresh products such as vegetables, fruit, meat, fish, and non-food items for daily use. The choice within a product category is usually limited to ensure that large quantities of one SKU (Stock Keeping Unit) are sold. The large volumes this creates also give a platform more room for negotiating with suppliers.

In 2019, several startups were active with impressive monthly GMV (gross merchandise value): [9]

Monthly GMV of CGB startups (2019). [9]

Many of these companies had existed for some time. Still, they only started working according to the CGB model in 2018, after community group buying had developed organically in WeChat chat groups since 2016.

Selling via WeChat had been quite normal for some time. So-called wei shang (微商), WeChat sellers, had used the Moments social media feed in WeChat to showcase and sell products through the app. They were young mothers or other Chinese with some extra free time, or Chinese abroad buying for consumers in China (dai gou). When CGB started to take shape, the wei shang were the most obvious source for community leaders.

Wei shang in WeChat's Moments timeline.

In 2020, Xingsheng, one of the early players, had been active in Hunan for two years, had 13,000 convenience stores (via their initial decade-old offline business) and 280,000 group leaders, and achieved 22-25% savings in store management costs through zero inventory and low spillage. It had an average order value of 30 yuan, an average item price of 13 yuan, and a gross profit margin of 22%, higher than that of China’s largest supermarket chain Yonghui. In 2020 Xingsheng’s GMV quadrupled to 40 billion yuan, which is more than Hema’s 2021 GMV of 34 billion. [21] As we will see, this attracted the attention of some of the big internet companies.

The success factors

In episode 80 of the Tech Buzz China podcast, we identified the following factors required to make CGB a success:

In addition to fruit and vegetables, also sell non-food (toilet paper, cooking oil, etc.) to increase the average order value. At one point, Niwonin had 90,000 SKUs, 40% of which were fresh produce.

Expand the logistics network with warehouses in the city.

Sell your own private-label products.

Other factors include offering the right SKUs based on consumer needs, good cooperation with community leaders, cold chain logistics, and good customer service.

The advantages of CGB for those involved are:

Platforms earn a margin on sales and have lower logistics costs, as goods are delivered in bulk for one residential community, thereby saving costs of the last mile delivery. The costs of marketing & sales are also lower. The community leader takes care of customer acquisition, promotion of offers, collecting orders and distribution to individual consumers.

Community leaders are paid a commission, the height of which depends on their efforts; active community leaders receive a higher commission than shops that only act as a pickup point.

Consumers get a lower price through bulk purchasing and, in some cases, fresher products because lead times from source to consumer tend to be slightly shorter. They can also pick up their purchases close to home.

The arrival of the big players

In 2020, about 10% of all groceries in China were sold via e-commerce. 50% was sold via fresh (wet) markets and 40% via supermarkets. Thanks to the COVID crisis, grocery delivery models (including CGB) started taking off in 2020. It was a good alternative for consumers who did not want (or were not allowed) to leave their xiao qu to do their shopping offline. During the crisis, teams were appointed in a xiao qu to shop for several people who were in quarantine.

CGB was a model that fit the situation very well. According to QuestMobile, by September 2020, the number of monthly active users of CGB mini-programs in WeChat had risen to 101 million, a growth of 68% compared to the same month in the previous year. This caught the attention of China's major internet players.

They finally seemed to have discovered a profitable model for grocery delivery. Despite the population density in the cities, this had been a challenge in China. Average order values were low, and delivery costs were high. In addition, having the right cold-chain infrastructure and a fast turnaround for perishable goods in the logistics chain was a challenge.

Some companies, such as Alibaba's Hema (Freshippo) and JD's 7Fresh, were trying a combination of apps and delivery from a store to customers within a few kilometers radius. This solved the cold chain problem. But the low average order value and the delivery costs via couriers, which can amount to 10 yuan, ate up a large part if not the entire margin.

Grocery delivery models

Unlike other delivery models, CGB does not have to incur high delivery costs for individual consumer orders. Delivery is made in bulk to the community leader (often for dozens, if not hundreds of consumers in their community of residence), so the cost is comparable to that of delivery to a retailer.

According to Kaiyuan Securities, last-mile delivery fees with CGB are 2% of the sales value, while they are 13% when delivering to individual customers. [10] Xingsheng claimed to be able to reduce delivery costs per consumer from 7-10 RMB (€0.90 – €1.28) for an individual delivery to 1.5 RMB (€0.19) for a CGB order. According to a Hema employee, profit was made with 20 orders per community group as long as no discounts were given.

And so, Alibaba, JD, Pinduoduo and Meituan all started setting up their own CGB platforms or invested billions of yuan in CGB startups.

Source of fees: Xingye (China Industrial Securities). Independent platform Shixianghui offers 5-15% commission.

In Q2 2020, Didi was the first big internet company to enter CGB in Chengdu, followed by Chongqing. The Didi Chengxin Youxuan team expanded to 16,000 within six months.

In April 2020, Meituan piloted in Jinan, Shandong and in July and it established a separate business unit, Meituan Select (美团优选, Meituan Youxuan), moving thousands of employees away from Meituan Maicai. In September, Meituan planned to expand to 1,000 cities and towns in 3 months.

At Pinduoduo (PDD), founder Colin Huang insisted the company entered CGB after seeing that Xingsheng’s success had made PDD lose volume of agricultural products it was selling in Hunan. PDD moved 1,000 employees (1/6th of its entire staff) into the new CGB division Duoduo Maicai.

Meituan and Pinduoduo both followed the strategy of trying to be first in a city. Didi instead aimed to get 10 million orders in each province, making it fall behind in national coverage. By the end of October, PDD was active in 120 cities, twice as much as Meituan and ten times as much as Didi. [21]

By February 2021, the average daily order volume of Meituan Select and Chengxin was more than 20 million. Duoduo’s was 15 million. While Meituan opened new cities more slowly than Duoduo, it later accelerated when it mobilized agents from takeaway, shared power banks, and other businesses to recruit grid station franchisees and team leaders. [21]

Unexplored market

Research from iResearch [11] found that nearly two-thirds of people who buy fresh produce online did so at least once a week in 2019. This high buying frequency was interesting for e-commerce companies. Other reasons for their interest in CGB were the large number of consumers and the still low e-commerce penetration in the regions that CGB users lived in; it was very popular outside the higher-tier cities in China. In those lower-tier cities, smaller towns, and villages in China often referred to as the ‘sinking market,’ other forms of grocery delivery, such as Hema's ship-from-store, were unavailable.

Due to the population density in the major cities, the retail space per inhabitant is much higher, and there is always a large supermarket just around the corner. Retail penetration is much lower in small towns and rural areas, but it is where most consumers live. In China, approximately one billion people live outside the so-called first & second-tier cities (Shanghai, Beijing, Shenzhen, Guangzhou, and virtually all provincial capitals).

In rural areas, (mobile) internet access and accessibility via asphalted roads have greatly improved in recent years, making small villages more accessible. CGB was therefore a good way to get a foot in the door in an area where e-commerce, especially for groceries, was not yet as established as in large cities such as Beijing and Shanghai. In the battle with Pinduoduo, which had a strong position in these markets, it offered an interesting entry model for companies such as Alibaba.

Hurting the 'real economy'

The government was less pleased with the arrival of the major players in the CGB market. First, it threatened what the government calls the 'real economy'; various small retailers selling the same products, as well as supermarkets, wet markets, and suppliers. Major internet companies would grow even bigger by entering a new market segment, where they had already made their mark in the supermarket sector with new retail initiatives. This could be to the detriment of small pop-and-mom shops and farmers who sell their products to consumers in local markets. More profit for the internet companies and potential unemployment elsewhere, the government concluded.

This danger was exacerbated by the fact that competition between internet players in a new market segment is usually accompanied by burning capital through discounts for consumers. In the past decade, we have seen how this repeatedly led to absurd situations in bicycle rental, ride-hailing, and meal delivery. Products and services were often sold below cost and subsidized with marketing budgets. The players with the deepest pockets (and most willing investors) would survive, and those would normally be the usual suspects. Small retailers would be unable to keep up with this race to the bottom and see their turnover slowly flowing to the CGB platforms.

The subsidies also hurt shops acting as community leaders; they were reluctant to help sell the platform’s products at prices disproportionate to those of their own assortment. But they had little choice; if they did not become a community leader, they would lose that turnover to someone else in the xiao qu.

Food manufacturers and suppliers also felt the effects of the fierce price competition from the tech companies' CGB platforms. After receiving complaints from retailers, some manufacturers like Coca-Cola even tried to prevent the wholesalers from selling their products to CGB platforms or forced them to at least charge the regular retail price. [12]

The 'real economy' under pressure from community group buying (photo: Bart-Jan van der Vorst)

No cabbages, semiconductors!

That the government found the development worrying was apparent from an editorial in the state newspaper People's Daily on December 11, 2020. In it, the internet companies were asked not to focus on selling some Chinese cabbages and fruit but to help solve real scientific and technical problems instead. They needed to pursue technological innovation crucial to the country, such as developing semiconductors. [12] Seeing more money burned in consumer subsidies was a clear example of the ‘disorderly expansion of capital’.

On December 9th, 2020, the Nanjing local government banned "unfair competition methods" such as very low pricing and misleading product information, referring to the existing Price Law and the Antimonopoly Law. Managers of Alibaba, Meituan, Didi, and Suning were required to sign a statement that they would not engage in such conduct.

On December 22nd, 2020, the State Administration of Market Regulation (SAMR) and the Ministry of Commerce summoned the internet companies listed in the table above to provide them with a list of restrictions on CGB. The list contained nine don’ts: [14]

Don’t sell products below cost to gain a monopoly position or to drive competitors out of the market.

Don’t make monopolistic agreements (price fixing, limiting the production of goods, market division).

Don’t abuse a dominant market position (extortionate prices, refusal to trade, etc.).

Don’t make mergers or acquisitions without the approval of the regulators that could lead to the formation of a monopoly.

Don’t mislead marketing and defamation against competitors.

Don’t misuse data that could harm the rights and interests of consumers.

Don’t use technical capabilities and user agreements to harm competitors or platform users.

Don’t illegally collect and use customer data that can lead to potential consumer risks.

Don’t sell counterfeit or inferior products.

The government wasn’t looking to ban CGB, but it wanted internet companies to play the game fairly. Echoing the People’s Daily article, the notification read: “It is hoped that Internet platforms will initiate greater social responsibilities and take greater responsibility for creating new momentum for economic development, fostering of scientific and technological innovation, protecting public interests and protecting and improving people's livelihoods.”

In March, the government showed it was serious when it imposed fines on Alibaba-backed Nice Tuan, Tencent's Shixianghui, Pinduoduo's Duoduo Maicai, Meituan Youxuan, and Didi's Chengxin Youxuan for dumping prices in the second half of 2020. [15] They were all fined the maximum 1.5 million yuan after a two-month investigation, except for Shixianghui who was fined one-third of that amount. Although the fines were peanuts for these players, they promised to behave better.

Who would win? The 2021 predictions.

Despite all this government intervention, the internet companies did not hold back in the first half of 2021. Alibaba hired new staff for its CGB division, [16] Tencent invested another $100 million in Xingsheng Youxuan [17] and Didi Chuxing looked to raise $4 billion in investment for its CGB initiatives.

Pinduoduo also planned to invest more than $6 billion in CGB. Alibaba-invested Sun Art Group, which owns the Auchan China and RT-Mart hypermarkets, said it planned to use CGB to bridge the gap between online and offline after a 5% profit drop in 2020. Logistics specialist SF Express launched the CGB platform Fenghuotai [19], and even Bytedance and Kuaishou had plans to enter the CGB market at the time. [18]

Logos of CGB platforms by December 2020

The big question remained who would win this race? According to iResearch, there were already 100 different CGB platforms in China as of December 2018. The original CGB startups that are not backed by the big players were likely to disappear soon, as we have seen in other industries. They simply do not have the financial means to hire as many and more expensive staff, and to invest as much in warehouses and other infrastructure. Early 2021, insiders thought, the three strongest players were Xingsheng (because of their experience in rural logistics), Meitian Select (good experience in business development and an attractive 15% remuneration for community leaders) and Pinduoduo's Duoduo MaiCai (experience with agricultural products and a popular application). [20] They weren’t wrong.

The estimated size of the CGB market according to iiMedia and Kantar.

The 2021 Shakeout

The arrival of the big players quickly started hurting the smaller startups. Xingsheng had entered 161 cities in the first two years of its existence, but when Meituan Select and Duoduo Maicai entered its home base Changsha, it quickly lost 10% market share in Hunan.

According to an employee of Didi’s Chengxin, at the height of the CGB craze, the entire market was burning at least 10 Bn yuan every month. [8] Many internet giants were losing 2 billion yuan every month. [21] In 2021 capital stopped flowing into the CGB initiatives.

While the big tech firms had gone into a price battle, the commissions of community leaders had been reduced, making them less active. Suppliers were pressured to lower their prices, and logistical service providers running grid warehouses also saw their margins squeezed. Then the platforms began reducing their own costs and staff.

The original CGB start-ups couldn’t keep up with the price war and started to scale back. LatePost quoted an employee of a startup saying: "It's like you are in a small canoe, and the enemy in a fancy warship is charging towards you." [21]

Nice Tuan (Shihuituan), the April 2018 start-up, turned profitable in 2020. In March 2021, it received a $750 million investment led by Alibaba. It was the leading CGB platform before the arrival of the big tech companies. But caught in the ensuing price war, Nice Tuan lost 5 – 6 yuan on every 10 yuan of products.

In March and May 2021, it was given a 1.5 million yuan fine twice for product dumping and deceptive pricing. In July 2021, it raised $300 million from investors, $700 million short of its goal. It started scaling down and laying off staff in August 2021, reducing its once 10,000 large staff to a few hundred.

It finally closed shop in March 2022, leaving 10 million yuan in payment debts and deposits of 200 suppliers and 5 million yuan in debts to grid warehouse operators behind, not to mention unpaid employees. [6] Many former staff and operations merged into Alibaba. [8] Nice Tuan had burned $1.3Bn from investors…

Early 2021, Tongcheng Life tried to defend itself against Meituan and Pinduoduo with 100 million yuan worth of subsidies. It went under in July 2021 and declared bankruptcy in early 2022.

Tencent-backed Shixianghui ceased services around the same time.

Of the early players, only Xingsheng remains but had to pull out of 9 provinces and cities in August and October 2022.[4]

Source: LatePost [22]

But it wasn’t just the startups that were struggling…

When large subsidies were no longer allowed, Didi’s Chengxin Youxuan dropped from 20 million daily orders to 6 million. [21] In September 2021, it began retreating, with the staff decreasing from 16,000 to 5,000. By the end of the year, the CGB initiative had been removed from the Didi Chuxing app. [6] Slowing growth momentum and lower-than-expected customer retention and repurchase rates caused the platform’s demise. It had also found it hard to replicate success in other regions because of differences in supply chain structures. [8]

Internally the failure was explained as: "growth is overly dependent on subsidies, lack of basic skills, and a serious misjudgment of the difficulty of retailing." [21]

Alibaba had four divisions exploring CGB: Ele.me, LingshouTong, Cainiao, and Hema (through its Hema Neighbourhood initiative). In September 2021, CGB was integrated into Taocaicai. The reason for Alibaba’s failure in CGB was described as "the upper-level struggles, the middle-level stands in line, and the lower level has no decision-making power." [21]

In November 2021, Hema Neighbourhood (盒马邻里) pulled out of Guangzhou, Shenzhen and Suzhou. In April 2022, it stopped its service points and self-pickup stations in Beijing, Chengdu, Xi’an, Wuhan, Shanghai, Hangzhou, and Nanjing.

None of the market players achieved their targets for 2021.

By the end of 2021, the combined GMV of Meituan Select, Duoduo Maicai, and Taocaicai was 220 billion yuan. That’s less than 0.5% of total retail sales of consumer goods. As such, CGB remains a tiny portion of the market. [21]

Source: Bain [8]

Into 2022…

Xingsheng turned a 2% net profit margin by January 2022, when it had 180 million MAU. It had however realized that it was hard to replicate its success in Hunan in other areas, just like its struggling competitors had experienced. Xingsheng closed many cities in Northeast and South China.

In March 2022, Tech Buzz China published an update about CGB. The market had significantly changed by then, and CGB had developed into two forms.

· In larger cities, it was a form of grocery delivery e-commerce, competing with many other models like ship-from-store (Hema, 7Fresh), front-end warehouses (Dingdong, MissFresh), and instant retail (JD Daojia, Taoxianda, etc.).

· In the ‘sinking market,’ the groceries were just supposed to be an entry method for a platform that would later sell all kinds of products. In rural areas, supermarkets were absent, and CGB offered low-cost food delivery without stores and inventory.

Xingsheng’s data showed that the second approach worked: its AOV and order frequencies were higher in the sinking market.

China Merchant Securities cut down its estimated market size for CGB by half to 1 trillion yuan in January 2022. Because:

Big non-food categories had not moved into CGB. Even Pinduoduo scaled back its attempts.

Despite progress, cold chain logistics remained underdeveloped.

Nobody had figured out profitable unit economics.

By mid-2022 the commissions had fallen from 20% to 5-10%. Most CGB group leaders in Beijing earned 1,000-3,0000 yuan per month (versus the 200 per day initially). Only 10% earned more than 5,000 yuan. [7]

JD disbanded its Jingxi Pinpin teams in March 2022 and by mid-2022, the CGB battle had been reduced to a stand-off between Meituan and Pinduoduo, with Xingsheng shakily remaining as the only independent player.

Chapter 2: Meituan and Duoduo, the last two standing

By November 2021, Duoduo Maicai and Meituan Youxuan both had about 30% market share, according to Guojin Securities. [8] When the dust cleared, they were the last ones standing, but both slowed down in order to turn around losses. Mid-2022, they still weren’t profitable, and their operational margins before overhead were estimated to be -7% for Pinduoduo and -12% for Meituan. Meituan Select’s loss in a single quarter exceeded 3 billion yuan. [21]