Taking a Power Swap - Charting NIO's Journey

Exploring an EV company's unique offering of battery swap, customer app and more

(image source: NIO)

Table of Contents

Things that caught our attention

The development of NIO's battery swap

Jianghuai Automobile – Power of Outsourcing

CATL - Powering Forward Together

Things that caught our attention

TikTok Shop is finally opening cross-border business to the U.S., opting for the currently popular fully managed model to directly compete with Temu. (Source) We wrote about the fully managed model in the Temu issue not long ago.

CATL is all set to manufacture electric aircrafts, marking another bold cross-industry attempt following their venture into shipbuilding. (Source)

Volkswagen and Xpeng Motors together will develop two Volkswagen-branded electric vehicle models which are scheduled to be produced in 2026. (Source)

Luckin Coffee has overtaken Starbucks’ China revenue for the first time in the second quarter of 2023. Luckin saw RMB 6.2 billion yuan in sales, while Starbucks registered RMB 5.9 billion. At the end of the quarter, Luckin had 10,836 stores, while Starbucks China had 6,480. (Source) Part of the recent success of Luckin lies in its strategy to open franchised stores in lower-tier cities. We wrote about this in Luckin’s Revival last December.

Key takeaways

Battery swap distinguishes NIO from other EV players. NIO has the fast charging and supercharging capabilities that other companies have, but others lack the battery swap system that NIO possesses. Moreover, NIO can also reduce vehicle prices by separating vehicles from batteries in several ways.

NIO began its battery swap station program in 2016. The first generation station, launched in 2018, could handle 100 battery swaps daily with a capacity of five batteries. The company has since upgraded to second-generation stations, which were introduced in 2020 and increased capacity to 13 batteries. Presently, NIO is developing third-generation stations, aimed at achieving higher automation and an unstaffed operation model.

While NIO attempted to open its standards and patents to other companies, their adoption requires adherence to NIO's specific battery requirements, a challenging proposition for many automakers. This restriction limits the broad adoption of battery-swapping stations.

NIO's swap strategy extends beyond competition with Tesla, vehicle differentiation, and price reduction by detaching the battery from the car. Its core aim is to enter the energy sector, specifically the vehicle-to-grid (V2G) business, where electricity from NIO's car batteries can be returned to the grid, creating a new commercial model.

NIO's strategy involves outsourcing all manufacturing to Jianghuai Automobile, a respected state-owned auto manufacturer in China. This frees up resources for research and development and reduces financial pressures. Without the need to build factories, NIO can quickly capitalize on market opportunities.

NIO recently revealed the launch of a single-motor variant for the first model under its Alps sub-brand. The brand is targeting the 200,000 to 300,000 yuan market, aiming to cater to a wider range of consumers in tier 3 and 4 cities.

NIO's performance in overseas markets hasn't met expectations, especially in terms of per vehicle profitability, falling short of its domestic market performance.

Introduction

Five years ago, we embarked on the EV industry with a spotlight on NIO (蔚来), a Chinese company that had been frequently compared to Tesla. Back then, NIO was making waves with its unique business model, outsourcing manufacturing to Jianghuai and creating a lifestyle brand that extended beyond just selling cars. Their flagship NIO Houses were more than just showrooms; they were social spaces for car owners and prospective users alike.

NIO House in Oriental Plaza, Beijing, 2019.

We also discussed the challenges NIO faced in a fiercely competitive landscape, including the need to ramp up production and the question of whether consumers were ready to shell out 400,000 Chinese yuan for a car. Despite these hurdles, NIO was eager to make its mark, rushing to go public and signaling its ambition to be a major player in the EV market.

Fast forward to today, and the landscape has changed dramatically. While there is still strong government support for EVs in China, driven by concerns about air pollution and a desire to establish China as a global tech leader, NIO now faces competition from a new breed of contenders. Companies like Xpeng, WM, and Byton are all vying for a piece of the EV pie.

So, where does NIO stand amidst this seismic shift in the EV market? In this follow-up article, we're going to take a deep dive into NIO's journey over the past five years, assessing its current competitors and the emerging trends that could redefine the future of mobility in China.

Note that free subscribers can read the first third of the article. Paying subscribers can read the full article.

Enjoy,

Freya Zhang, Ed Sander & Rui Ma

(click on the images above for information on the Tech Buzz China team)

"Power Swap"

Let's take a trip down memory lane to 2014, when NIO made a daring leap into the future with its strategic focus on battery swap technology. The concept was simple yet revolutionary: instead of waiting for your car's battery to charge, you could simply swap it out for a fully charged one at a "Power Swap" station.

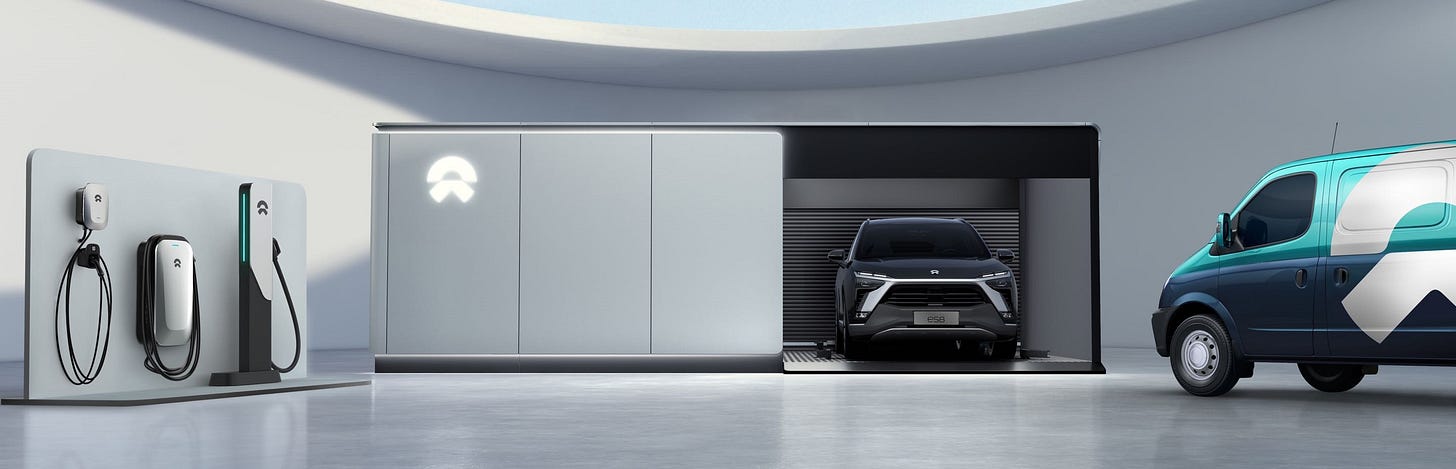

NIO's power swap station (image source: NIO)

The idea of battery swapping wasn't entirely new. It had made a quiet debut during the 2008 Olympics when some Chinese regions experimented with swap-enabled commercial buses and taxis. Even international ventures like Better Place and Tesla had toyed with the concept through various research projects and brief operational trials.

However, in 2014, battery swapping was still a fringe concept, yet to be embraced by traditional automakers. The early pioneers of this innovative approach were companies like BYD and BAIC, representing a new wave in the automotive industry. The driving force behind battery swapping was the need to address a major pain point for electric vehicles: the lengthy charging times. The goal was to significantly improve the customer experience.

In the early days of electric vehicles, fast charging technology was still on the horizon, and battery cells couldn't support quick charging. Home charging, the primary method, required either an entire night or several hours, proving a major inconvenience for customers and consequently tarnishing their charging experience. The vision was to make the driving experience of electric vehicles as seamless as that of traditional fuel cars.

NIO's unwavering commitment to battery swap technology stemmed from their firm belief that no matter how advanced an electric vehicle's battery might become, it could never match the convenience and experience provided by a traditional fuel car if it relied solely on charging.

The story of Better Place serves as a cautionary tale. Despite their advanced battery swap technology and stations, the company struggled due to a lack of partnerships with automobile manufacturers. About ten years ago, electric cars held a tiny share of the overall market, with only Renault collaborating with Better Place. Given the limited number of electric vehicles Renault sold and the infrequency of battery swaps, many battery-swap stations sat idle for extended periods.

Meanwhile, Tesla decided to abandon the battery swap model and shifted its focus towards developing fast charging. The reasons were primarily financial. Tesla's primary market was in the United States, where the cost of battery swapping was significantly higher for electric vehicle users.

Differentiated strategy

This unique aspect - battery swap - distinguishes NIO from other EV players. Presently, competition is primarily centered around the differentiation of supercharging technologies, for example, the speed of charging, and the layout of supercharging stations. But NIO stands out with its unique feature - the battery swapping system and network, which covers cities and highways. This means that NIO has the fast charging and supercharging capabilities that other companies have, but others lack the battery-swapping system that NIO possesses.

In addition to differentiating itself from competitors like Tesla, NIO can also reduce vehicle prices by separating vehicles from batteries in several ways:

The battery-as-a-service (BaaS) approach reduces hardware costs. Since the battery is separate from the vehicle, the cost of the battery does not contribute to the vehicle's selling price, thereby lowering the overall purchase cost of the vehicle;

This model also minimizes users' initial investment and increases the accessibility of the vehicle, because it allows the battery to be rented out separately to the user, who can choose to purchase the vehicle and lease the battery. According to NIO's plan, the outright purchase cost is 70,000 yuan for the standard range battery pack (75/70kWh), and 128,000 yuan for the long-range battery pack (100kWh);

The battery is NOT considered in the depreciation checklist of the user. As the battery is separate from the vehicle, its cost and lifespan won't affect the vehicle's resale value. When the vehicle is resold, the cost of the battery can be eliminated, leaving the value of the vehicle unaffected. This increases the overall residual value of the vehicle, easing concerns over cost for users.

It facilitates battery technology upgrades. Separated from cars, the battery can be upgraded independently. When there are significant advancements in battery technology, users can opt to replace the battery instead of the entire vehicle, avoiding rapid obsolescence, extending the lifespan, and reducing the total cost for the user.

Although battery swap has its advantages in terms of refuelling time and relieving grid pressure, it comes with certain drawbacks:

High construction costs of battery swap stations. A significant amount of investment is needed to build these stations and acquire a large number of batteries, which increases the company's capital expenditure and operating costs.

Challenging management and maintenance of batteries. The task of charging, managing, and maintaining a multitude of batteries requires substantial human and physical resources, thereby escalating the operational costs for the company.

Safety concerns with the battery swap model. Frequent disassembling and installation of batteries may affect vehicle safety, and batteries themselves pose certain safety risks. On June 25th, a fire broke out at an NIO battery swap station in Guangdong, resulting in the entire station being burnt down. The cause of the fire is yet to be announced as the investigation remains ongoing.

Battery lifespan might be affected under the swap model. The frequent dismantling and installation of batteries could potentially speed up battery degradation, shortening their service life.

The development of NIO's battery swap

The journey of NIO's battery swap stations commenced in 2016, with the first-generation (Gen1) stations opening their doors to customers in late 2018. These trailblazing stations, with a humble capacity of just five batteries, could handle 100 swaps in a 24-hour period under full load and typically operated at 70-80% utilization.

Fast forward to today, NIO has mostly transitioned to second-generation (Gen2) swap stations, with about 100 of the Gen1 stations still operational. Construction of these evolved Gen2 stations began in April 2020, offering an improved capacity with 13 batteries available for swapping. NIO's Gen2 swap stations have been co-developed with Sinopec, which provides partial grid support. In the future, Sinopec may support NIO by leasing land.

So far, over 1,100 such stations have been built, together with Gen1 stations collectively performed ten million battery swaps by the end of the second quarter of 2022. This figure represents the cumulative number of swaps carried out by both first and second-generation stations, with NIO's data reporting not distinguishing between the two.

The charging technology used in battery swap stations is identical to that used in traditional charging stations. The clear advantage of swap stations, however, lies in their ability to adjust the charging power and current, shortening charging times during peak demand periods.

Running at full capacity, a Gen2 station can provide up to 312 battery swaps in a 24-hour period. Actual usage varies by region, with certain areas bustling with swap activities, while others exhibit a lower frequency. On average, each station sees about 70-80 swaps per day.

Each battery is offered for swapping services only after it has been charged to 80% capacity. A battery with at least 10% remaining charge would typically take one hour to reach this level. Under high power and current charging conditions, a battery can achieve an 80% charge within just 45 minutes. During off-peak hours, batteries are charged slowly to extend their lifespan. Swap stations in major city centres and on highways see higher utilization rates, while those in remote areas have lower usage.

The Bill of Material (BOM) cost for a Gen1 station was 2 million yuan, whereas a Gen2 station is cheaper at 1.5 million yuan. Each swap module requires one staff member, and the lifespan of a swap station is estimated to be between 10-15 years, during which regular maintenance of the equipment is necessary.

NIO is currently exploring the development of third-generation (Gen3) swap stations. These will distinguish themselves with a higher level of automation, moving towards an unstaffed model. NIO has a goal to construct 4,000 swap stations worldwide by 2025, including 1,000 outside of China.

Yet unsettled debate over battery swapping or charging

As we look to the future, the experience of battery swapping and charging is set to converge as high-power charging and solid-state battery technologies mature. The future of EV infrastructure is as much about technology as it is about strategic choices.

(Note: the section below is only available to paid Tech Buzz China subscribers)