Rain or Shine for Alibaba Cloud?

A deep dive into China’s cloud computing market, with particular attention to Alibaba cloud.

Table of Contents

Things that caught our attention

Chapter 1: Before We Start: Some terminology

Chapter 2: Alibaba in the Chinese cloud market

Private vs Public vs Hybrid Cloud (paid content starts here)

Chapter 3: Other noteworthy news on this topic (paid content)

Please note: the exclusive information in chapters 2 and 3 is only available to paying subscribers.

Things that caught our attention

In each newsletter, we will share some interesting facts and news we came across since the previous edition, primarily related to our earlier content.

The most well-known tech investment banker in China, Bao Fan, was first revealed to be missing, then to be cooperating with a government investigation, by his company, China Renaissance. We did a podcast on Bao Fan a while ago.

In the United States, Pinduoduo’s cross-border e-commerce platform Temu reached a daily GMV of $7 million a week before broadcasting two commercials during the Super Bowl. Data AI showed Temu had 5 million DAU (Daily Active Users) in early February and 16 million MAU (Monthly Active Users) in January. Temu became the youngest brand to ever advertise during the Super Bowl and paid a record fee of $14 million for two 30-second commercials. Temu also launched in Canada and is running internal tests for European countries. (Sources: 36Kr, Latepost, links in Chinese)

As Ed recently wrote on Chinatalk.nl, Temu has also started rolling out PDD-style gamification. We also wrote about Temu in December.

Xiaohongshu was one of three companies (along with Ant Group and Meituan) recently visited by Shanghai mayor Gong Zheng, a sign of support for the company. Gong asked Xiaohongshu to help stimulate consumption through its app features. To learn more about these, read the article we published about the company two weeks ago.

Luckin Coffee’s 2022 revenue exceeded 10 billion yuan ($1.45 billion). The ‘resurrected’ coffee chain is planning to increase its number of stores from 8,214 at the end of last year to 10.000 this year. We wrote about Luckin’s revival in December.

We hope you enjoy this new edition of the newsletter on Alibaba cloud.

Rui, Freya, and Ed

Introduction

In this newsletter, we’re taking a deep dive into China’s cloud computing market, with particular attention to Alibaba cloud. We’ll explore the leading players, their characteristics, how the market has developed in recent years, and what challenges lie ahead.

In chapter 1, we will share some terminology. Chapter 2 contains exclusive information we gathered from expert interviews in the Six Degrees Intelligence database. Chapter 3 summarizes relevant recent developments taken from Chinese tech media.

Key takeaways

Cloud services in China differ from the US. The share of IaaS is much higher, for one, although PaaS is growing quickly and this is one of Alibaba cloud’s strengths. In addition, demand for hybrid cloud is surging while demand for public cloud is slowing down.

Alibaba Cloud is the market share leader and also makes the most profit versus competitors Tencent and Huawei, in large part because its own immense data needs have allowed it to develop products that are very robust and fit user needs.

There have been two distinct periods of development in Alibaba cloud’s history. In the beginning, Alibaba cloud mostly focused on selling to other tech companies and used a product-driven sales strategy. Later, they had to adjust their sales tactics to fit more traditional enterprises and government clients. They also tried to become more of an integrator but eventually had to scale back when project management became too complex to oversee.

AI will be a core growth area for the entire cloud sector going forward, as will be emerging sectors such as EVs. Alibaba Cloud has made significant investments in these areas.

Chapter 1: Before We Start: Basic terminology

In case you need to become more familiar with the terminology used in cloud computing, we have compiled a small guide of terms used in this article.

Cloud computing can be broken down into three categories or ‘layers’:

Infrastructure-as-a-Service (IaaS): servers, storage, networks, and virtualization. Through IaaS, the desktop someone works on is hosted virtually ‘in the cloud.’ Western examples are Amazon Web Services (AWS) and Microsoft Azure.

Platform-as-a-Service (PaaS) offers a platform to develop, execute and manage applications without building and maintaining your own infrastructure. Western examples are SAP Cloud and Google App Engine.

Software-as-a-Service (SaaS): software offered as an online service, often accessed through an internet browser. SaaS is probably the most well-known category, as you will all use it at work and at home. It includes applications like Salesforce, Dropbox, Slack, Google Apps, Microsoft Office 365, etc.

Virtualization, a part of IaaS, is the process that creates a simulated version of a machine’s hardware and software components. An example is a cloud-based version of a computer desktop that isn’t running on the computer or terminal through which it is accessed.

Cloud business can also be categorized in:

Public cloud: a subscription service offered to any customer, but the customer’s data is not shared with others. Consumer examples are Google Drive and Microsoft Office 365.

Private cloud: all layers are entirely controlled by a single organization through on-premise infrastructure (or ‘private cloud’) and not shared with others. This form of cloud computing is often chosen because of legal requirements and data security considerations.

Hybrid cloud: a mixed form of private and public cloud. Where necessary, data and apps can be exchanged between the two environments.

A private cloud can be seen as an office building owned by a company, while the public cloud is an apartment building where various tenants rent individual apartments.

CPU: Central Processing Unit (CPU) is the primary component of a computer (or server) that acts as its ‘control center’; the ‘central’ processor managing the machine's operating system and apps.

GPU: Graphics Processing Unit (GPU), hardware that helps handle graphics-related work like graphics, effects, and videos. Think of the video card in your computer.

Inference chips: Semiconductors designed to handle enormous amounts of data required for training and inference in AI applications.

Middle Platform: (zhōng Tái) Middle platform is an application architecture to organize re-usable business services in order to satisfy volatile user scenarios. Gartner: ”As a leading digital business innovation practice in China, is made to enable modularity, composability and thus composable business. This research showcases the architecture and building blocks of the middle platform, explaining how it enables composable business.”

Chapter 2: Alibaba in the Chinese cloud market

According to a recent IDC report (link in Chinese), in the first half of 2022, the overall scale of China's public cloud service market, including IaaS, PaaS, and SaaS, reached US$16.58 billion.

The IaaS market grew by 27.3% year-on-year.

The PaaS market grew by 45.4% year-on-year.

The combined IaaS + PaaS market grew by 30.7% year-on-year, 18% lower than the growth rate of 48.7% in the first half of 2021.

The growth of the internet industry is largely driven by the use of cloud technology, which is why Alibaba and Tencent are the dominant suppliers in this field. Although the public cloud market is still expanding, its growth rate has slowed down in recent years due to market maturation and the impact of the pandemic.

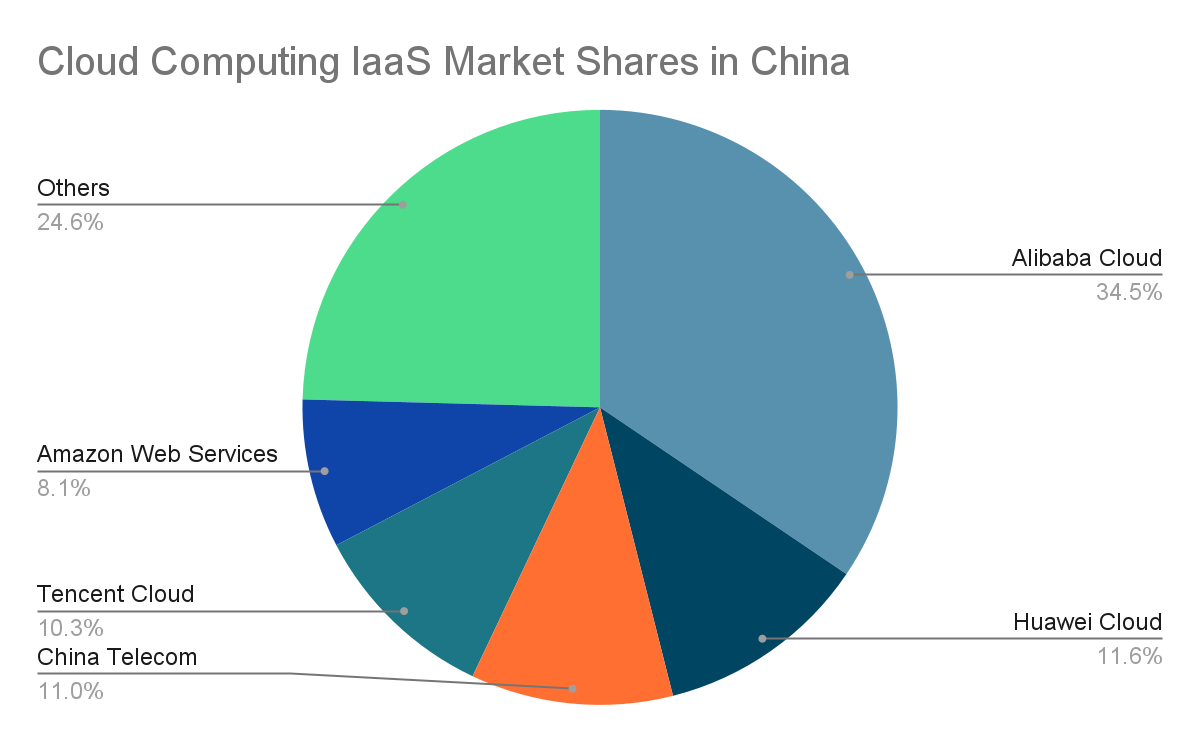

The leading players in China’s cloud market are Alibaba Cloud, Huawei Cloud and Tencent Cloud, in that order.

Source: IDC China Public Cloud Service Market (H1 2022) Tracking

Market shares including PaaS don’t differ much from those in the above chart.

According to industry experts, it is anticipated that Alibaba will maintain its position as a market leader, holding almost 40% market share over the next 2-3 years.

Alibaba cloud's profit margins are slightly better than those of its competitors. The basic cost of Alibaba cloud's servers represents 35-40% of their revenue, which used to be around 40% but has since decreased slightly. In comparison, Tencent Cloud's cost is higher, ranging from 40-45%, while Huawei's is around 45%.

IaaS Dominates, PaaS Lags

At first, the public cloud market primarily concentrated on Infrastructure as a Service (IaaS), which allowed customers to eliminate physical servers and migrate their infrastructure to the cloud. In the early years of cloud computing in China, the emphasis was also on IaaS. For companies like Alibaba, Tencent, and Huawei, IaaS constitutes 60% to 70% of their business, with PaaS accounting for 15%. Additionally, IaaS gross margins are typically less than 10%, although PaaS and SaaS can reach over 50%. In contrast, Western cloud providers such as AWS, Google, and Azure have IaaS as 50% of their business and PaaS as 40%.

In Western countries, customers and companies are willing to invest in Platform as a Service (PaaS). However, in China, except for the gaming industry, internet companies generally possess the necessary capabilities and human resources to create their own databases. Nonetheless, due to budget constraints, they often opt to build applications and databases on their own physical servers rather than purchase cloud services from a public provider. By doing so, they can save costs and feel more in control of their systems.

The emergence of public cloud technology was a game-changer for government agencies, enterprises, non-internet companies, financial institutions, and others. However, these organizations lacked the necessary technical expertise to handle cloud services on their own. Nonetheless, they had a need for technical services to help them achieve their revenue goals. To save costs, these organizations were willing to outsource these services and purchase Platform as a Service (PaaS) solutions.

While Infrastructure as a Service (IaaS) has experienced a downward growth trend, the software layers such as PaaS (and to a lesser extent, Software as a Service or SaaS) have shown a positive upward trend. Although PaaS currently holds a relatively small market share, it has begun to attract more attention. This is good news for Alibaba cloud, which has a strong presence in PaaS solutions.

The adoption of cloud technology by internet companies has reached a plateau, and future growth must come from traditional companies. Unlike the free market of the internet, the traditional enterprise market operates on an annual IT budget. Some large state-owned enterprises have a fixed budget each year, and this limits their ability to pursue multiple innovative initiatives simultaneously. They may have to prioritize and phase out projects over time due to budget limitations. They can only tell you, "It's not possible. We only have one billion this year, let's do one billion first, and we will do another billion next year."