In Hong Kong IPO Wave, Robots That Work Beat Robots That Wow

Beyond the Hype: What UBTECHand DOBOT Tell Us About Robotics IPOs in Hong Kong

Content

Things that caught our attention

BS alert! ‘Quick commerce works in China because of low labour costs’

So, what has the meal delivery war brought JD and Alibaba so far?

“Indian Tycoons Attracted by Chinese Technology, Quietly Advancing Cooperation.”

China generates a lot of electricity, but how they charge for it is also very different

These topics are mostly posts that Rui Ma and Ed Sander share on Twitter and our Substack Notes. Follow us there for shorter, worthwhile insights that won’t get their own deep-dive report.

Introduction

When people picture robots, the first image is often humanoid — sleek machines that walk, dance, and mimic us. These are the clips that go viral online and make headlines around the world. But in capital markets, humanoids remain more spectacle than substance. The companies that are really raising billions in Hong Kong today are not building sci-fi androids. They are building robots that move boxes in warehouses, assemble electronics, and assist doctors in surgery. In other words: robots that solve problems and generate revenue.

In the free section of this piece, we set the stage. We explain why Hong Kong has suddenly become the preferred venue for Chinese robotics listings, what distinguishes industrial robots and professional service robots from consumer gadgets or humanoids, and what the latest market data reveals about where growth is real and where hype still dominates. This context shows why execution, not theatrics, is what investors are rewarding.

For our paying subscribers, we then go deeper into two case studies that matter most: UBTECH and Dobot. These two companies are not just random examples. They represent the two poles of how capital evaluates robotics firms — the “technology vision” type and the “commercial execution” type. By studying their financials, strategies, and valuation outcomes, we can better understand the framework Hong Kong investors are now using. And more importantly, this framework gives us a practical way to judge the next wave of IPOs from robotics firms lining up to list.

If you’ve read our earlier deep dive on Unitree’s humanoids, you’ll recognize the theme: viral hype captures attention, but repeatable execution builds businesses. The same lesson applies here.

China’s tech sector is moving fast, and robotics is one of the clearest examples. If you want to stay ahead with in-depth analysis that you won’t find anywhere else, now is the time to upgrade to a paid subscription and keep up with the speed of China tech.

Enjoy reading.

Yours sincerely,

Rita Luan, Tech Buzz China Researcher

Real Robotics, Real Markets

At the 2025 World Robot Conference in Beijing, exhibition highlights went beyond humanoid theatrics. Among the more than 1,500 showcased robotics products were agile quadruped robots, rescue drones, inspection units, catheter-shaping systems and robotic mowers, demonstrating real-world functionality in industrial and service domains. The expo also featured dedicated zones for manufacturing automation, medical and logistics robotics and emergency services. These were not novelties for spectacle, they were robots already woven into the fabric of high-value applications. The technologies showcased in Beijing were not ends in themselves but signals of where real value lies and that signal is now resonating in the capital markets.

The Real IPO Story

While humanoid robots dominate headlines, the real momentum in capital markets comes from companies delivering measurable productivity gains. Investors are rewarding robotics firms that embed themselves in industrial supply chains, medical systems, and logistics networks—domains where efficiency and precision translate directly into revenue. These businesses are not chasing speculative moonshots but scaling operational platforms that solve immediate pain points, from automated assembly and warehouse handling to surgical navigation. Over the past two months, such firms in China have accelerated into public markets, using Hong Kong’s innovation-focused IPO frameworks to secure growth capital and global visibility.

Since June, several Chinese robotics companies with established deployment records and commercial strategies have sought listings on the Hong Kong Stock Exchange. In late June, Robot Phoenix, a developer of automation systems for light-industrial assembly and logistics, submitted an IPO application under Chapter 18C — Hong Kong’s recently introduced framework that allows pre-profit, high-growth tech firms to raise capital if they can demonstrate strong R&D intensity and market potential.

The largest of these offerings was by Geek+, the world’s leading provider of autonomous mobile robots for logistics. On July 9 2025, the Beijing-based company raised HK$2.71 billion (≈USD 345 million) in an IPO that drew heavy demand, with the retail tranche oversubscribed more than 133 times and institutional orders more than 30 times. In early August, Huayan Robotics, a Guangdong-based cobot manufacturer, has confidentially filed for a Hong Kong IPO aiming to raise more than USD 200 million.

Notably, the recent listings cluster around two segments that are often overshadowed by the more glamorous humanoid narrative: industrial robotics and professional service robotics.

Industrial robotics refers to programmable robotic systems that automate production in structured environments, delivering speed, precision and consistency at scale. From four-axis robots handling high-speed pick-and-place to six-axis arms performing welding or complex assembly, and newer collaborative units designed to work safely with humans, they form the core of modern manufacturing across sectors from autos and electronics to energy.

Professional service robotics, by contrast, refers to enterprise-facing robots deployed outside traditional mass-production lines but still in high-stakes environments. What unites them is not consumer convenience but mission-critical integration: uptime, safety, and compliance are as important as functionality.

Together, these industrial and service robotics categories form the backbone of modern infrastructure, not novelty gadgets but systems that power factories, logistics hubs, and critical services. That is exactly why industrial and service robotics firms lead today’s IPO pipeline; they come with deployed systems, signed clients, and clear business metrics.

Humanoid-focused firms are also testing the waters. Unitree Robotics has entered IPO tutoring with CITIC Securities and is aiming for a listing by late 2025 or early 2026, though whether investor appetite will translate into sustainable business outcomes remains to be seen. The broader industry picture tells the same story: while humanoids generate headlines, the real commercial momentum lies with companies solving operational pain points. China’s robotics sector is expanding at double-digit rates, and within that growth the split between execution-driven value and vision-driven speculation is becoming sharper.

Split Between Scale and Profitability

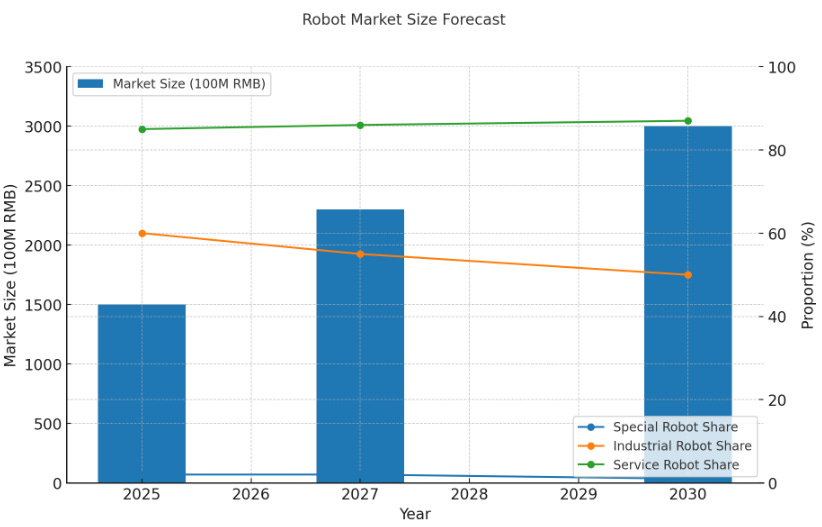

China’s robotics industry posted double-digit growth in the first half of 2025, with industrial output up more than 30% and service robots expanding by over a quarter. Analysts expect the market to surpass RMB 150 billion (≈USD 21 billion) this year, with professional service robots contributing more than RMB 85 billion (≈USD 12 billion). Industrial shipments reached around 370,000 units, underscoring the sector’s role as one of the fastest-growing parts of China’s manufacturing economy.

Behind the growth figures, however, signs of divergence are emerging. Overcapacity in lower-end segments has pushed average prices for six-axis robots below RMB 150,000 (≈USD 21,000), with entry-level units available for under RMB 20,000 (≈USD 2,800). Profit margins have narrowed to around 22%, squeezing smaller manufacturers. Larger players such as Estun and Inovance are responding by developing proprietary components, targeting overseas markets, and focusing on higher-growth areas such as automotive, consumer electronics and new-energy industries.

The picture looks different for humanoid robotics. Unit prices remain high, typically RMB 400,000 to 500,000 (≈USD 56,000–70,000), but costs still exceed about RMB 450,000 (≈USD 63,000), limiting scale efficiencies. Despite frequent references to “mass production,” most shipments number only in the hundreds and are often prototypes or customized orders. Technical challenges in motion control, energy storage and system integration continue to slow adoption, though progress is being made in lighter frames, vision systems and automated battery-swapping technologies.

Across segments, the market is showing stronger demand for robots with clearly defined functions, shorter deployment cycles and adaptability to specific use cases. In collaborative robotics, competition is intensifying as hardware becomes increasingly similar, shifting the focus to software applications, in-house modules and international expansion.

The same contrast between rapid expansion and uneven commercial outcomes is evident in capital markets, where investors are differentiating between companies that can demonstrate execution and those still reliant on long-term narratives.

Patience for Vision, Premium for Execution

To gauge how Hong Kong investors are approaching this year’s robotics IPO wave, two early listings offer useful benchmarks: UBTECH Robotics Corp Ltd (HKG: 9880, Mkt cap:44B HKD) and Shenzhen Dobot Corp Ltd (HKG: 2432, Mkt cap:22B HKD). Both came to market ahead of the current cohort and illustrate how capital applies valuation logic in the sector.

UBTECH, best known for its humanoid research, still derives most of its revenue from professional service robots in education, security and commercial settings. The company remains loss-making but continues to invest heavily in its Walker humanoid line and embodied-AI technologies. It listed in Hong Kong on December 29, 2023, raising HKD 914 million (≈USD 117 million), followed by four additional offerings in 2024 that raised HKD 2.07 billion (≈USD 265 million) and another HKD 2.41 billion (≈USD 307 million) in July 2025.

Dobot represents the execution-focused track, with growth driven by overseas demand for collaborative and light-industrial robotics. The company is also not yet profitable, but it has built a broad customer base across dozens of countries. It listed on December 23, 2024, raising HKD 752 million (≈USD 96 million), or HKD 865 million (≈USD 111 million) if the overallotment option is exercised.

Together, these cases show that Hong Kong investors are rewarding companies with demonstrable execution in industrial and service robotics, while giving only limited credit to long-term visions unless backed by clear commercial lines.