Luckin's Revival

Luckin’s Revival … So Far

Housekeeping / Announcements / Fun:

Happy Holidays! This is our last letter for the year. Thank you so much for reading!

As with the previous piece, the below is written by Ed Sander and Freya, and edited by myself, and is based off of Tech Buzz’s partnership with Six Degrees Intelligence, a leading global expert network / quantitative research firm that operates in China.

As a reminder, you are not being charged for this note nor anything for the rest of the year, although we are targeting January 2023 as the resumption of our paid membership.

As before, all of the information shared below, unless linked to an external site, are gleaned from multiple proprietary expert interviews you will not find elsewhere! Therefore, I ask that you please do not share this information with anyone outside of your investment organization. Let me know of your feedback!

A reminder that if you would like a free trial to the full database of expert transcripts, please reply to this email. It is, however, currently only available in Chinese.

The Discord server remains very active and open, so do please check in there if you haven’t. Thank you so much to all of you who participate and share regularly there, I’ve learned a ton.

Luckin’s Revival … So Far

TL;DR: Luckin’s rise from the ashes of its massive fraud has been both surprising and spectacular. The below is based on expert interviews conducted in May and June of this year on the details of Luckin’s operations. The brand’s self-operated stores outside of Tier-1 cities continue to be a huge boon to profitability, and franchising has also gone very well. In addition, the new management has improved the new product development process, and correctly identified new marketing channels such as WeCom (commercial version of WeChat). Many believe that Luckin has already defeated Starbucks, especially judging by the pandemic performance of the two players. Let us know what you think!

Background:

Recall that in January 2020 Muddy Waters published a report accusing Luckin Coffee of revenue fraud of $300 million, which led to its delisting from Nasdaq. Last month, 36Kr reported that Snow Lake Capital, a hedge fund that allegedly was behind the fraud report, released a new report claiming that Luckin’s rebirth was ‘a miracle in Chinese business history,’ and even bet 15% of its AUM on the company. Snow Lake names three factors for the renewed success of Luckin, all of which show up to some degree in the later sections of today’s piece:

Right time: because of the pandemic Starbuck’s alternative office space model failed, while Luckin’s buy-and-go claimed market share.

Right place: Luckin invented new coffee-based beverages (in 2021 it launched 113 new recipes, and its Coconut Cloud Latte has been very popular) that helped it expand into 2nd and 3rd-tier cities.

Right people: Centurium Capital became the controlling shareholder (57%) and helped reorganize the management team.

At the end of 2021, Luckin overtook Starbucks in number of stores. In the second quarter Luckin’s self-operated stores saw a revenue growth of more than 41%, impressive considering the Shanghai lockdowns and even more impressive considering Starbucks saw sales drop 44% in the same period.

Luckin Gets Lucky:

Prior to the fraud scandal, revenue and profit at individual stores was unknown. Without a contingency plan Luckin’s cash flow would have dried up 3 months after the scandal broke. However, customers were worried they would lose their pre-paid credits if Luckin would go bankrupt, resulting in irrational buying. Volume doubled and even tripled or quadrupled at some stores. When sales stabilized, they were higher than before the scandal.

Snapshot of a Store:

550 self-operated stores in Shanghai and 291 in Suzhou / Wuxi / Nantong and Changzhou indicating strong coverage outside of Tier 1 cities, which we already know to be Luckin’s strength

Daily average: 600 cups @ 15 RMB or 5mm RMB a day and around 140mm RMB per month, with peak of 160mm RMB in Dec. 2021.

Profitable in Shanghai since March or April 2020 with margin starting at 17% and stabilizing around 30%. While Beijing’s revenue is not as high as Shanghai’s it sees comparable profitability.

In the second quarter of 2022 Shanghai region stores suffered an estimated net loss of more than RMB 40 million per month owing to the lockdowns with around 900 daily store closures on average in April and May. But business has since returned and stabilized.

In addition to profitability, other KPIs that Luckin uses are customer satisfaction, quality control results, punctuality rate, etc. It advises individual stores based on profitability of the surrounding area and type of business district. A store director manages 200 stores.

Franchising: The Next Stage of Growth

Before 2019 Luckin only had one or two hundred franchise stores, all of which were tea stores and failed. However, pivoting to coffee has been a massive success

After opening the franchise model to coffee stores in 2020, the franchise stores accounted for 30% of new store openings. Share of new stores that will be franchised is already roughly 50% in 2022, and expected to increase to 60% in 2023 and max out at 70% in 2024. The total number of franchise stores, however, is not expected to exceed 1,000 per year

Initial investment to open a franchise store (60-80 sqm+): 600,000 RMB. Fixed costs including coffee machine and other equipment: 90,000 RMB

In the early days, the success rate of franchisees was just 50%. It is now at 95%.

Commission rates that franchise stores pay depend on their gross profit

Monthly gross profit: Commission

< 20,000 RMB: 0%

20,000-30,000 RMB: 10%

20,000-40,000 RMB: 15%

40,000-80,000 RMB: 20%

>80,000: 25%

Now that with the profitability of self-operated stores improving, Luckin has been tightening its policies for franchise stores. Luckin is also improving the quality and brand control of its franchise stores.

Pricing

Average Luckin pricing is 15 RMB, which means one cup a day gets to roughly 400 RMB per month, or 5% of an urban worker making 8000 RMB salary a month. There is still room to grow as only 10-15% of customers are drinking Luckin everyday. Most are at 2-5 cups a week. So growth of 15-20% CAGR for the next three years is entirely within reach.

In its early years, Luckin offered discounts as high as 82%. With the continuous launch of new products, roughly 20 per week, this was brought down to 52%, which customers accepted. The average net price of a Luckin drink has increased from 10-11 RMB to 15 RMB, 5 RMB of which is profit margin. Competitor Manner Coffee’s average price per cup is around 22 RMB.

Luckin adopts flat rate pricing across China. Because wages are lower in 2nd and 3rd-tier cities the profit of stores in such locations can be two or three times higher than in Shanghai.

Customer Relationship Management

Luckin has maintained its online-only sales model; even when in a store consumers can only order through the app. Orders from third party platforms account for 40-50% of volume, while more than half come from Luckin’s own apps.

Luckin has been using WeCom, Tencent’s corporate communication and office tool, to develop private traffic at low cost. Since everybody uses WeChat in China, they also have an automatic WeCom account. In April 2020, Luckin selected 50 out of 4,000 stores for trials with customized promotions. By scanning QR-codes on displays in these stores customers could add themselves to Luckin’s WeCom account. This enabled Luckin to later give the customer customized coupons based on their tastes, preferences, and the weather at their location.

By July 2020 Luckin had acquired 1.8 million users on WeCom that together ordered 35,000 cups per day. The number of Luckin customers on WeCom has now reached 20 million (as of 1H 2022).

Product Development

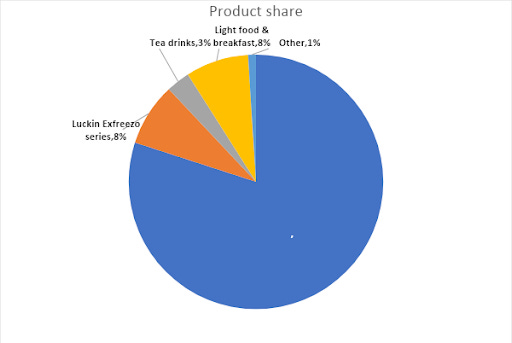

Luckin also made a name for itself with new, proprietary products. Within the freshly ground coffee category, its self-developed coconut latte accounts for more than 20%, and other new products account for another 12% or so. New product development takes 6-8 months and the company is aggressive about launching new drinks.

Other Post-scandal Adjustments

After the accounting fraud scandal, the following measures were taken to reach profitability:

Salaries of employees (including management) were mostly frozen; there have been almost no salary increases

For marketing, Luckin has become more diverse compared to their old celebrity endorsement strategy. While still using endorsements – a deal with Eileen Gu really paid off – they have also started cooperations with some banks and do short-term promotions, product placements and KOL campaigns

Location Expansion: County-level cities such as Kunshan have done quite well in sales – as high as 2,000 cups per day (more than 3 times the average), and each city can support 4-5 such stores

After the management reshuffle following the scandal Luckin’s new CEO Guo Jinyi took the following measures:

Introducing an incentive stock option for directors in first-tier cities in the second half of 2021. This was rolled out to second-tier city directors in the first half of 2022.

Leftover management from UCar days (where the original founders came from) were removed and good performers such as Cao Wenbao, formerly a vice president of McDonald’s Greater China, was promoted to join the board

Supply chain performance has also improved. In Luckin’s early days only 70-90% of orders from the supply chain would arrive on time. This has increased to 98.9% though continuous investment in improvements.

Re-Listing

Although Luckin said during a Q2 2022 earnings call it remained ‘committed to US capital markets’, now that Luckin has reached profitability it is expected to file a new IPO in Honk Kong or Mainland China, not Nasdaq, in the near future.

In the meantime, the former Luckin Coffee chairman and CEO have started a new coffee chain, Cotti Coffee, with members of their previous Luckin and CAR Inc. teams. Together with Manner, Saturnbird and Tim Hortons it is a new player entering a market that according to iiMedia Research will maintain a growth rate of 27.2% and will reach RMB 1 trillion in 2025.

Final Thoughts:

It’s funny to think that Luckin’s plan was actually sound from the getgo. If only they had stuck to it instead of engaging in fraud. In a twisted way, the scandal also ensured that no one else would enter the fray – there were already many skeptics, but surely no one would really invest in a direct competitor after the scandal. A mixture of good timing, focus on the right aspects – product development and digital marketing helped Luckin not just survive but thrive during the pandemic. The bigger story though, might just be how much Starbucks has fallen, in comparison. Maybe in a few years, we won’t be talking about Starbucks in China anymore, but Luckin in the US! Weirder things have happened with this company, haven’t they?