Temu Watch #8: How Temu responded to US tariffs

An overview of Temu's strategies before and after May 12th

Contents

Things that caught our attention

Introduction

In March, we published Temu Watch #7, which elaborated on the many ways in which Temu had prepared itself for import tariffs and the cancellation of de minimis, which lets cross-border businesses ship packages directly to US consumers without having to pay import tax for goods valued under $800.

One of the key insights from that report was that Temu would be able to mitigate most of these challenges; however, if the tax rate exceeded 50%, it would have a significant negative impact on business operations, ultimately losing its competitive advantage. Considering how most regular import tariffs were less than 50%, the prospects did not seem all that bleak for Temu.

On April 2nd, the White House announced the cancellation of de minimis as of May 2nd. Ironically, this tax-free policy below $800 was first introduced by the Obama administration, to alleviate the high cost problem in the United States by introducing low-priced goods from China. According to the announcement, this would result in a 30% or $25 fee per postal item, the latter fee to be raised to $50 by June 1st. Later, the tariffs exploded in what seemed like a game of ‘trade war chicken’ and reached levels that would most probably end Temu’s fully managed model approach.

And they did. At the end of April, Temu stopped its fully managed service. It would no longer have a price advantage when shipping goods by aeroplane to US consumers.

On May 12th, when the US and China reached a temporary truce, the tariffs were lowered to 54% for 90 days, and each package would be taxed a maximum of $100. This could still be prohibitive according to our findings shared in Temu Watch #7, but Temu has announced the restart of its fully managed business. And then, on May 29th, a U.S. trade court declared Trump's tariffs unlawful only to have them reinstated a day later while the appeal of the Trump administration is considered.

In the last few months, the situation has been highly unpredictable and has changed almost daily. We have therefore held back on doing a new Temu Watch report. What we would publish today could be irrelevant the next day. Still, considering some requests we have been receiving for an update, and how Temu's responses tell us a lot about possible future scenarios in various markets, we thought it might be time for a new Temu Watch, which we will publish on top of our regular bi-weekly schedule.

This Temu Watch is based on a series of expert interviews conducted in May, which should provide additional insights into the situation at Temu over recent weeks. Do note that the situation remains versatile.

We have split this report into two sections. The first section examines the impact of the tariffs prior to their suspension on May 12th. This section is free for all to read. The second section examines the period following the pause in tariffs and offers some new general new insights into Temu’s operations. This section is available to paid subscribers.

Subscribe to unlock the full report and support our in-depth coverage of key China tech trends.

Enjoy,

Ed Sander, Tech Research Analyst

Part 1: Before May 12th

The information in this section was primarily obtained from an expert interview conducted on May 7th, prior to the tariffs being paused and reduced.

In April 2025, the United States suddenly raised tariffs from 20% to 145%, which had a profound impact on the cross-border e-commerce industry. In particular, those merchants who rely on small packages, self-delivery, and have no overseas warehousing or low-priced products have almost all suffered heavy losses. After the tariff was raised to 145%, online platforms that provide fully managed services, such as Temu and Shei,n faced greater operating pressure.

The cancellation of the T86 policy (the de minimis policy for small packages) on May 2nd further impacted Temu's business operations. These policy changes have resulted in a decline in Temu's order volume and advertising spending in the United States.

Pricing

Before the tariffs were paused on May 12th, the overall tax rate for goods imported from China was approximately 105%, whereas it had typically been only 5.7% previously. If the original price of a consumer electronic product were $3, after the tax increase, the cost would be more than $6. Due to the increase in tax rates, shipments dropped significantly from April 2 to May 13, and the frequency of customs inspections increased from 5% to 15%.

On April 14, Temu announced to merchants that it would start raising the prices of fully managed goods to help them cover the additional tariffs. It also promised merchants more free traffic, assistance with customs clearance, and help in selling in other markets. [1] The price increases went into effect on April 25th.

Consumers who choose the fully managed model have to pay more than twice the fees at checkout. The new tax rate was as high as 145%, and the additional fees for certain high-profit items ranged from 100% to 130%, while the extra fees for most items reached as high as 160%. These additional fees include a 145% tariff and a 15% logistics fee. Each order also incurs a handling fee of approximately $2 for customs handling or clearance fees. Due to the sharp increase in costs, consumers' willingness to purchase has decreased, resulting in a significant decline in the number of orders.

Under the semi-managed model, the prices of various categories of goods vary, with some categories increasing by more than 100%, while most categories increase by between 50% and 70%.

Under the fully managed model, the final retail price of hot-selling products usually increases by 30%-50% after arriving at the US forward warehouse by sea. The prices of popular products on the platform have generally increased by this amount. For example, the cost of a mobile phone case increased from $1 to $ 1.50, but compared with similar products in the United States, which start at $3, it still offers a particular price advantage.

On Amazon, about half of the products come from China. These products also underwent price adjustments after April, but Temu still maintained its price advantage. Approximately 30% of Amazon's current products originate from Southeast Asian countries, while the rest come from the United States, Canada, Australia, and other regions. In early May, the prices of Temu's fully managed products increased by 30% to 50%, while the prices of Vietnamese products increased by about 20%, resulting in a 10% to 20% reduction in its price advantage. These changes significantly affected Temu's market competitiveness and consumer purchasing behaviour.

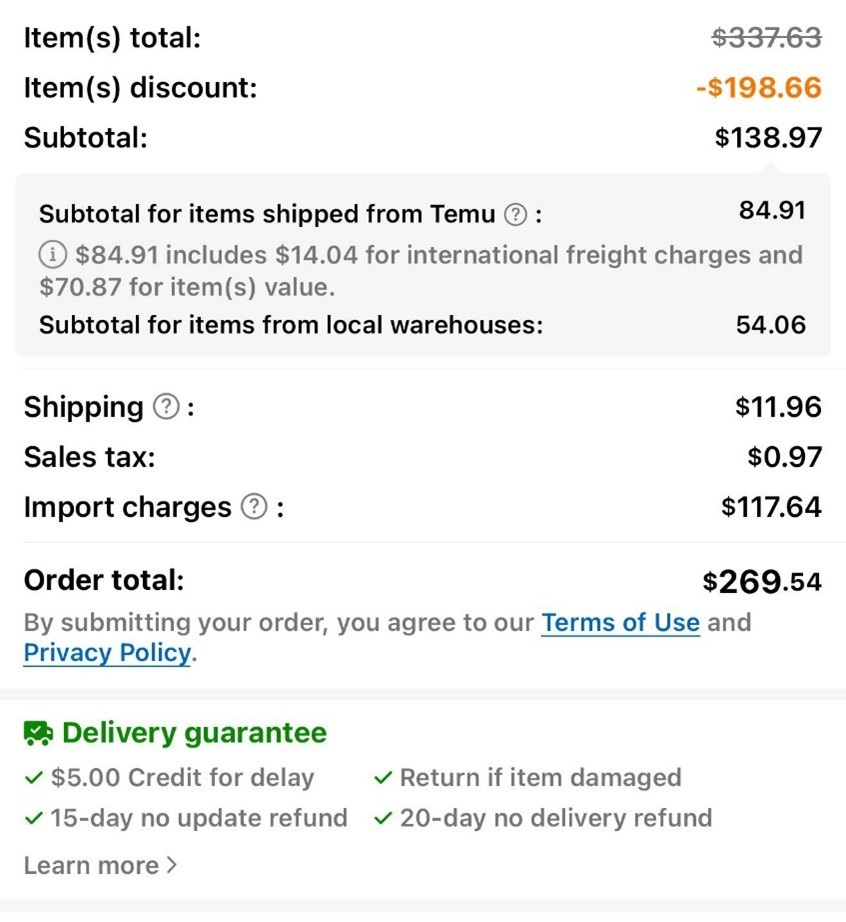

As can be seen in the screenshot below, which was shared on Reddit, Temu clearly indicated the source of the price increases.

Source [2]

“Items imported into the U.S. may be subject to import charges. These charges cover all customs-related processes and costs, including import fees paid to customs authorities on your behalf,” Temu explained on its website. Earlier in April, it had announced: “Due to recent changes in global trade rules and tariffs, our operating expenses have gone up. To keep offering the products you love without compromising on quality, we will be making price adjustments starting April 25, 2025.” [3]

Example calculation of price and profit changes. [4]

Business Models

The change of the de minimis tax-free policy has had a significant impact on both Temu and Shein in the North American market. The two companies are heavily dependent on the policy and therefore face enormous challenges. Specifically, 90% of Temu's business relied on the fully managed model that used the de minimis policy, and only 10% was semi-managed model.

Note: the source used for the chart below claimed the share of semi-managed was around 20%, and according to Dolphin Investment Research, the proportion of orders in Temu's semi-custody business may also be around 20%. [5]

Temu made a series of significant adjustments to its cross-border e-commerce operation model.

As of April 26th, Temu began removing fully managed products. By April 30th, almost all fully managed stores on Temu’s US site displayed “This store is closed.” [6] As of May 4, all fully managed air freight products were marked as out of stock and ceased to be sold. Shipping packages from China to consumers under the fully managed model was terminated.

Under the new operating policy, the best-selling products are now shipped to the forward warehouse in the United States by sea, utilising a fully managed model. Currently, the customs clearance process for the fully managed model is largely the same as that for semi-managed merchants, although the types of goods sold differ.

The new regulations have less impact on the local-to-local model.

The number of fully managed SKUs dropped significantly. From 4 million at the peak and 3.4 million usually, it has reduced to 100,000-150,000 currently sent by sea. At the same time, the number of semi-managed SKUs increased from 800,000 to about 1 million since the beginning of March, of which 90% are from China. These data refer to the number of SKUs on the shelves and do not represent actual sales.

About 5% of fully managed or semi-managed merchants have turned to Amazon, mainly focusing on 3C products. The lost goods are primarily medium- to large-sized items, while light and small items are mostly retained on the Temu platform.

In response to the total merchant churn rate of 20%, which is lower than the expected one-third, Temu accelerated the recruitment of semi-managed merchants. This included merchants from Vietnam, Canada, and other regions, as well as Chinese merchants in these areas. It has also made structural adjustments to semi-managed goods, retaining those that remain competitive after tax, such as certain Chinese household goods. However, the competitiveness of goods such as 3C and cosmetics has declined.

In early May, Temu’s policy was to expand the number of SKUs, especially those that remained competitive after tax. The semi-managed model would cover categories that could not be stocked by fully managed, such as seasonal clothing. Additionally, it introduced non-China-made goods through the local-to-local model to mitigate the impact of tariffs.

The prospect of semi-managed business in the United States is unclear, and a growth bottleneck appeared last year. Regarding the profitability of this business, it has been profitable since July of last year. However, it suffered a small loss in the fourth quarter. The primary source of income is advertising. However, the semi-managed business also faces some restrictions, especially in terms of expanding the number of merchants and the scale of cargo trays, and investment promotion efforts have also weakened this year. Despite this, the local model still shows great potential. Currently, this model is still in its early stages, and there is considerable room for growth in the number of merchants and GMV.

Semi-managed Y2 Model

On April 27th, Temu launched the "domestic shipping semi-managed" model, also known as the Y2 Model. It is similar to the semi-managed model, but instead of asking merchants to store goods in overseas warehouses, it enables Chinese merchants to ship directly from China to US consumers after the order is received. Merchants are responsible for customs clearance and compliance. [7]

Temu has been struggling to attract enough merchants to take the risk of storing goods in overseas warehouses. This Y2 model opens up new possibilities for Temu to attract more merchants to join its semi-managed program and keep its logistical costs low. Merchants won’t run the financial risks of overseas inventory and can ship on demand.

The logistics for the Y2 model after the consumer places an order are as follows: [8]

Temu does not offer the option to existing semi-managed merchants; they would need to apply to open a new store, a request that Temu will review and consider. Merchants will need to have capabilities for logistics and customs clearance. Temu is likely to retain pricing power and will be strict about delivery times. According to Paidai Cross-Border e-Commerce [7], Temu will demand an ambitious 9-day delivery, which might be a challenge considering the current US import climate. Late delivery will result in fines for the merchants. Temu may facilitate (but not cover the costs of) some of the logistics with third-party partners.

Temu provided a one-click migration model for full-hosting merchants. [5]

By offering this model, Temu essentially makes the US tariffs, customs clearance challenges, and rising logistics costs the merchants' problem. As such, it’s no surprise that the reception among many merchants has been lukewarm.

Impact on sales

Overall, Temu's total orders and visits in the United States decreased by about 50%-70%.

In the US, the average daily GMV of the US market dropped from $80 million in early March to about $40 million in early May. At the same time, the business model structure also changed significantly. The proportion of fully managed business dropped sharply from 75% to 10%, while the proportion of semi-managed business increased, and the proportion of local-to-local business increased from 2%-3% to 8%.

The traffic composition of the platform also changed. The proportion of on-site traffic increased from 60% to 70%-80%, primarily from existing users; meanwhile, off-site traffic decreased from 40% to 20%-30%, mainly through channels such as Facebook and Instagram. User activity has also declined. The number of daily active users dropped from 50-60 million last year and more than 60 million in early March to about 40 million in May.

In addition, due to the 145% tax imposed by the US market, about 20% of semi-managed merchants have chosen to turn to other markets, such as Europe. Most commodity prices have increased by more than 50%, which has not only affected sales but also the recruitment of new merchants.

Shifting markets

After the fully managed products performed poorly in the US market, the company adopted several strategies to expand its sales channels. These products were transferred to other regions, such as Europe and Southeast Asia, for sale. However, due to differences in standards, some products cannot be simply transferred to domestic sales. For example, 3C products need to be converted from US standards to European standards, which requires redesign.

Fortunately, most household goods, beauty and personal care products, and clothing items do not have significant differences in quality standards so that they can be sold directly in other markets. These markets include Latin America, the Middle East, Japan, South Korea, and Southeast Asia. The effectiveness of this strategy varies depending on the product category and regional market. For products with similar quality standards, such as home, beauty care, and clothing, they can enter these new markets relatively smoothly. This diversified sales channel strategy has helped alleviate the difficulties encountered in the US market while also opening up new growth opportunities for the company.

Although other regions have grown, a gap remains. Although other regions are expected to fill the gap in the US market in the second half of the year, the progress is relatively slow. From the perspective of financial impact, the US market was expected to be reduced by $10 billion throughout the year, depending on the tariff policy. If the 145% tariff were to continue until the end of the year, the loss would reach $10 billion, while other regions would only compensate at most $5 billion. However, if the tariff issue was to be resolved between July and August, the full-year impact may be reduced to $5 billion US dollars.

Impact on advertising of Shein and Temu

At the beginning of 2025, e-commerce giants significantly reduced their advertising spending in the US market. The tariff policy implemented in early April impacted the advertising strategy of most cross-border e-commerce platforms. Due to the impact of these tariff policies, the overall advertising volume of e-commerce platforms in the US market has decreased significantly this year. However, it should be noted that in November and December each year, the proportion of advertising in the US market typically increases significantly due to large-scale promotional activities, such as Black Friday. These holiday factors will drive additional growth in brand and performance advertising, while various traffic support measures will also increase overall delivery.

According to data from March, Temu's global advertising expenditure on the Meta platform reached $61 million, with the US market accounting for $13 million, making it its largest market. At the same time, Temu's advertising investment in the US market of Google was about $4 million, while the investment on other platforms, such as Applovi,n was relatively small, only tens of thousands of dollars.

In contrast, Shein's main advertising platform in March was also Meta, with a total global investment of $35.3 million, of which $3.9 million was invested in the United States, Canada, Australia and New Zealand. Shein invested $19.9 million in Google ads worldwide, of which about $7.2 million was spent in the United States, Canada, Australia and New Zealand. It is worth noting that Shein's $1.3 million advertising on Bing was all aimed at the US market. Additionally, Shein also invested approximately $2.3 million in AppLovin.

But then the tariffs arrived …

According to Smarter Ecommerce data, Temu completely stopped all sponsored video and shopping ads on TikTok and Google in the United States on April 9. In the first two weeks of April, Temu reduced its advertising spending on platforms such as Meta, X, and YouTube by an average of 31%. Meanwhile, Shein saw its average daily advertising spending drop by 19%. [5]

At the same time, both increased their spending in Europe and other regions. According to Sensor Tower data, in April, Temu's spending in France and the UK increased by 40% and 20%, respectively, while Shein's advertising spending in France and the UK increased by 35% month-on-month. [5]

Temu and Shein have many similarities in their global advertising strategies, but there are also some differences. Temu's total advertising expenditure in April was $66 million, of which performance advertising accounted for $57.79 million and brand advertising accounted for $8.5 million. The proportion of advertising in North America was only 4%.

In April, Temu's global advertising was as follows: Europe accounted for 49%, Latin America accounted for 16%, Japan, South Korea and Southeast Asia accounted for 12%, the Middle East accounted for 9%, Africa accounted for 6%, North America accounted for 4%, and Australia and New Zealand also accounted for 4%.

Among Japan, South Korea, and Southeast Asia, South Korea had the most advertising, followed by Thailand and Malaysia, while Japan had almost no advertising. In Africa, advertising was mainly concentrated in Morocco, Nigeria and South Africa, with Morocco accounting for the majority.

During the same period, Shein's global advertising situation was slightly different: Europe accounted for 52%, mainly concentrated in the UK and France; Latin America and South America accounted for a total of 17%, mainly in Mexico and Brazil; Southeast Asia accounted for 12%; the United States, Canada, Australia and New Zealand accounted for 5%, with the most significant number in Canada; Japan and South Korea accounted for 5%; the Middle East was only placed in Saudi Arabia, accounting for 9%.

The effect of Temu's increase in advertising in Europe was not ideal, mainly due to pressure from competitors and the presence of numerous independent websites. European consumers have a high acceptance of independent websites, which further intensifies market competition.

According to data from marketing performance agency Tinuiti, Shein’s daily ad impression share on Google Shopping in the U.S. was 0% on April 26. Two weeks earlier, Temu’s share on the platform also fell to zero. Earlier, Shein’s impression share in U.S. Google Shopping ads dropped from 20% on March 31 to 10% on April 15, and finally to 0% last Saturday. “We did expect Shein to continue to decline in the auction, but they did ultimately shut down their ads,” Andy Taylor, VP of research at Tinuiti, said. Temu’s share of U.S. Google Shopping ad impressions fell from 19% on March 31 to 10% on April 9, and then to 0% on April 12. [9]

In the US market, the reduction of advertising investment by Temu and Shein has had different impacts on various platforms. The decrease in advertising budgets initially started with Meta, and then gradually spread to other platforms such as TikTok. Specifically, in the US market, advertising on the Applovin and Bing platforms has been completely stopped. These changes have undoubtedly had a profound impact on the overall landscape of the US digital advertising market. However, the platforms still retained part of their advertising budgets to maintain the active status of their accounts to avoid complete cessation.

This concludes our look at the situation up to May 12th. The paid readers-only section below continues with the developments after the tariffs were reduced.