Redefining Fresh: Alibaba's Freshippo and the New Frontier in Grocery Business

How Freshippo Uses Big Data, Private Labeling, and Supply Chain Optimization to Reshape the Fresh Produce Business.

Table of Contents

Things that Caught Our Attention

Segmentation, Targeting, Positioning

Things that Caught Our Attention

The China Association of Automobile Manufacturers (CAAM) revealed that the top ten new energy vehicle groups sold 2.498 million units from January to May this year, up by 62.8% YoY. BYD led the charge, with sales surpassing 1 million units, a YoY increase of 97.7%.

In Q1 this year, Meituan's core local business achieved a revenue of 42.8 billion yuan, with an operational profit of 9.445 billion Yuan, doubling YoY. The company's businesses such as Meituan Youxuan and Meituan Maicai generated around 15.7 billion yuan, marking a decrease in operational losses.

According to 36Kr, tea chain ChaPanda (茶百道) has raised about 1 billion yuan, securing a valuation nearing 18 billion yuan. ChaBaiDao reportedly earned revenue of around 4 billion yuan in 2022, with a profit of 900 million yuan, implying a profit margin of around 22.5%. Meanwhile, Luckin Coffee significantly expanded its presence in the first quarter of this year, adding 1137 new stores. By the end of Q1, the total count of Luckin Coffee locations reached 9351.

ByteDance is reportedly testing an artificial intelligence (AI) conversational tool internally, currently known as "Grace." Currently, the product is in its refining and testing stage. A few weeks ago, we wrote about Baidu's Ernie Bot: Trying to Ern the Chatbot Crown *.

Key Takeaways

The intricacies of the fresh produce business create unique challenges, demanding a robust supply chain and a predictive model driven by data. Freshippo harnesses Alibaba's big data, including demographics and previous purchases from platforms like Taobao & Tmall, to decide on new store locations.

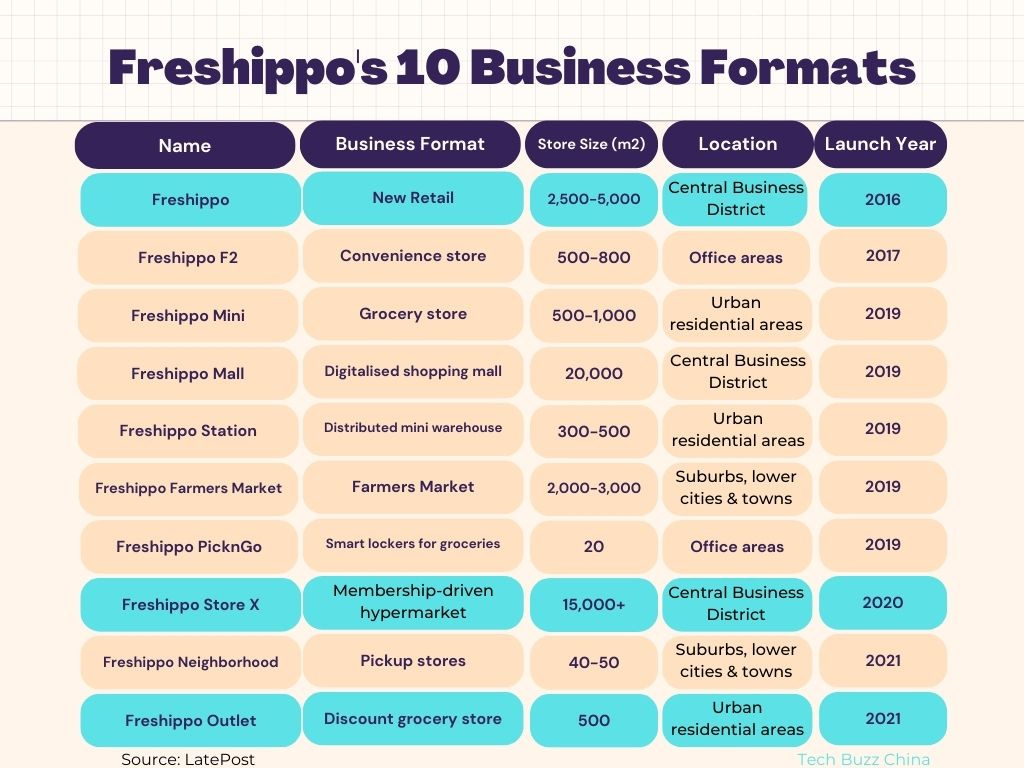

Currently, Freshippo's primary operations lie with its original brand, Freshippo (83% of the revenue), the membership-driven hypermarket Freshippo Store X (6-7%), and discount grocery store Freshippo Outlet (<6%).

Freshippo's private label SKUs currently make up 15-17% of total SKUs and account for about 15% of total sales. The company aims to increase these figures to over 30% and 40-50% respectively.

Freshippo's Store X model, aimed to compete with large-scale warehouse stores like Costco, relies on membership fees to offset lower product profits. This store format intends to increase standard products to represent at least 45% of sales.

Initially designed as outlets for surplus inventory, Freshippo's outlet stores have evolved into strategic entries into lower-tier markets, offering more affordable pricing.

Freshippo is focused on optimizing its supply chain and plans to establish six production warehouses. Using a 'central kitchen' approach, these warehouses will handle production, processing, selection, quality control, refrigeration, and storage, potentially boosting Freshippo's profit margins by reclaiming profits usually captured by suppliers.

Introduction

If you've been following along with our series analysing the Alibaba Group, you'll recall our recent examination of Cainiao, Alibaba's logistics network. Today, we're switching gears and focusing on another key player within the Alibaba family: Freshippo. This part of our analysis continues to dissect Alibaba's "1+6+N" organizational structure, with Freshippo falling into the "N" category. We also hope that you find this timely, given Freshippo's intent to go public in the coming six to twelve months.

First off, what exactly is Freshippo? In a nutshell, it's a revolutionary retail platform that's redefining the concept of community-focused retail experiences. By effectively combining digital applications and brick-and-mortar stores, Freshippo delivers a unique blend of online and offline shopping that's centered around fresh food.

In 2017, Freshippo launched its unique "Daily Fresh" initiative, selling products only for one day to ensure optimal freshness. Initially offering mainly vegetables and milk, "Daily Fresh" expanded its portfolio to around 400 SKUs by 2020, featuring a variety of items like fruits, meats, poultry, eggs, and 3R (Ready to Cook, Heat, Eat) products.

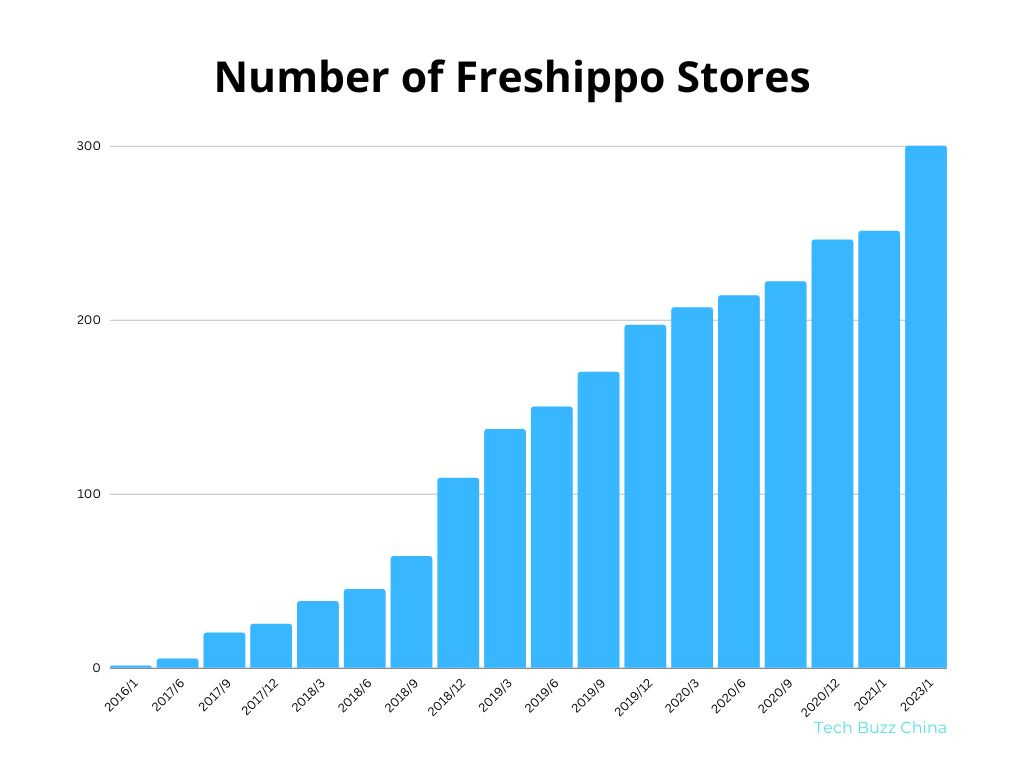

Currently, the Freshippo platform boasts an impressive reach, with 300 stores spread across 27 cities in China.

LatePost recently shared some interesting figures about Freshippo. In 2022, Freshippo's gross merchandise volume (GMV) was approximately 45 billion yuan, a substantial increase from the previous year's 34 billion yuan. This year, Freshippo's looking to go big or go home, with a lofty GMV target of 100 billion yuan in mind. If successful, this would translate to a growth rate of over 100%.

Since Freshippo's debut in 2016, it's been a trailblazer in the retail industry. By blurring the lines between online and offline shopping, Freshippo was among the first to revolutionize China's fresh produce supermarkets. Over the last eight years, the company has dabbled in as many as ten different business formats, experimenting and innovating constantly.

Some of you may have come across media reports hinting at Freshippo seeking financing at a valuation of 6 billion USD, a significant dip from the rumored 10 billion USD valuation in January. While this might raise a few eyebrows, it's also worth noting that Freshippo has been scaling down its business formats.

From a business perspective, these ventures weren't significantly contributing to Freshippo's overall GMV and would have required more time to validate. Originally intended as a brand extension strategy to engage different audiences, this approach turned out to be more challenging than anticipated.

Fast forward to 2022, Freshippo's revenue composition looks something like this: