TikTok Shop Watch #2: Out of Asia, into US & Europe

How is TikTok Shop doing in the US, UK and Europe?

Contents

Things that caught our attention

German subscribers might be interested in the Deutschlandfunk radio report E-Shops aus China krempeln den Onlinemarkt um in which Tech Buzz China’s Ed Sander is one of the interviewed.

A WeChat account sharing news about instant retail revealed details about the payment of delivery couriers and how much extra they can earn when continuing work during Spring Festical. We summarized the article in a note.

Introduction

Last week, we examined the state of TikTok Shop in Southeast Asia. This week, we move west to see how Bytedance’s cross-border e-commerce platform has progressed in the US, Europe, and the Middle East.

Please note that some of the data in this report can be conflicting since they come from different sources that can use different definitions for metrics. Still, when sharing a few details of this report on LinkedIn, an e-Commerce Leader at TikTok commented: “This is surprisingly spot on for someone who hasn't worked at Tiktok. Most people don't understand how it's working.” Well, there you have it.

The two chapters, which include GMV statistics and a look at the various regions, are free for all subscribers to read; the rest of the report is available to paid subscribers only.

We hope you enjoy this report. Next week, in the final part of this series, we will investigate the sales models of TikTok and how live commerce has been doing in all of its markets.

Cheers,

Ed Sander – Research Editor

Gross Merchandise Value

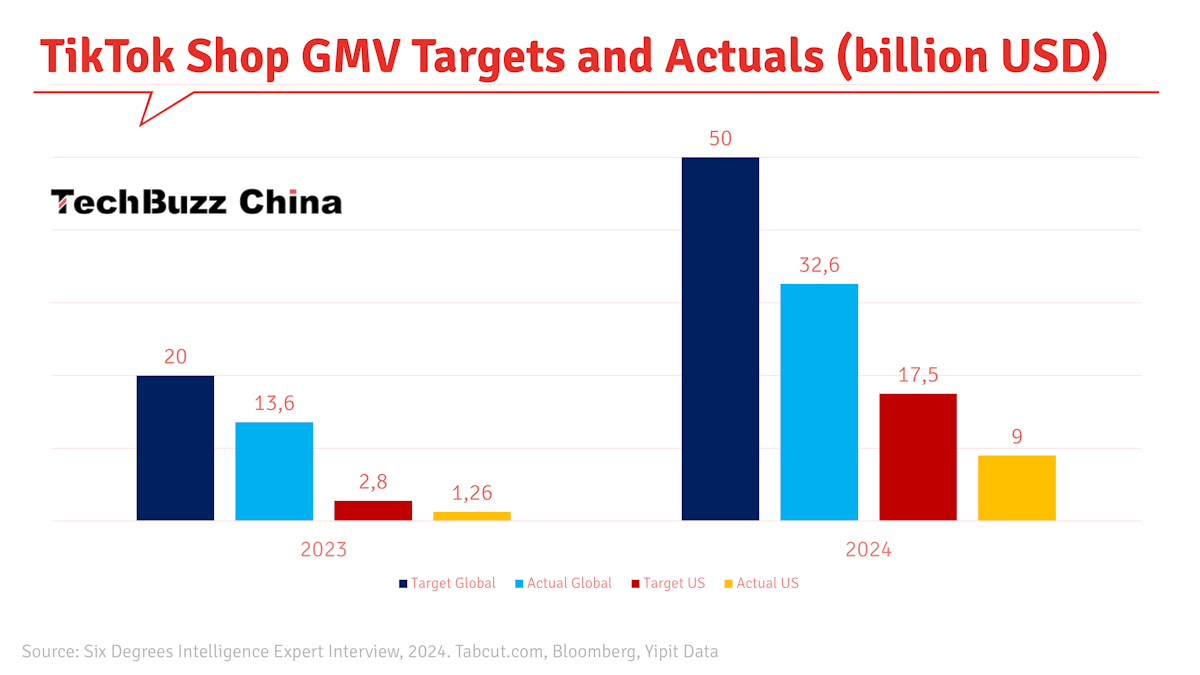

Halfway through 2024, TikTok revealed that the global GMV in 2024 was expected to be around $50 billion, growing from $19.5 billion in 2023. The US market would contribute about $14-17 billion, and the Southeast Asian market accounts for most of the rest. However, internal estimates put it at more than $80 billion if all goes well.

Seemingly, it didn’t go well … Both the ‘realistic’ and ‘optimistic’ targets were not achieved due to the poor performance of the US market. Layoffs, political risks and a lack of understanding of the US market may make reaching the goal difficult.

Earlier in 2024, experts still expected TikTok Shop's total merchandise transaction volume to exceed US$40 billion in 2024 and its growth rate to exceed Shein and AliExpress's. But even that estimation turned out to be too high …

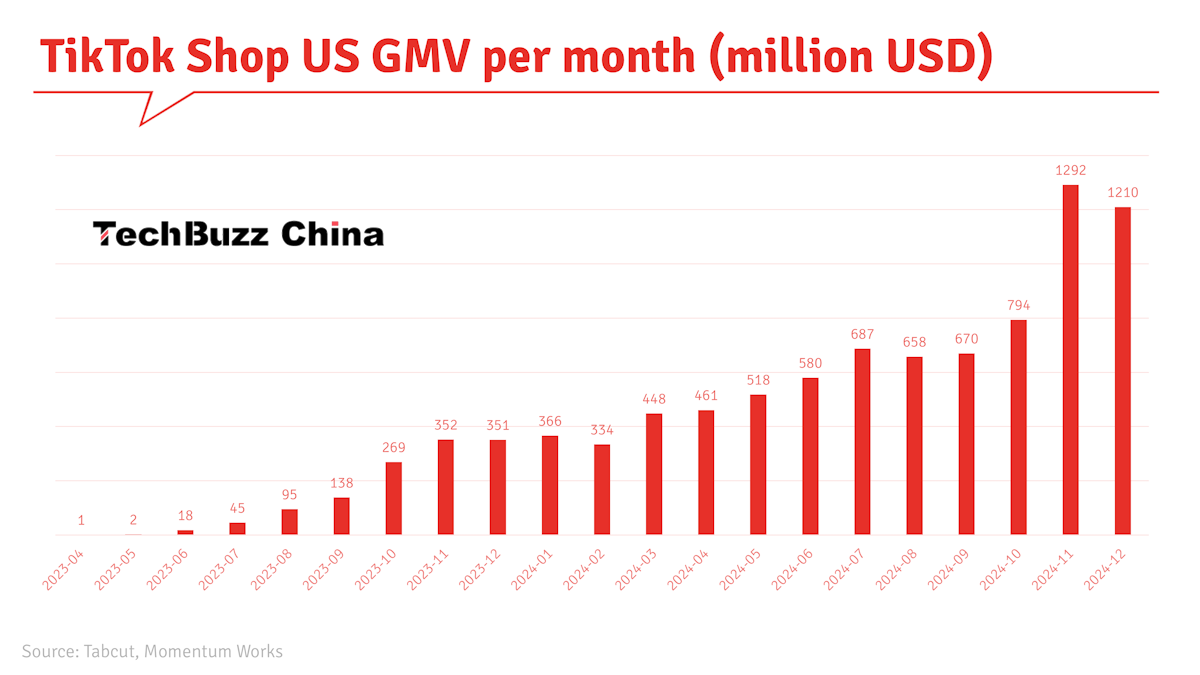

According to video commerce data analytics firm Tabcut.com, TikTok Shop’s global GMV reached $32.6 billion in 2024, with the US accounting for $9 billion. The AOV in the US and Singapore is about $20, while it is about $5 in Malaysia and Indonesia. [1]

Meanwhile, the Saudi Arabian market has developed slowly due to pricing and profit margin restrictions.

While the US shows impressive growth in the chart above it should be noted that in 2023, TikTok Shop was only active for one quarter in that market. TikTok also missed its target of $14-$17 billion. Considering the spending power of UK consumers compared to those in Southeast Asia, the size of the UK market also remains limited.

Markets

According to a former TikTok Shop Business Development Manager in Southeast Asia, TikTok's e-commerce division is strategically shifting, focusing its efforts on Europe and America. These regions are known for their higher average purchase values, which makes them particularly attractive for the company's expansion plans. The expected outcome of this restructuring is to boost TikTok Shop's profitability in these Western markets.

TikTok Shop is a relatively new entrant in these regions and sees significant potential for growth and expansion in both European and American markets. This approach demonstrates a cross-market subsidisation model, where TikTok uses profits from one area (Southeast Asia) to support its expansion efforts in other markets.

After having already launched TikTok Shop in the United Kingdom (2021), TikTok Shop suspended plans to launch in Brazil, Ireland, Spain and other countries to focus on its US launch in 2023. A year later, it suspended entry into eight countries, including Japan, South Korea, and Germany, to continue focusing its resources on the US market. [2]

In early January 2025, news broke that TikTok Shop had picked up its plans for Mexico, which would launch on January 13th. The platform would work with local merchants, among which are top sellers on Mercado Libre. TikTok had reserved $2-3 billion for product subsidies and promotions to kickstart the market. It would offer customers three 50% off orders. TikTok would also waive commission and shipping costs for merchants for two months. A playbook that has also been used elsewhere, as we will see. Influencer sales would start in February. [3][4]

Let’s first look at the other non-Asian markets TikTok has been active in or gearing up for…

USA

After Trump's original plans to ban TikTok, Bytedance was cautious about launching TikTok Shop in the US. The user growth of TikTok also slowed down, and launching in-app e-commerce could result in TikTok losing Amazon as a significant advertising client. So, instead, it opted to launch in Southeast Asia and the UK in 2021. It considered the UK a comparable market in terms of language, culture and consumption habits. However, that year, the commercialisation department’s target of $12 billion was not achieved. [5] Our December 2023 report described the many issues TikTok Shop ran into in the UK market.

In internal meetings in Seattle, TikTok e-commerce director Kang Zeyu repeatedly urged the team to launch US business ahead of schedule. This resulted in the postponement of plans to enter Brazil, Spain, Ireland and other countries that had been preparing for several months by completing formalities, renting offices and recruiting employees in these markets. [5] When TikTok Shop failed to launch in July 2023, the manager in charge of the technical team was replaced. [6]

Before officially launching in the US in September 2023, TikTok has already been testing the market for a few months. In May, the single-day sales in the US were $300,000, which increased to more than $5 million in August and $10 million in October. According to data from FastMoss, during the Black Friday period on November 24th, the single-day GMV reached $33 million. [7]

TikTok Shop launched a price war on Black Friday, benchmarking Temu's hot-selling list. The top 500 hot-selling products had to be at least 15% cheaper, the top 500-3000 products at least 5% cheaper, and the products after that had to be simply cheaper than Temu. [5] Over 5 million new customers bought something on TikTok Shop during Black Friday in 2023. [8]

In 2023, TikTok’s global GMV was approximately $20 billion, with the US market accounting for 6.5% ($1.26 billion). For 2024, TikTok Shop set a global GMV target of $50 billion, including $14-$17 billion in the US market.

In 2024, TikTok Shop’s average daily sales have reached about $20 million, almost catching up with those in Indonesia. The average order value in the US is close to $30 US dollars, much higher than the $5 in Indonesia. [5]

In Q4 2023, TikTok optimised the algorithm and doubled the ad load for e-commerce traffic from 5% to 10%. However, users quickly complained when 150,000 creators and merchants posted shoppable content. Some users shared instructions on how to block posts with the #tiktokshopping hashtag. [9]

TikTok is now careful not to destroy the user experience of its short video app with an abundance of commercialisation. It currently allocates about 2% of its feed content to e-commerce, much less than the 10% in Southeast Asia. [5]

All the signs seemed optimistic, judging from various reports that were published throughout 2024:

In February 2024, 202,000 stores were active on TikTok Shop US, comparable to the number in Indonesia by the end of 2023. It had taken Indonesia two years and the US half a year to reach this number. [10]

In June 2024, e-commerce marketing company Omnisend claimed that 33% of American users have already purchased on the platform. 56% of Gen Z respondents had shopped at TikTok Shop in the previous 12 months —almost two times more than other generations. Thirty-six per cent of Gen Z shopped there at least once a month. [11]

Canvas Beauty, a beauty brand by entrepreneur Stormi Steele, set a TikTok U.S. record on June 8th with a 6-hour live stream that achieved $1 million in sales. [12]

Earnest Analytics found that about 27% of TikTok Shop shoppers will buy again five months after their first purchase. In this indicator, while being behind Amazon’s 36%, TikTok Shop outperformed other e-commerce platforms, including Walmart, Temu, Shein and Etsy, as well as other social commerce channels Whatnot, Flip and Instagram Checkout. [13]

In August 2024, Salesforce shared that since the last survey in April 2024, there had been a 24% increase in the number of shoppers who report making a purchase through the TikTok app. [14]

A report released by TikTok Shop shows that on November 29, the sprint day of Black Friday, TikTok Shop's sales in the United States exceeded $100 million, three times that of last year's Black Friday. In addition, the overall GMV of cross-border merchants in the self-operated (POP) model on Black Friday increased by 191%, and the overall GMV of the fully managed model on Black Friday soared by 187%. [15] Note that the channel of its single-day revenue of over 100 million is unknown and may include malls, live broadcasts or merchant advertisements.

In 2024, among all the countries, the US revenue accounted for 24%, ranking first, and the growth rate was also the steepest. [16] According to Tabcut data, the US had a 27,6% share in global GMV in 2024.

According to Baijing Chuhai, by September 2024, one year after the launch of TikTok Shop, the GMV of content e-commerce had increased more than fivefold, daily paying users had tripled, and the number of content creators increased by 10 times. The number of influencers with active sales grew by 70% each quarter. [17]

In November 2024, during the Black Friday season, TikTok Shop set a new GMV record of $1.2 billion in the US, a 51% month-on-month increase. Daily sales reached almost $40 million. The bestselling categories were Beaty & Personal Care, Women’s Apparel and Phones & Electronics, according to Kalodata. [18]

According to Earnest Analytics, TikTok Shop was the fastest-growing e-commerce platform during the November 1st -13th holiday season, growing 213% YoY, faster than Temu (18%) and Shein (16%). [19]

TikTok Shop has 398,000 stores (of which 216,000 have active sales) and 11 million influencers in the US. In 2024, 1033 stores achieved over $1 million in GMV and 77 stores achieved over $10 million. The top store, Micro Ingredients, which sells health products, achieved $63.4 million in GMV. [45]

These are all impressive figures, but we need to realise three things. First, TikTok Shop started from a very low base, having only been active since September 2023. Second, these figures can’t hide the fact that TikTok Shop did not make its internal targets. Third, it’s unclear how much TikTok Shop had to invest to achieve these widely publicised results.

For instance, during Black Friday, TikTok Shop launched a package of traffic bonus policies, including but not limited to cooperating with mainstream media and top celebrities in the United States for publicity and promotion, setting up special promotion area landing pages, flash sale channels, and Black Friday exclusive low-price tags and other modules; and promoting live streaming. [20]

By June 2024, it was reported that to make its $17.5 billion target in the US, TikTok still had to sell $12 billion in the year's second half. From January to May, TikTok Shop had only generated $2 billion, according to Tabcut data, only reaching 11.4% of its annual goal. [21] By August, TikTok Shop US had generated $4 billion, less than one quarter of its goal. [22]

In August 2024, Latepost reported that TikTok Shop had not reached its goals since its US trial run in May 2023. In the first half of 2024, daily US GMV exceeded $20 million, doubling from the end of 2023, but still far from the target of $45 million. By comparison, Temu’s daily GMV in May was around $90 million, with the US accounting for 35%. TikTok Shop set a target for the daily US GMV to peak at $75 million in the second half of 2024. [2]

At the start of 2024, according to Bloomberg, the US TikTok Shop had set a full-year GMV target of $17.5 billion. According to 36Kr’s exclusive report, only about $8 billion of this target was achieved, less than half the expected amount. [23] Tabcut had the US GMV number as $9 billion. [1] This is partly due to the difficulty of live e-commerce to develop in the local market and partly due to the impact of the potential ban.

As it had in the UK, TikTok found that US users had no habit of live shopping, and there was a shortage of livestream hosts. It also dealt with a market where, unlike in many Asian countries, offline business was already very developed, and the competition was intense. [2]

UK

TikTok picked the UK as its first Western market because the US planned a TikTok ban then. The country has well-developed offline retail, and influencers have already established monetisation on platforms like Facebook and Instagram. [24]

When it entered the UK, TikTok Shop had to decide if it would focus on live commerce, which had made Douyin so successful in e-commerce, or the more accepted search-based ‘shelf commerce’. It decided to go for live commerce, thinking the domestic model was the right approach. This turned out to be the wrong bet, as we described in December 2023. [6]

In 2023, some small TikTok Shop stores in the British market experienced negative growth in February, with some merchants leaving the British market. Still, it remained stable and grew slightly in the following months. Throughout the year, the number of stores remained roughly the same, rising from about 21,000 in January to about 25,00 in December 2023. The growth trend of monthly GMV in the British market was more pronounced. [25]

Still, after three years, the UK contributes less than 10% to TikTok’s overall e-commerce business. [24]

After a difficult start in the UK, TikTok Shop hit a record high during Black Friday 2024. An average of 6,000 livestreams were held daily, and 1.6 shoppable videos were created during the promotion period. Cross-border live commerce grew 257% YoY and TikTok Mall 170%. [26]

Some think Europeans are warming up to the ‘interactivity and fun’ of live shopping. In research by Retail Economics, 29% of UK respondents said they had purchased on TikTok in the previous 12 months. TikTok UK claims that 80% of DAU make purchases after watching short videos or livestreams, and there are 5,000 livestreams every day, twice as many as in 2023. The average daily GMV increased by 90%. [26]

But again, note that the base for all this growth was minimal ($600 million GMV in 2023). While PR messages are full of the results of specific brands and streamers, especially those related to beauty care, it is unknown what investments TikTok Shop had to make to get these results and their ROI is…

According to Retail Economics, the content e-commerce market in the UK will more than double from GBP 7.4 billion to GBP 16 billion in the coming four years and its share of the e-commerce market will increase from 6% to 10%. [26] Considering how live commerce already had a share of 25% - 30% of e-commerce in China in 2023, the UK still has a long way to go. However, compared to shelf e-commerce (traditional, search-based e-commerce), which has slowed down to single-digit growth, it at least shows potentially significant growth.

Mainland Europa

In 2023, European social e-commerce revenue was $26.7 billion, and it is expected to grow to $48.3 billion by 2028. Spain is expected to overtake the UK in the number of social commerce users by 2027. [26] If true, TikTok Shop will be in a prime position to grab this business as it is the leading social media app by time spent in many countries.

However, TikTok has the most stringent compliance requirements. Compared with its rivals, TikTok has adopted a more cautious approach to dealing with political risks. For example, while Temu shifted its primary focus to the European market, TikTok slowed its expansion overall, avoided entering high-risk emerging markets, and focused on improving the user experience in existing markets.

At the beginning of 2024, TikTok Shop hoped to open in 40 countries in the year's second half, including Brazil and 10 European countries. Soon, however, the goal became conservative and was adjusted to prioritise the ten core European countries. [27]

In April, TikTik posted several e-commerce-related jobs on its website, such as a Senior Fulfillment Solutions Manager (Amsterdam): ‘We are looking for highly qualified and experienced Senior Fulfillment Solutions Managers to strengthen our logistics team. (..) This role includes strategic planning, optimising logistics and fulfilment solutions, and ensuring efficient and effective delivery of products from suppliers or retailers to end consumers. (..) responsible for planning and designing logistics solutions for Great Britain and the entire EU”. [28]

Another example was an “E-Commerce, ESG and Trade Policy Analyst” in Brussels. "Observe the political trends and debates that impact Tiktok's current and future eCommerce business strategies in EMEA." [28]

In May, news broke that TikTok was inviting merchants in France, Spain, Germany, Ireland, Italy and Mexico for a beta version of TikTok Shop. [29] But although even one service provider claimed TikTok Shop would launch in Germany in Q2 2024 [28], by the end of May, it was reported that the July launch of TikTok Shop in the EU was once again postponed, as well as those in Brazil and Mexico, to focus on the US market. [30] In July, rumours of a launch in Spain and Ireland as early as October returned. The rollout would be limited to these two countries, but more would follow in 2025. TikTok Shop had already recruited a team of 40 in Spain. [31]

After all the delays, TikTok Shop was finally launched in Spain, where it has to compete with Amazon and AliExpress, and Ireland in December 2024. [24] More recently, TikTok Shop was said to be testing in Germany and Italy and preparing for a launch in The Netherlands in 2025. [32]

TikTok has started recruiment of staff for the German market. “We are looking for a talented account manager to join the Germany team for the Fulfilled by TikTok (FBT) division.” Other e-commerce related job openings are available in Brussels, Berlin, Copenhagen. Dublin, Hamburg, Luxembourg, Madrid, Milan, Paris, Stockholm and Warsaw. [46]

Europe is challenging for TikTok Shop. The EU’s Digital Services Act (DSA) officially came into effect in August 2023. Online platforms with more than 45 million monthly active users must strengthen censorship and promptly delete illegal and harmful online content. TikTok’s internal assessment of the European market is that it will take at least half a year to get volume gradually. This also meant the European market's contribution to 2024’s $50 billion target would be limited. [27]

TikTok felt the power of the DSA in April 2024, when the EU ordered TikTok to deliver a risk assessment for its rewards program, in which users of TikTok Lite in Spain and France could receive points for watching content. Points could be exchanged for Amazon vouchers, gift cards or TikTok’s coins currency. Failure to deliver the assessment in time could result in fines of up to 1% of its total annual worldwide turnover or periodic penalties of up to 5% of its average daily income. Even though TikTok claimed it was not available for users under 18, the EU was worried about the potential addictive effect of the rewards program, especially for minors. [33]

In February 2024, EU regulators had already announced a formal investigation into TikTok over the app’s addictive design and screen-time limits, its privacy settings, and the social media platform’s age verification procedures. [33]

Middle East

In April 2024, there were rumours that TikTok Shop would pull out of Saudi Arabia. TikTok denied the rumours. However, livestreaming, for both e-commerce and entertainment, had been suspended since December 2023. As a result, TikTok Shop’s daily order volume dropped from 30,000 to 1,000. At the time, a Bytedance staff member claimed the company was about to expand to Brazil and Australia, neither of which have materialised. TikTok Shop was operating a fully managed model for cross-border e-commerce in Saudi Arabia and would have to wait until at least 2025 for local shops. [34]

An MCN claimed that TikTok was considering relocating many employees from the US to Saudi Arabia to build a live commerce base. TikTok had also requested MCNs to recruit more livestream hosts. [34]

Currently, participants in the Middle East e-commerce market mainly include three types of companies: global e-commerce giants like Amazon, local e-commerce platforms such as Noon and Trendyol, and challengers from China such as the ‘four little dragons’ TikTok, AliExpress, Temu and SHEIN. In early 2024, Shein saw 100,000 daily orders in Saudi Arabia, Temu 30,000 and TikTokShop 30,000 before the suspension of live commerce. Amazon is dais to have approximately 300,00 daily orders. [34]

The per capita GDP in Saudi Arabia is as high as $32,000. It has a high proportion of young people and high Internet penetration, but the current e-commerce coverage is only 5%, but it is growing rapidly. However, consumers still prefer to buy from offline stores and brand websites. According to data from Serui Insights, 65% of respondents in Saudi Arabia are accustomed to shopping from brand websites. [34]

Consumers in the Middle East are used to paying by cash or cash on delivery instead of (online) payment in advance, which is common among e-commerce companies. As many consumers refuse to accept and pay for the goods on arrival, shipments must be returned at merchants' cost. Customers are critical about delivery times, and each day’s delay significantly reduces the acceptance rate. Even successful deliveries may take multiple attempts to contact the customer. Bytedance invested $10 million in iMile, which focuses on logistics and distribution in the Middle East and is said to have a high acceptance rate. [34]

The rest of this report, including information on merchant recruitment and profitability, products and pricing, organisation, logistics and the challenges and outlook for TikTok Shop is available for paid subscribers only.