Cambricon: China’s Nvidia—or Nvidia Without the Profits?

What China’s stock market champion reveals about hype, policy, and the risks of AI investing.

Content

Things That Caught Our Attention

A collection of posts by Ed Sander and Rui Ma on Substack Notes, Twitter and LinkedIn. The team has been preparing and leading various study tours and investor trips, so we’ve been a bit quiet lately.

Investment themes from China’s internet era to AI era: Rui Ma on Differentiated Understanding podcast.

Ed visits Meituan’s ‘Happy Monkey’ community store in Hangzhou.

US: 100/100 solution, 100/100 cost. China: 80/100 solution, 20/100 cost.

Tech Buzz China visits Shenzhen Logistics Expo’s first ever autonomous delivery exhibition hall.

Tech Buzz China visits the much anticipated $NIO F2 factory.

People love to say Americans are the risk-takers and the Chinese are the cautious optimisers. Rui thinks those stereotypes miss the real story.

Introduction

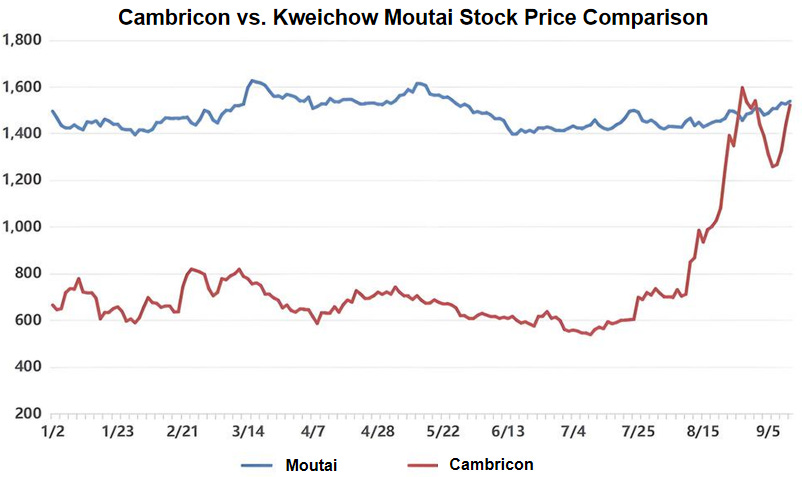

When Cambricon Technologies briefly overtook Kweichow Moutai this summer to become the most valuable company on China’s A‑share market, it stunned more than just the financial press. For a moment, a state‑backed AI chipmaker, known more for its ambition than its earnings, had eclipsed the country’s most iconic consumer brand. Screenshots of the real-time leaderboard flooded WeChat investor groups. Analysts rushed to re-run their models. Was this a blip, or the start of something bigger?

Cambricon’s market cap surge wasn’t built on profits, product scale, or global dominance. Instead, it rode a wave of strategic scarcity: the hunger for a “Chinese Nvidia,” the capital glut chasing foundational tech, and a national policy agenda that rewards alignment over revenue. The company’s fundamentals didn’t change overnight. What changed was perception.

Depending on who you ask, Cambricon is either the tip of China’s AI spear or a high‑beta symbol of state-backed tech investing in the post‑Nvidia era. Either way, its rise is too big to ignore. What does it actually build? Who buys from it? And can it stay relevant as the AI chip race stretches from the cloud to the edge?

This report separates fact from hype in Cambricon’s rise and explores what it signals for the next wave of China’s “strategic champions.” The free chapters explain the company’s fundamentals—its revenue model, flagship products, and place in China’s AI supply chain. The paid sections delve into its Nvidia‑style ambitions, the true strength of its ecosystem, and the macro and policy risks that could shape its future path.

Subscribe now to unlock the full report and stay ahead in China’s AI chip race.

Enjoy reading.

Yours sincerely,

Rita Luan, Tech Buzz China Researcher

Cambrian explosion

In China’s equity markets, the company with the highest stock price is often hailed as the “king of stocks” (股王)—a title that blends investor sentiment with symbolism. For over a decade, Kweichow Moutai, the state-backed liquor maker, held that crown, representing a safe haven of stable earnings and predictable demand. But in August 2025, that stability was briefly overshadowed by an unlikely challenger: Cambricon Technologies, a nine-year-old AI chipmaker that, for a moment, became the most expensive stock on the A-share market.

The shift wasn’t just numerical. Cambricon’s ascent reflected a broader pivot in market psychology, from traditional value stocks to high-growth tech plays riding China’s AI wave. As some have said on social media: “Baijiu is the past. Chips are the future.” Yet as impressive as the rise looked, it may say more about market euphoria than about sustainable fundamentals.

A Frenzy Rooted in Hope, Not Fundamentals

Cambricon’s stock surged to 1,464.98 yuan ($218) on August 27, briefly overtaking Moutai. A second spike came on September 12, peaking at 1,522.22 yuan ($227). On both occasions, it was sentiment, not scale, that drove the rally. While Cambricon had impressive momentum, its fundamentals remained modest.

In the first half of 2025, the company reported revenue of 2.88 billion yuan ($395 million)—a stunning 4,300% year-over-year increase and a net profit of 1.04 billion yuan ($143 million), its first ever for a half-year period. Yet even if that profit pace were sustained, full-year earnings would reach just 2 billion yuan ($274 million)—a fraction of Moutai’s 62 billion yuan ($8.5 billion) in 2024.

While Cambricon was briefly compared to Kweichow Moutai in symbolic market value terms, a sharper contrast emerges against Intel. As of late August 2025, Cambricon’s market capitalization had reached roughly RMB 579.4 billion ($79 billion), nearly 75% of Intel’s $107.7 billion, despite generating only 1.6% of Intel’s revenue. This disconnect underscores how investors are pricing Cambricon not on present fundamentals but on scarcity value and policy-fueled expectations.

According to institutions such as Qianzhan Industry Research Institute and ASKCI Consulting, China’s AI chip market exceeded RMB 140 billion (≈USD 19.4 billion) in 2024, reflecting a year-on-year increase of approximately 17% to 20%. However, market share data paints a more concentrated picture. According to a July research report by Bernstein, Cambricon held a 1% market share in China’s AI chip market in 2024, ranking fourth behind NVIDIA (66%), Huawei Ascend (23%), and AMD (5%).

This pattern underscores a central thesis: Cambricon may be able to act like “China’s Nvidia,” but not yet like “a profitable Nvidia.” This is less a celebration of fundamentals and more a bubble of sentiment.

Behind the Rally: A Perfect Storm of Catalysts

Cambricon’s dramatic rise was not driven by any single breakthrough. Instead, it was the product of a rare alignment of earnings momentum, policy intervention, and capital concentration, each reinforcing the other.

Earnings Inflection: Siyuan 590 Goes to Market

The breakout moment in Cambricon’s 2025 story mainly came from one product: the Siyuan 590, its flagship AI chip designed for cloud computing. After small-scale trials in 2024, the chip entered mass shipment in early 2025. The first-quarter revenue surged to 1.11 billion yuan ($153 million)—almost equaling the company’s full-year sales in 2024.

What made the 590 appealing wasn’t cutting-edge performance but practicality. It comes with 80GB of high-bandwidth memory, making it suitable for running large language models. The chip is built for inference, the stage where AI models are used to make predictions, rather than being trained. It works best in mid-size server clusters of 1,000 to 3,000 cards—just enough to support commercial deployments without demanding a supercomputer.

Although the 590 lags behind Nvidia’s A100 in speed and memory bandwidth, it is cheaper, easier to install, and most importantly available in a market squeezed by U.S. export bans. Its plug-and-play design means data centers can use it with minimal technical friction. That makes it especially attractive in China’s push to replace foreign chips with homegrown alternatives.

Industry analysts estimate 100,000 to 200,000 units of the 590 could be shipped in 2025, with ByteDance alone expected to account for a significant chunk of that demand. But some structural limits remain. The chip performs well in inference, but lacks the scalability and throughput needed for high-end AI training—the more compute-intensive stage where foundational models are built.

Policy Tailwinds: Bans, Budgets, and a National Mission

U.S. export controls in 2023 and 2024 cut China off from Nvidia’s A100, H100, H20, and L40S chips, while Huawei faced its own supply chain constraints. The vacuum created a rare opening for second-tier domestic players to step in.

By the first quarter of 2025, Cambricon’s inventory had swelled to RMB 2.76 billion ($380 million)—a level that might raise alarms in most industries. Yet under tightening export controls and a domestic scramble for high-performance AI chips, those unsold units turned into leverage rather than liability. With global supply chains strained and Nvidia’s GPUs out of reach, Cambricon’s ready-to-ship stock became a lifeline for Chinese AI developers. Some enterprise customers were reportedly willing to pay a 30% premium for immediate delivery. In China’s post-sanction chip economy, inventory wasn’t dead weight—it was bargaining power.

Beijing moved to reinforce this advantage. In 2025, the central government launched a new wave of AI infrastructure spending, with local governments accelerating intelligent computing centers across provinces. Many of these projects carried implicit directives to “buy Chinese,” positioning Cambricon with its state ties as a prime beneficiary.

The company’s backing from the Chinese Academy of Sciences (CAS) and funding from Big Fund II, a RMB 200 billion ($27.5 billion) semiconductor initiative, further cemented its role as a policy-favored proxy for national AI ambitions.

Capital Concentration: Scarcity Meets Speculation

Cambricon’s listing status added fuel to the fire. As the only pure-play AI chip designer on China’s A-share market, it became the default pick for investors seeking AI exposure. With no direct competitors available, Cambricon offered a kind of scarcity value that money couldn’t resist.

Foreign capital poured in, with Invesco and Morgan Stanley entering Cambricon’s top 10 freely tradable shareholders in 2025. At the same time, AI-themed ETFs launched by leading Chinese asset managers such as China Asset Management (ChinaAMC) and E Fund made Cambricon a central holding in their portfolios.

On August 28, Cambricon’s daily turnover soared past 20 billion yuan ($2.7 billion), accounting for nearly a quarter of all trading volume on the STAR Market. The feedback loop was textbook: rising prices attracted inflows from ETFs and retail investors, which in turn drove prices even higher. That same evening, after the stock had surged over 130 percent within just a month, the company issued an official risk warning to investors. It acknowledged that its share price had significantly outpaced both its industry peers and major benchmarks such as the STAR Composite Index, which tracks China’s tech-focused STAR Market, and the SSE 50 Index, which represents the 50 largest stocks on the Shanghai Stock Exchange. Cambricon cautioned that its valuation may have diverged from its current fundamentals, and that investors could face substantial risks.

Yet much of the capital fueling Cambricon’s rally remains narrative-driven and fragile. As the only pure-play AI chip designer on China’s A-share market, the company has become a symbolic proxy for the nation’s AI ambitions. But scarcity value is not the same as a sustainable moat. Despite enthusiastic media coverage touting improvements in manufacturing efficiency, Cambricon has yet to disclose hard data on critical metrics such as chip yields or cost reductions. In the absence of verified performance indicators, investor sentiment continues to hinge more on optimism than on objective fundamentals.