Platform or Price War? Xiaomi’s Double-Edged Drive Into EVs

Xiaomi’s Big Auto Gambit Is Both a Disruptor in Motion and a Scale Player on Wheels

Content

Things that caught our attention

Instant retail war:

Introduction

In less than two years, Xiaomi has gone from consumer tech giant to one of the most disruptive new forces in China’s electric vehicle market. With 10 billion dollars on the table and two cars already in production, the SU7 sedan and the YU7 SUV, the company has catapulted itself into the center of the EV conversation. Early results suggest real momentum. Preorders have surged into the hundreds of thousands. Monthly deliveries have briefly overtaken Tesla’s Model 3. Its launch strategy, blending sleek design with ecosystem connectivity, has captured national attention.

But the honeymoon may be short-lived. Xiaomi now faces the hard part of turning hype into scale and orders into cars. Production delays are mounting. Wait times stretch beyond 50 weeks. Supply chain challenges and early quality concerns are beginning to test customer patience. At the same time, China’s EV market is cooling. Subsidies have ended, price competition is intensifying, and powerful incumbents like BYD and Huawei are pushing hard into the same segments.

Still, this is not just about building cars. Xiaomi is positioning its vehicles as extensions of a larger digital ecosystem powered by HyperOS, the operating system already linked to nearly one billion connected devices. Each vehicle becomes a new interface for its broader platform, integrating mobility with smart homes, wearables, and services.

This report evaluates Xiaomi's strategic entry into the EV market through the dual lens of platform integration and scale execution. In the free portion of this report, we unpack how Xiaomi moved from zero to contender in record time and where early execution risks are beginning to show. For paid subscribers, we go deeper into the real question facing the company. Is Xiaomi creating a defensible mobility platform that unifies hardware, software, and user data into a long-term advantage? Or is it moving too fast in an industry that punishes overreach, falling into the same margin traps and operational strains that have brought down other fast movers? If you want to explore these strategic trade-offs in depth, and understand how Xiaomi stacks up against its biggest competitors, the full report offers detailed insights.

Subscribe for full access and to support independent, data-driven analysis of China’s leading tech and energy companies.

Sincerely,

Rita Luan, TechBuzz China Researcher

Xiaomi’s All-In Drive Toward the Future of Mobility

In March 2021, Xiaomi Corp. officially declared its foray into the smart electric-vehicle market, committing $10 billion over the next decade. Chairman and CEO Lei Jun framed the venture as “the last great entrepreneurial project of my life,” pledging his personal reputation in pursuit of success. Observers largely saw this move as a logical extension of Xiaomi’s “Human x Car x Home” ecosystem strategy, aiming to leverage the company’s proven strengths in hardware-software integration, user-experience design and razor-thin supply-chain cost control, which are hallmarks of its smartphone and smart-home businesses, into the far more complex realm of mobility.

Yet from the outset, analysts and investors questioned Xiaomi’s core playbook: would the company seek to upend the auto industry through deep “technology + ecosystem” synergies, or simply replicate its smartphone-era “high volume, low margin” sales engine at scale? By insisting that its automotive line would embody the same “tech + value” DNA, Xiaomi has signalled both possibilities, leaving the market debating which path it will ultimately follow.

Empowered by Capital, Full Speed Ahead

Xiaomi’s financial commitment to electric vehicles has reached new heights. According to Goldman Sachs, the company plans to allocate RMB 13 billion (≈USD 1.81 billion) to R&D for its EV and related new-business initiatives in 2025, up from RMB 9.7 billion (≈USD 135.2 million) in 2024 — a clear signal of how central mobility has become to its growth strategy.

In March 2025, Xiaomi executed the largest equity offering since its Hong Kong IPO, raising about USD 5.3 billion (≈ ¥38.8 billion). Proceeds are being split between two equally vital priorities. First, Xiaomi is deepening its technological edge by investing in autonomous-driving algorithms, next-generation battery systems and intelligent-cockpit platforms. Second, it is scaling manufacturing capacity by upgrading existing production lines and building a second smart plant, while also shoring up day-to-day working capital. This dual allocation highlights Xiaomi’s ambition to marry disruptive innovation with rapid volume expansion as it seeks to redefine the contours of smart mobility.

Shift to SUV

With this substantial financial backing secured, Xiaomi shifted from capital deployment to market execution, fast-tracking new model launches and zeroing in on the expanding SUV segment.

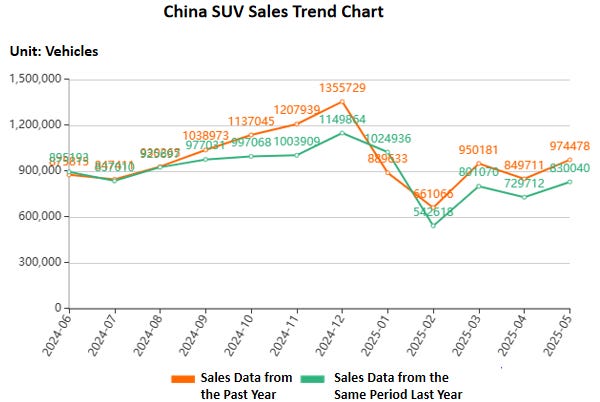

Since officially entering the smart-EV market in 2024, Xiaomi has rolled out the SU7 sedan and the flagship YU7 SUV, quickly drawing widespread attention and amassing substantial orders. In early 2025, after a thorough review of shifting market dynamics and consumer tastes, the company shifted its strategic emphasis squarely to the SUV segment. According to the latest sales data released by the China Passenger Car Association, SUV sales in May 2025 reached 974,478 units, accounting for 49.29% of the market share and ranking first among all vehicle categories. Compared to the same period last year, SUV sales grew by 17.4%, and increased by 14.68% from the previous month.

Mid-to-large SUVs alone jumped 72% month on month, and June sales set a new record at 1.04 million units, a 16% year-on-year increase and 7% rise from May. These figures underline an explosive surge in SUV demand, where higher average transaction prices and equipment premiums translate into stronger profit potential, making SUV market share a linchpin for Xiaomi’s growth and margin expansion.

On the financial front, Xiaomi’s smart-EV division is in a classic “growth-pain” phase, where nascent scale effects are offset by heavy upfront investments. In the first quarter of 2025, Xiaomi Group reported total revenue of RMB 111.3 billion (≈USD15.5 billion), a 47% year-on-year gain, with its innovative-business segment (including smart EVs and AI) contributing RMB 18.6 billion (≈USD 2.6 billion). Smart EVs accounted for RMB 18.1 billion (≈USD 2.5 billion) of that figure. The segment achieved a 23% gross margin yet recorded an operating loss of RMB 500 million (≈USD 70 million), reflecting the high costs of early market expansion and capacity build-out.

Toward Opportunity or Into the Storm?

China’s new-energy-vehicle market entered 2025 in a phase of rapid expansion, yet those very forces are reshaping the competitive landscape to reward scale and penalize latecomers. For Xiaomi, still in its first year as an automaker, the months ahead will serve as both its grandest showcase and its most rigorous test.

The figures are remarkable. In the first half of 2025, China produced 6.97 million NEVs and sold 6.9 million, up 41% and 40% year on year. Exports climbed even faster, reaching 1.06 million units, a 75% increase over the same period last year. Meanwhile, charging infrastructure continued its rapid rollout: by March, China counted 13.75 million charging points, of which 3.9 million were public stations.

Yet beneath these impressive numbers, the market is beginning to show signs of a shifting momentum. Early indications of a slowdown are starting to surface. Wholesale deliveries of passenger NEVs rose just 3% month on month in June, down from the blistering pace of earlier quarters. Demand that was pulled forward by subsidies and fleet electrification is now normalizing. Perhaps most consequentially, Beijing’s purchase incentives expired in 2022, removing artificial support and leaving automakers to compete on product attributes, brand equity and service quality alone.

Price competition has escalated accordingly. Tesla now offers its rear-wheel-drive Model Y with five-year zero-interest financing, a down payment as low as RMB 79,900 (≈USD 11,100) and monthly instalments around RMB 2,667 (≈USD 370). For a limited time, down payments are waived entirely, driving daily costs to as little as RMB 146 (≈USD 20). These programs push the effective price of a mid-size EV SUV below RMB 200,000 (≈USD 27,800), placing severe margin pressure across the segment.

For Xiaomi, which continues to absorb launch costs and build brand trust, the widening gap between rising customer-acquisition expenses and shrinking pricing room presents more than a tactical headache. It has become an existential test of whether its “technology-driven value” proposition can endure in a market that has entered its knockout stage.

Against this backdrop, Xiaomi’s major rivals are moving aggressively to consolidate their leads. In June 2025, BYD reported 382,600 vehicle deliveries, while Huawei’s AITO unit exceeded 52,000 — both well ahead of Xiaomi’s SU7 and YU7 combined volumes. Technologically, Huawei leverages its HarmonyOS stack and ADS 3.0 driver-assist platform to offer a tightly integrated, full-stack solution, while Tesla maintains a clear advantage in OTA maturity and global infrastructure. Li Auto’s L-series has carved out a strong position through extended-range powertrains and family-focused design. Xiaomi, by contrast, is still racing to build brand credibility and execution consistency across software and hardware. These disparities underline the need for Xiaomi to move beyond short-term excitement and develop enduring differentiation across its tech stack, delivery operations, and user experience.