Alibaba’s Big Bet: “ALL IN AI”

Jack Ma’s Final Gamble? Rebuilding Alibaba in the Age of AI

Content

Things that caught our attention

Summary of a non-deal roadshow (NDR) that Tencent held last month.

China's EV Industry is Going Through Trials by Fire in 2025.

While preparing for his October study tours, Ed visited Pet Fresh, the new ‘Hema for pets’ initiative by ‘retired’ Hema founder Hou Yi. He also checked out Tea Cat, a subsidiary of Cotti Coffee and Alibaba’s off-line Xianyu (Idle Fish) stores. We’ll be writing more about the latter in one of our coming reports.

Introduction

Among China’s major tech companies, Alibaba is making one of the most ambitious investments in artificial intelligence. In February 2025, the company announced a $53 billion commitment over three years to expand its AI capabilities, upgrade its cloud infrastructure, and strengthen its position across the technology stack. The move marks a significant shift in strategy, with AI now positioned as a core business priority.

Why is Alibaba making this pivot now? What does it reveal about its long-term direction and competitiveness? And can this effort establish Alibaba as a serious contender in global AI infrastructure and services?

This report draws on Chinese-language sources, expert interviews, and market analysis to examine the motivations, timing, and structure of Alibaba’s AI transformation.

The free section provides strategic context, including Jack Ma’s return, the evolution of Alibaba’s AI focus, and its organizational restructuring. The section for paid subscribers begins with AI and Cloud Infrastructure and covers Alibaba’s execution strategy, including cloud revenue targets, chip procurement, global data center expansion, and its position relative to Tencent, ByteDance, Huawei, and others.

If you find value in this type of analysis, we invite you to become a paid subscriber. Your support enables us to continue producing high-quality, research-driven reporting on China’s tech landscape.

Enjoy,

Rita Luan, Tech Research Analyst, Co-writer

Rui Ma, Consulting Editor

Alibaba’s Big Bet: “ALL IN AI”

Jack Ma Reboots Alibaba: "We Have Fallen Behind"

At the 2019 World Artificial Intelligence Conference in Shanghai, Jack Ma and Elon Musk presented starkly different views on AI. Ma, optimistic about technology, dismissed concerns, saying “humans can learn it” and should focus on solving problems on Earth. Musk offered a darker outlook, warning AI could reduce humans to “biological software for silicon-based life.” What once seemed a philosophical divide now appears to foreshadow the acceleration that followed.

Though Ma stepped down as Alibaba’s chairman in 2019, he remained influential as the company deepened its commitment to China’s AI sector. The 2022 release of ChatGPT intensified global competition and urgency. By 2023, Ma was advocating internally for sweeping change. Alibaba soon shifted from its long-held mission of “making it easy to do business anywhere” to a new focus: “user-first and AI-driven.”

In February 2025, the company formalized this pivot, announcing a 380 billion RMB (53 billion USD) investment in AI infrastructure over three years, signaling its evolution into an AI-native technology firm.

Elon Musk and Jack Ma met in Shanghai at the 2019 World Artificial Intelligence Conference, where they held a debate on topics including AI, employment, and space exploration. Coincidentally, we at Tech Buzz China are leading a trip to the conference this year. Do let us know if you’re interested in joining by emailing team@techbuzzchina.com!

The move comes amid growing pressure on Alibaba’s core commerce business. Its 2015 “New Retail” push into offline sectors like supermarkets, healthcare, and malls, including Freshippo, initially showed promise. But the pandemic accelerated online shopping and exposed operational inefficiencies.

Meanwhile, rivals gained ground. Pinduoduo attracted cost-conscious shoppers in lower-tier cities, while ByteDance won younger users through Douyin’s short videos and livestream shopping. By Q3 FY2024, Alibaba’s revenue rose 5 percent year-over-year to 260.4 billion RMB (37.4 billion USD), but operating profit fell 36 percent to 22.5 billion RMB (3.25 billion USD).

In 2024, Chairman Joe Tsai admitted to strategic missteps. “We have fallen behind because we forgot who our real customers are,” he said, citing a focus on traffic over user needs. At the 2023 Global Digital Economy Summit, Ma added, “AI is not a multiple-choice question, but a mandatory one.”

A Pivot Years in The Making

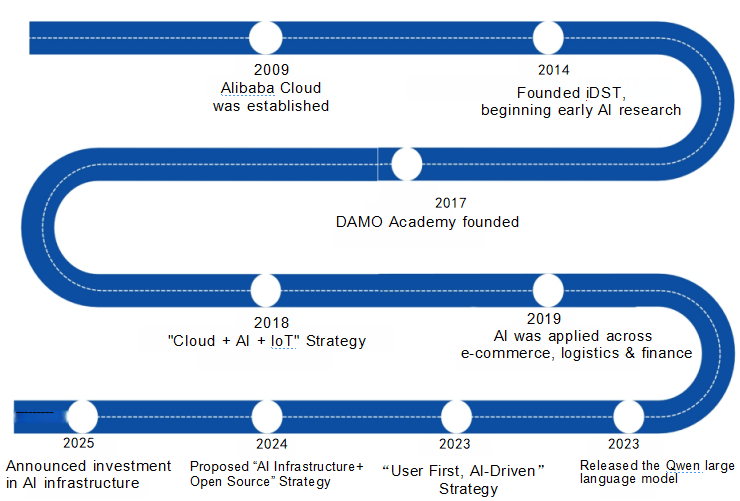

Alibaba’s transformation into an artificial intelligence-focused company began well before the rise of generative AI. In 2014, the company established the Institute of Data Science and Technologies to integrate AI into e-commerce. This initiative evolved into the DAMO Academy in 2017, expanding its scope to include AI research, quantum computing, and semiconductors. A year later, Alibaba launched a unified digital infrastructure strategy built around cloud computing, AI, and the Internet of Things.

These early investments laid the foundation for a broader AI shift in 2023. That year, Alibaba released large language models, ramped up open-source activity through its ModelScope platform, and embraced an “AI-driven and user-first” strategy under new CEO Eddie Wu. The strategic pivot was further reinforced by the return of Jack Ma and Joe Tsai to active leadership.

To support its evolving focus, Alibaba restructured in 2024 under the “1+6+N” framework. The central management team was trimmed to 50 members, while six core business units were granted increased autonomy. Each unit now operates with its own CFO team and significant budgetary authority, a move designed to enhance agility and sharpen strategic execution.

Between 2023 and 2025, Alibaba refocused its business around e-commerce, cloud computing, and AI. It reduced non-core investments from 31 percent to 9 percent, generating 437 billion RMB (60.4 billion USD) in cash flow. While divestments such as InTime Department Store and RT-Mart resulted in losses, they signaled a pivot toward scalable, high-growth sectors.

As part of its AI strategy, Alibaba has provided capital and cloud credits to startups, enabling access to computing resources via Alibaba Cloud for model development and training. This approach strengthens Alibaba’s position in AI infrastructure and promotes ecosystem integration.

Internally, specialized teams now lead AI efforts across the organization. DAMO Academy oversees research, Alibaba Cloud handles infrastructure and commercialization, and the Smart Information Group focuses on consumer-facing applications. AI is being embedded into business operations, supported by the Qwen team, which has grown to approximately 100 members and leads work on large language models.

ModelScope, Alibaba’s open-source AI platform, currently hosts more than 54,000 models and serves a developer community of 5 million. While the platform has seen significant growth, it remains well behind the global leader Hugging Face, which offers nearly 1.6 million models.

On February 24, Alibaba announced a three-year investment of 380 billion RMB (53 billion USD) in artificial intelligence and cloud infrastructure—the largest private tech investment in China to date. The amount exceeds its total AI and cloud spending over the past decade, which was 327 billion RMB (46 billion USD). The plan involves daily spending of 350 million RMB (50 million USD) and marks a shift from e-commerce to AI as the company’s core focus. The stock rose after the announcement.

“This will be the most intensive period of infrastructure development in the company’s history,” said CEO Eddie Wu during the Q3 FY25 earnings call. He said AI will improve efficiency and create more value across Alibaba’s business and consumer platforms.

The investment aligns with a global surge in AI spending. Microsoft has committed 80 billion USD, Alphabet 75 billion USD, and Amazon around 100 billion USD. for AI infrastructure in 2025.*

To fund the effort, Alibaba is drawing from core business revenue, capital markets, and its cloud division. In November 2024, it issued 5 billion USD in bonds and 1 billion Singapore dollars (714 million USD) in green bonds. It also raised funds by selling a 357 million USD stake in SenseTime and exiting a 1.5 billion USD position in XPeng. Additional capital came from private fundraising for Hema (Freshippo). It is worth noting that Alibaba had initially planned to raise funds through the IPO of Cainiao Logistics, but the IPO was withdrawn in March 2024 due to market conditions and strategic considerations. *

Execution, however, remains a concern. In 2020, Alibaba pledged to invest 200 billion RMB in cloud, but spent only 116.3 billion RMB between 2021 and 2023, according to Caixin. This shortfall has raised questions about its ability to deliver on large-scale tech investments.