Table of Contents

Things that caught our attention

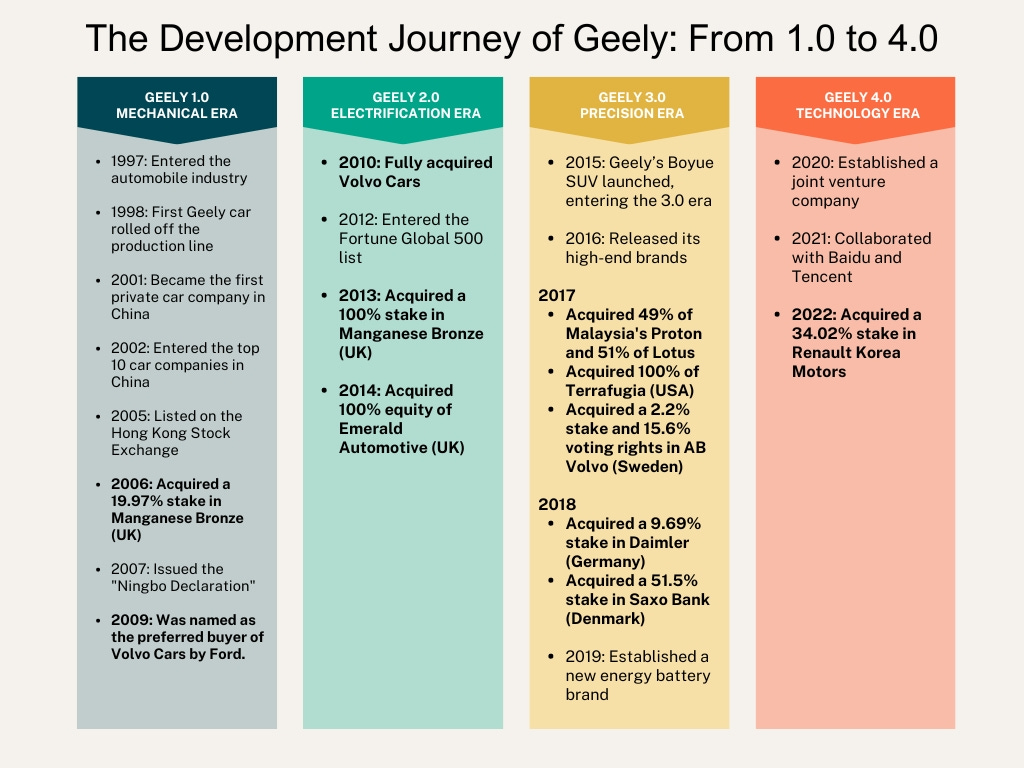

The Development Journey of Geely: From 1.0 to 4.0

Multi-Brand Strategy Targets Diverse Markets

Challenges in Managing Autonomous Driving Development at Geely

Crisis in Smart Features and User Experience

Layered Strategy for In-House Development and External Suppliers

Challenges of Overseas Expansion

Things that caught our attention

Just when you thought the previous local services wars between Meituan vs. Ele.me and Meituan vs. Douyin had calmed down, Xiaohongshu is rolling out local services to 49 cities. Read Ed’s summary of this news here.

The price war in Chinese domestic e-commerce has been raging for years, and some platforms have had enough. Read Ed’s summary here.

TikTok Shop US is not reaching its targets. Read Ed’s summary here.

Last year, we wrote about how Meituan was helping retailers set up ‘lightning warehouses’ for instant retail. Now, Meituan has launched self-operated lighting warehouses under the Squirrel Convenience brand. Read Ed’s summary here.

Introduction

In the fiercely competitive landscape of China's auto market, price wars have pushed traditional carmakers to reinvent themselves, with new energy vehicles (NEVs) emerging as the battleground for future growth. Geely, a company that began manufacturing cars in 1997, saw the writing on the wall back in 2015. Amidst a challenging period when sales plummeted—down 11% in just the first half of 2014—Geely launched the "Blue Geely Initiative." This move aimed to fully embrace NEVs, transforming a survival strategy into a leap towards a sustainable future.

Over the years, Geely has rolled out electrified versions of its Geely, Lynk & Co, and Volvo models, such as the Lynk & Co 01 PHEV, Volvo XC40 Recharge, and Polestar 2. Not stopping there, the company also launched NEV brands like Geometry and Galaxy to solidify its position in the market.

By 2024, Geely has firmly established itself with ten brands, while Geely, Lynk & Co, and Zeekr are the most dominant. In July 2024, the company sold 150,800 vehicles, marking a 12.8% year-on-year increase, with NEV sales soaring by 44% to 59,100 units. The Galaxy series, Geely’s NEV flagship for the mass market, achieved a staggering 742% growth in the first half of 2024, with 81,000 units sold.

Meanwhile, Zeekr, born from Lynk & Co, has become a leader in the premium NEV segment. Offering cutting-edge technology and luxury features like Qualcomm chips, the Mobileye autonomous driving systems, and the 800-volt charging architecture, Zeekr has boosted its market competitiveness.

On the evening of September 1st, Zeekr announced its delivery figures for August 2024. The brand delivered 18,015 vehicles in August, marking a 46% year-on-year increase and a 15% rise from the previous month. From January to August, Zeekr delivered a total of 121,540 new cars, an impressive 81% increase compared to the same period last year. Especially in a highly competitive market, Zeekr has solidified its position as a leading force in the 250,000+ RMB premium electric vehicle segment, making it a standout in the push for high-end NEVs among Chinese brands.

Geely's rise to dominance in the NEV market showcases its strategic foresight and adaptability. In this newsletter, we'll dive into Geely's remarkable journey from its early beginnings to its current 4.0 phase, examining the challenges it faced in transitioning to NEVs, its innovative multi-brand strategy, and the obstacles it must overcome as it expands globally.

But there's more—this October, you could see it all firsthand! Join us on the Tech Buzz China Autumn 2024 Exclusive Investor Electric Vehicle Trip from October 21-25, 2024, where we will be visiting Geely itself. Don’t miss this chance to witness the future of electric vehicles up close. Sign up today!

The Development Journey of Geely: From 1.0 to 4.0

Zhejiang Geely Holding Group Co., Ltd., commonly known as Geely Holding, was founded in 1986 and is headquartered in Hangzhou, Zhejiang Province. It initially focused on producing and selling auto parts. Geely has completed a diverse ecosystem layout through a series of acquisitions from the company's early years to the present, achieving the implementation of internationalization strategies. They have also laid the groundwork for intelligent, electrified, and shared strategies.

Geely 1.0 - Mechanical Era

Geely's founder and chairman, Eric Li Shufu, has a journey that reflects the growth and transformation of private enterprises in China following the country's reform and opening up. Li Shufu was born in 1963 in a poor village in Taizhou, Zhejiang Province. Originally named Li Xufu, he later changed his name to "Shufu" after starting school, meaning "a scholar with good fortune."

In 1982, at 19, after graduating from high school, Li Shufu, constrained by his family's financial situation, entered the workforce. He started by riding a bicycle around town taking photographs for people. After six months, he saved up 1,000 yuan (about $528 USD in 1982) and opened a photo studio.

During high school, Li Shufu studied diligently and learned that the fixer used in photo development contained silver bromide, which could be extracted using sodium sulfide. This knowledge allowed him to start a side business of recycling fixer and extracting silver, earning his first significant profit. However, in 1983, new regulations on gold and silver forced him to cease this business.

In 1984, Li Shufu and his three brothers founded Taizhou Shiqu Refrigerator Parts Factory, producing evaporators, a key component in refrigeration. By 1986, he had established the Beijihua Refrigerator Factory, which successfully competed with state-owned enterprises, reaching annual sales of 40 million yuan (about $11.58 million in 1986). However, in 1989, the government implemented centralized production for refrigerators, excluding private companies like Beijihua, leading to its closure. Li Shufu then moved to Shenzhen to study.

While studying, Li Shufu noticed a strong demand for decorative materials, prompting him to return to Taizhou and start a decoration materials factory. He developed China’s first magnesium-aluminum curved panel and later produced aluminum-plastic panels, which became the foundation for Geely Group's "Geely Decoration Materials Co.," known for its focus on aluminum-plastic panels. The name "Geely" (Jílì, 吉利) was derived from this venture, symbolizing prosperity.

In 1992, Li Shufu joined the real estate boom in Hainan, investing millions but ultimately losing everything when the market collapsed. Returning to Taizhou in 1993, he reverse-engineered a Honda motorcycle, creating his own "Huatian" (华田) brand. Partnering with a struggling state-owned motorcycle factory, he secured the necessary production qualifications and began manufacturing motorcycles.

At that time, no one in China was producing scooters, and imported ones were prohibitively expensive. After over a year of development, Li Shufu launched a scooter that became wildly popular in the market. As demand soared, his partner raised prices, prompting Li Shufu to acquire a motorcycle factory in Linhai, allowing him to produce independently.

In 1996, Li Shufu founded Geely Group, naming it "Geely," which means "auspicious and prosperous," reflecting his hopes for the company's success. In its early stages, Geely primarily produced agricultural and small commercial vehicles, gaining some recognition in the domestic market.

In 1997, Geely entered the car manufacturing industry with its brand, becoming one of China's first independent car manufacturers. The Geely 1.0 era was marked by affordable vehicles aimed at the mass market.

Around the year 2000, cars were still seen as luxury items in China. Even relatively affordable models like Xiali (now a subsidiary of FAW Group) and Suzuki Alto cost over 100,000 RMB (about $12,000 USD in 2000), while the Volkswagen Santana, considered a luxury car, was priced at around 170,000-180,000 RMB (about $21,000 USD in 2000).

Geely identified an opportunity in the low-cost small car market and launched a series of budget-friendly models, including the Haoqing, Meiri, Uliou, and Free Cruiser. To compete with Xiali, Geely priced the Haoqing at around 60,000 RMB (about $7,200 USD) and even offered a model for as low as 29,900 RMB (about $3,600 USD). This aggressive pricing strategy quickly won over consumers.

In 1999, Geely produced over 1,600 cars, almost all of which sold out. By 2000, with the introduction of the Geely Meiri, the company's annual sales exceeded 10,000 units, marking Geely's rise in the Chinese car market. That year, China’s total domestic car sales were only 2 million units, marking Geely an emergent player in the market.

In 2003, Geely launched its commercial vehicle brand, Higer (海格商务车), and expanded into the commercial vehicle sector. During this time, Geely introduced several brands, including Geely, Englon (英伦), and King Kong (金刚), and established showrooms in major cities like Beijing and Shanghai.

In 2005, Geely collaborated with Italdesign to launch the Emgrand (帝豪) brand and became the first Chinese carmaker to participate in the Frankfurt Motor Show. It is also the first Chinese automaker to be listed on the Hong Kong Stock Exchange (HK: 0175). By 2007, Geely had started its global expansion, setting up subsidiaries and sales networks in Europe, North America, and the Middle East, and entering the high-end car market.