Temu Watch #9: Temu's US Recovery

How Temu recovers from the US tariffs and moves towards profitability

Contents

Things that caught our attention

Tech Buzz China in the Media

Inside the China Room with Jiang Jiang, August 13th 2025, What Silicon Valley Learned in Shanghai: China’s AI boom - with Rui Ma

The Wire China, August 10th 2025, Rough Times at SenseTime

Tech Buzz China Trips to China

Introduction

In recent Temu reports, we have predicted that the cancellation of ‘de minimis’ in the US would not have a showstopping impact on Temu’s business. Temu did, however, temporarily halt its fully managed business, in which it ships parcels from China to US consumers, when the cancellation became effective on May 2nd. But as I shared in a recent keynote in Berlin (part of which is included below), halting that business was not the result of the cancellation of ‘de minimis’ itself, but the 120% tariffs that were applicable at that time.

When, on May 12th, the tariffs came down to 54%, Temu restarted its fully managed business, no longer just relying on semi-managed and local-to-local businesses from US warehouses.

But Temu has made significant changes to their models and the logistics, and has shown their resilience to trade war antics. In this new Temu Watch, which is based on five detailed interviews with people close to Temu, we update you on the latest developments.

Free subscribers can read about the status of Temu in various markets around the world. Paid subscribers will learn how Temu changed its business models, advertising strategy, logistics and what the outlook is on the rest of the year, including Temu’s expectations for profitability.

Become a paying subscriber to unlock the full report and support our in-depth research into key China tech trends.

Ed Sander, Tech Research Analyst

Markets

Temu's has been performing well outside the United States. Globally, Temu's year-on-year growth rate in the second quarter reached at least 30% while it exceeded 20% in Europe. Temu's expansion speed in Europe remains strong, partly because the company has transferred 20% to 30% of its advertising budget used initially for the US market to Europe.

Emerging markets such as Central and Eastern Europe, Latin America, Poland, Brazil and Southeast Asia also showed significant growth momentum. The US market’s share in Temu’s GMV was less than 40% last year, but even a 20%-30 % drop can be offset by growth in other regions. The company is optimistic about the vast market potential in the regions above, as well as Japan and South Korea.

Temu achieved a global GMV of approximately $35 billion in the first half of the year. [1]

Still, in the field of global trade and e-commerce, tariffs remain a significant trade barrier. And not just in the US. Take Brazil, for example, its tariffs are nearly 30%, and starting from February 2025, the customs clearance process has become more complicated. On the other hand, in countries such as Japan and South Korea, foreign merchants face obstacles in setting up online stores, such as the requirements of local identification and handling of finances, which pose a considerable challenge to foreign merchants.

Europe – tightening regulations

Temu has established a German division and is aggressively recruiting European suppliers of food, confectionery, beauty products, and other FMCG items. They are expanding their original value proposition of ultra-cheap Chinese goods and betting their future on also becoming a legitimate FMCG player in Europe. [2]

However, changes in the import tax policies are looming. The European €150 threshold for import tax exemption is scheduled to be abolished in 2028, but many parties in the EU are calling for an earlier date. Given that most Chinese small packages are worth less than €50, the new policy will impact these goods.

Despite potential price increases, sales are not expected to be affected for more than two to three months after the implementation of the policy. This situation is similar to the market reaction when Amazon implemented the 20% VAT policy in Europe in 2021. At that time, the market experienced some fluctuations in the early stage, but recovered and set a new high within a quarter. It is expected that the new small package tax-free policy will experience a similar period of fluctuations and gradually stabilise after about one to two months. Consumers may express dissatisfaction with the new policy on social media, but this sentiment usually subsides quickly.

In addition, Europe's requirements for logistics and environmental certification are becoming increasingly stringent, and small packages must comply with WEEE (Waste Electrical and Electronic Equipment) environmental standards. Although the cost of ecological labels is not high, the related labour costs have increased significantly, and the compliance requirements of products have become more complicated. These changes will have a profound impact on the operating model and cost structure of cross-border e-commerce platforms.

With the implementation of the new European small package tax-free policy, combined with the existing logistics commodity inspection, merchants will face higher costs. In the one to two months after the implementation of the regulations, profits are expected to fluctuate, and the decline may reach 20% to 30% or even more. Although the total transaction volume of the platform may remain unchanged during this period, the profits of merchants will be significantly reduced.

Meanwhile, the EU Commission has preliminarily found Temu in breach of the Digital Services Act concerning illegal products on its platform. Consumers shopping on Temu are very likely to find non-compliant products among the offerings, such as baby toys and small electronics. If the decision is upheld, it could result in a fine of up to 6% of the total worldwide annual turnover of Temu and trigger an enhanced supervision period. Besides this case on illegal and dangerous goods, the EU is also investigating Temu for illegal dark marketing patterns in its app. [3]

Southeast Asia

Although Temu has achieved success in some markets, expansion in the Southeast Asian market still faces challenges, mainly due to regulatory barriers and fierce market competition. In the region, the company's prices and average order value are less competitive than those of Shopee and Lazada. Amazon, on the other hand, has launched a cheaper product line, leading to more intense market competition. More notably, Shein provided substantial subsidies in its new round of funding, undermining Temu's marketing advantage.

Besides competition, Temu has encountered some other major obstacles in its expansion in Southeast Asia. First, Indonesia was concerned that Temu might impact local industries and refused to issue a business license. To address this challenge, Temu tried to enter the market by acquiring local companies, similar to TikTok's strategy with Tokopedia, but this attempt was not approved. Although Indonesian company Bukalapak expressed its willingness to cooperate, it still has not received regulatory approval.

US – the impact of tariffs

Changes in US tax policies and de minimis policies have had a significant impact on the performance of major cross-border e-commerce platforms in the first half of 2025. In the first quarter of 2025, Temu's total merchandise volume increased by 15% to 20% compared with the same period last year. However, due to the adjustment of the de minimis policy in April, sellers became hesitant in managing inventory. As we discussed in Temu Watch #8, Temu suspended marketing investment in the US on May 1 when the US eliminated duty-free shipping for small packages under $800. This led to a halving of Temu's fully managed supply in the second quarter, with 30% of it turning to semi-managed, which in turn caused its total merchandise volume to fall by 20% to 30%.

These changes have had a significant impact on Temu's market share and revenue. After the business was interrupted in early May, about a third of merchants abandoned the US market and turned to Europe or other regions. Some merchants chose to sell on other platforms, such as Amazon, after a decline in sales due to price increases.

After May 12, with the adjustment of tariff policies, marketing activities resumed. Temu restarted its cross-border parcel service (fully managed model) to the United States in late May, but many products were not put back on the shelves until July. As a result, from May to June, the order volume in the United States was not ideal and did not gradually recover until late July.

Tech Buzz China’s Ed Sander explained at the K5 Conference in Berlin in June why the cancellation of de minimis will not ‘kill’ Temu.

Some products with high historical sales and strong compliance were put back on the shelves at the end of June. By July, sales had returned to April levels, and a large-scale promotion is expected in early August. Regarding the number of SKUs, the number of fully managed SKUs in the United States was about 4 million at the beginning of the year. By early July, this number was about 3.3 million. It is expected that the number of SKUs will have recovered to more than 3.5 million by the end of July. However, the number of fully managed SKUs may not return to 4 million until August.

After the fully managed model was restored, major merchants switched their core products from the semi-managed Y1 model (see below) to the fully managed model. Some merchants who shifted their focus to Europe began to reintroduce European inventory to the US market as the US strategy resumed.

Temu's operations are expected to rebound in the US. Specifically, it reached 60% to 70% of past levels during Prime Day (July 8-11), and is expected to recover to 80% to 90% by August and September. By early September, 60% of the business volume previously lost in the fully managed model is expected to have recovered.

Sino-US trade relations are expected to enter a new phase on September 1, and tariff policies may be further eased. Before the Geneva meeting on May 12, issues related to fentanyl and trade tariff disputes frequently appeared, being mentioned once every 1-2 weeks, explicitly targeting China. However, since the Geneva meeting, US President Trump has no longer mentioned fentanyl and trade tariff differences.

Although negotiations between China and the United States on issues such as rare earths have not yielded concrete results, the overall atmosphere remains positive. At present, the current tariff level may have reached a peak of 30% (excluding small packages, which are currently exposed to 54%), while tariffs on commodities are expected to drop to 20%. However, given the limited bargaining chips that China can offer, it is almost impossible to return to the original tariff level.

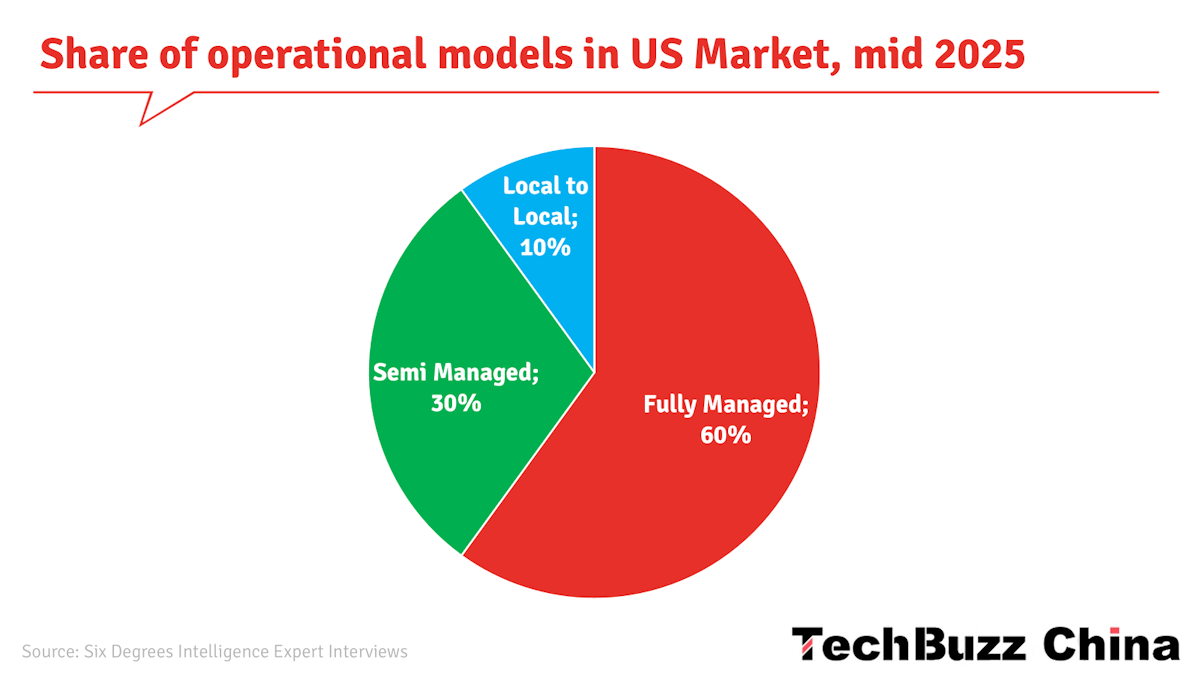

In the US market, the composition ratio of GMV is 60% for fully managed, 30% for semi-managed, and 10% for local-to-local. The tariff on fully managed deliveries has been significantly reduced from the original maximum of 120% to about 54%, which has almost restored the cost of direct shipment to the level before the policy adjustment. By adopting the T01 customs clearance (bulk import of goods over $2500) and a B2B2C model, Temu has successfully kept the prices of most goods unchanged, with only a few highly competitive categories having a slight price increase.

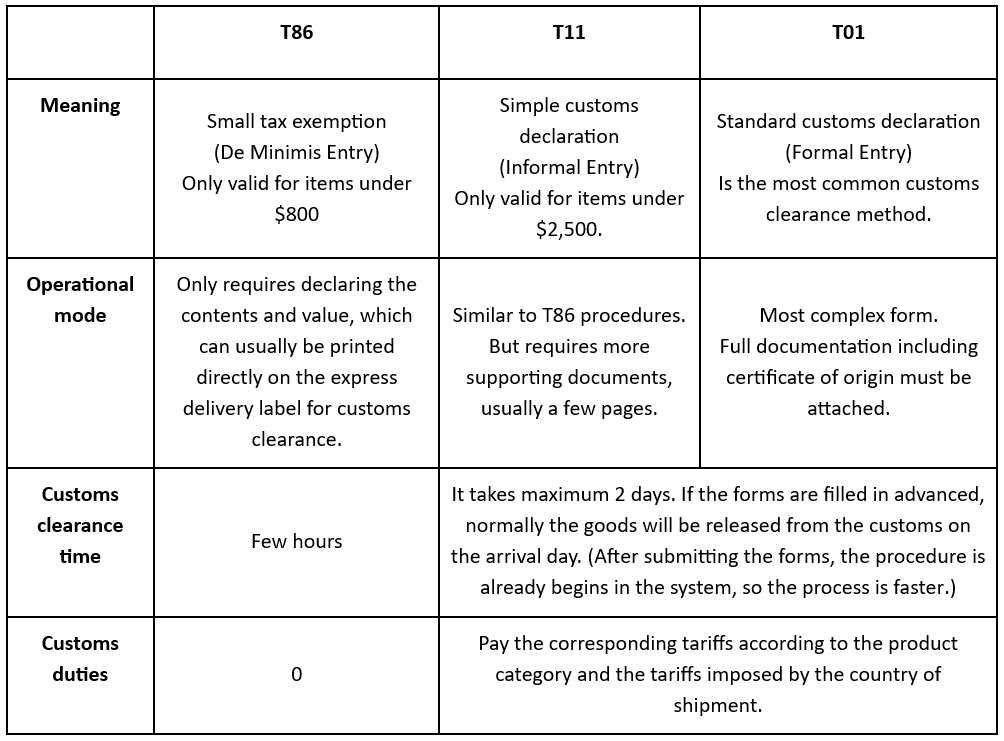

A short explainer about custom policies, courtesy of Latepost.

There are three common customs clearance methods for cross-border e-commerce in the United States. Source: LatePost. [1]

After the cancellation of the T86 (de minimis) policy, cross-border e-commerce goods entering the US have only two options:

Simplified customs declaration (T11) for goods valued under $2,500

Standard customs declaration (T01)

Both procedures involve automated inspections, so the real slowdown isn't the customs formalities, but the queues. If forms are filled out in advance (essentially queuing in advance), goods can generally be released the same day. Even if forms are filled out upon arrival, customs clearance is still possible within two days. Therefore, the customs clearance process doesn't significantly impact the fulfilment timeframe for Chinese goods. [1]

T01 is the most stringent customs clearance method, requiring the value of goods to be estimated strictly based on the original invoice and country of origin. When the total value of a shipment is high enough, the T01 customs clearance cost per item can be very low. Direct mail parcels are taxed based on the retail price. At the same time, when merchants stock up domestically and move goods to overseas warehouses (as in Temu’s semi-managed model), the value of the goods is declared based on the "purchase cost price" commonly used in corporate trade, and the tax bases of the two are different. [1]

The United States is also stepping up its efforts to prevent countries close to China from engaging in transhipment. In early July, the United States' new tariffs on Vietnam specifically included a tax requirement for goods transiting through a third country. On July 30th, Trump signed a new executive order suspending the duty-free policy for small packages from all countries starting August 29th, completely severing the tax-free access provided by transhipment. [1]

Offloading to Canada

As traffic in the US app and website has not yet fully recovered, some goods are shipped to Canada first. In the past, goods were shipped from Canada to the United States to circumvent the high inspection rate and certification issues in the United States, but now they are mainly shipped from the United States to Canada. From a logistics perspective, goods shipped from the United States to Canada are usually delivered within 3 to 4 days.

This model of direct shipment from the United States to Canada can not only digest inventory but also improve distribution efficiency in Canada. However, after the fully managed business in the United States is restarted, the transhipment from the United States to Canada will be terminated to avoid additional tariffs. In July, the daily order volume in the Canadian market was about 100,000. With the expansion of the US business in the future, Canada will operate independently.

The rest of this article is accessible for paid subscribers.