The Counterattack of Leapmotor, So Far

Turbulent tides within and beyond...

Table of Contents

Things that Caught Our Attention

The Establishment of Leapmotor

Product Evolution and Strategic Shifts

An Untimely End of the First Model

Full-stack In-house Research and Development

Cost Reduction and Efficiency Improvement

Things that Caught Our Attention

Last month, Tech Buzz China completed its exhilarating Spring 2024 Electric Vehicle Trip, journeying through five vibrant cities and visiting eight key players in the EV supply chain—all in just one week. The trip was a smashing success, sparking enthusiasm among investors, some of whom are already clamoring for a follow-up trip centered around the battery supply chain.

But that's not all! We're gearing up for another thrilling EV adventure this autumn. We're in the midst of curating a stellar company list and ironing out the logistics. If you're an investor eager to dive deep into the heart of China's booming EV industry and battery supply chain, keep your eyes peeled for updates. Seeing is believing—join us on the road!

Introduction

How many of China's new electric vehicle (EV) startups will survive? In the peak year of 2018, a substantial amount of investment flowed into these new EV companies. At one point, China had over 40 such brands, so-called "new forces", entering the EV market, but within just three years, more than 30 of them had failed.

In the following three years, NIO, Xpeng, Li Auto, Leapmotor, and NETA survived through 2023. However, 2024 is set to be even more brutal. In an internal letter from 2024, Xpeng's Chairman stated, "This year marks the start of fierce competition for Chinese car brands, akin to entering an arena of intense elimination." The competition in the car market is fierce, with continuous price wars.

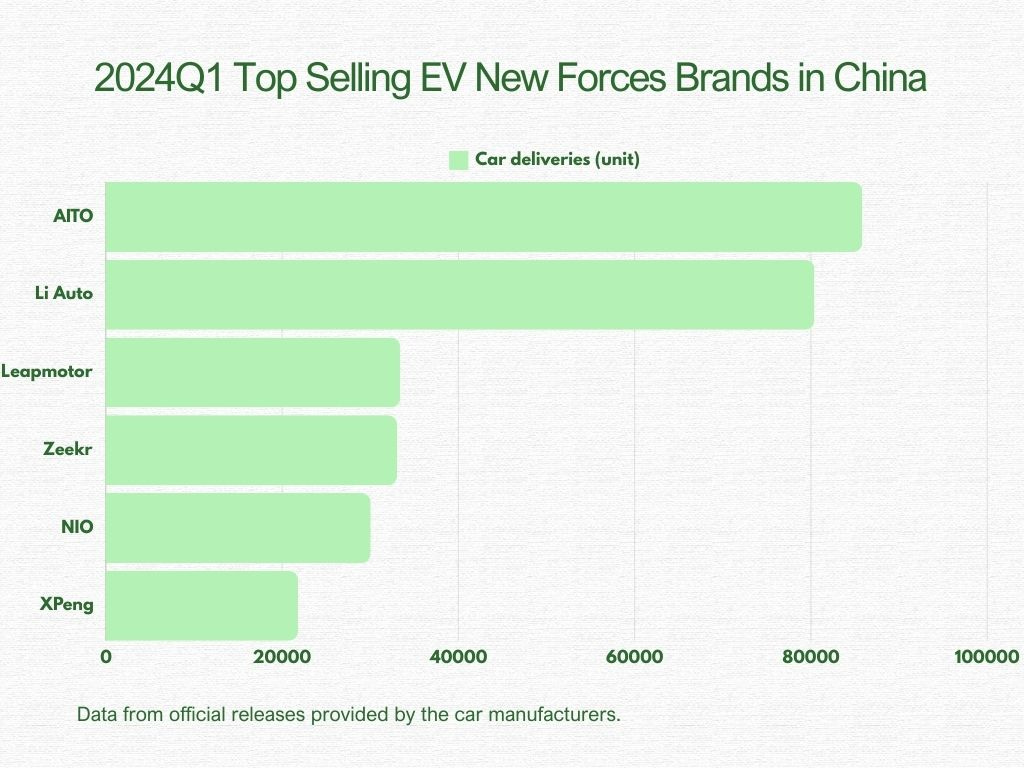

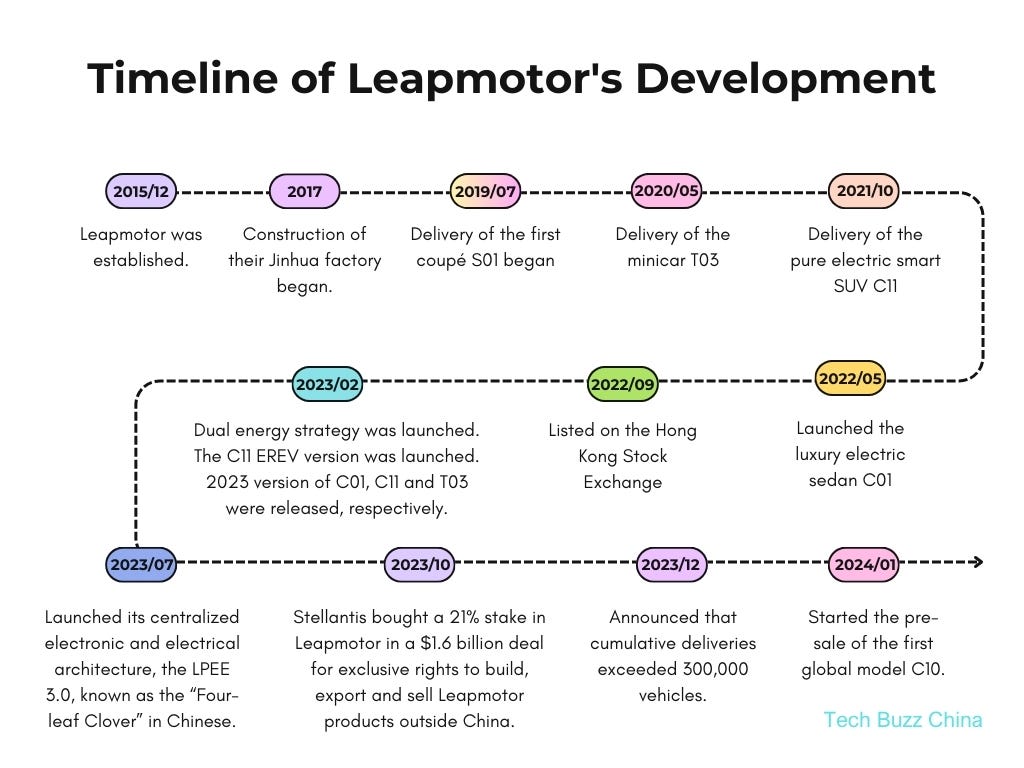

Founded eight years ago, Leapmotor started as a relatively unknown brand and filed an IPO following NIO, Xpeng, and Li Auto. Now it has risen to the third in delivery volume among new forces in 2024Q1.

In this issue, we examine the journey of Leapmotor, detailing the company's inception, product evolution, and strategic pivots. We will cover the successes and setbacks, from the rise and fall of Leapmotor's first model to its pursuit of cost leadership. Delve into the challenges of sustained losses, the path to its IPO, and the implementation of a dual power strategy. Gain insights into Leapmotor's comprehensive in-house R&D initiatives, including the Clover architecture, CTC 2.0 technology, intelligent oil-cooling electric drive system, and advanced smart driving system. Lastly, we will highlight Leapmotor's focused efforts on cost reduction, efficiency enhancement, and its ambitious expansion into the global market.

Freya Zhang and Ed Sander, Research Editors

Rui Ma, Consulting Editor

(click on the images above for information on the Tech Buzz China team)

The Establishment of Leapmotor

Zhu Jiangming, the founder of Leapmotor, once divided the new forces in car manufacturing into three categories: those with traditional automotive industry experience, called "car people"; those from the internet sector; and those from the technology sector. The first category includes figures like Shen Hui from Weltmeister and Gu Feng from Aiways; the second category is represented by top-tier new energy firms like NIO, XPeng, Li Auto, and their founders; Zhu Jiangming himself, along with Elon Musk (although Musk is arguably a hybrid, his exploits in SpaceX are much more recognized in China than his PayPal legacy), are categorized in the third group. On its official website, Leapmotor has written that it is a car company with tech DNA, belonging to the "tech people making cars" category.

After graduating in 1990 from Hangzhou University (later merged into Zhejiang University) with a degree in electronic engineering, Zhu was assigned to work at a factory operated by the Zhejiang School of Electronic Industry. In 1993, Zhu and his friend Fu Liquan started their entrepreneurial journey with a startup capital of 5,000 yuan, primarily selling telecommunications equipment, programmable switchboards—a product that Huawei and ZTE also started with. As the 21st century approached, showing signs that older switchboard technology would be phased out, many companies started shifting their focus.

Early in the 21st century, Zhu’s team decided to pivot to the security surveillance field. In 2001, Hangzhou Dahua Information Technology Co., Ltd., the precursor to ZHEJIANG DAHUA TECHNOLOGY CO., LTD. (SHE: 002236, market cap 54,69 billion CNY), was established with a registered capital of 500,000 yuan, a hundredfold increase from the initial capital.

At Dahua, Zhu played a central role in management and technology, similar to Elon Musk. In 2002, Zhu led his team to develop one of the first 8-channel real-time DVRs (digital video recorders) based on an embedded platform. With its leading technological products, Dahua quickly accelerated its growth, successfully listing on the stock market in 2008 and reaching the second-largest global market share by 2015, second only to Hikvision.

A quick side note: the security industry has faced challenges in both the B2B (business-to-business) and B2G (business-to-government) markets in the past two years, showing signs of weakness during the pandemic with limited market recovery. In China's surveillance equipment market, Hikvision and Dahua have been in fierce competition. Despite receiving more support, Dahua remains smaller than Hikvision. Internationally, both companies are actively expanding, but their growth has been slow. Performance in the US and Europe has declined, prompting both to shift focus to the Middle East and Asia. In the first half of 2023, Hikvision's overseas revenue grew by 3%, while Dahua's increased by only 1.05%.

Back in the year 2023, Tesla was founded. The prelude to the electric and smart car industry began overseas and eventually sparked a wave in China’s industry. Between 2014 and 2015, companies like NIO, XPeng, and Li Auto were established. Zhu also eyed the new energy vehicle sector for his next venture, supported by his old friend and chairman of Dahua, Fu Liquan. In December 2015, Dahua, Fu, Zhu, and other shareholders jointly established Leapmotor, holding shares of 33%, 32%, and 20%, respectively. Since then, Leapmotor has become Zhu's primary focus.

Product Evolution and Strategic Shifts

Leapmotor currently offers seven models of extended-range and fully electric vehicles, including the T03, C11, C01, and C10, each available in both pure electric and extended-range versions. These vehicles primarily target the car market with prices under 200,000 yuan.

An Untimely End of the First Model

Leapmotor's product positioning has been quite versatile. Initially, they launched a two-door Coupé, the S01. Coupé models have always been a challenge for domestic brands. Geely, a leading brand, also faced criticism with its early model between 2003 and 2006, the Beauty Leopard, which was mocked as "Geely willing to buy back from owners."

Leapmotor argues that while most mainstream manufacturers focus on SUVs, larger cars generally have range issues with current technology, whereas small cars have better range. At that time, the SO1 has no competitors in its price range, making it more recognizable. However, the S01 did not perform well in the market, reflecting the company's lack of experience. Here are two anecdotes:

Leapmotor's journey into the automotive world began with a rookie mistake—they didn't know that producing and selling cars required special qualifications. As a result, they had to subcontract the manufacturing of their first model, the Coupé S01, to Changjiang Automobile. It wasn’t until a strategic move in December 2020, when they fully acquired Fujian New Forta, a traditional vehicle OEM, that Leapmotor finally secured their essential full vehicle production qualification.

After the launch of the S01, Leapmotor was eager to showcase their latest innovation with media test drives, a common rite of passage for new models. They entrusted a service provider with the seemingly simple task of obtaining temporary license plates. However, in a turn of events straight out of a cautionary tale, the provider cut corners and used counterfeit plates. Unbeknownst to the journalists, their thrilling test drive had a sting in the tail—a traffic stop where the unsuspecting editor behind the wheel racked up a shocking 12 penalty points from the traffic police.

Despite being marketed as "fully self-developed," the S01 did not impress with its product capabilities. Although it featured an intelligent driving chip co-developed with Dahua and offered advanced features like facial recognition and fingerprint unlocking, many consumers reported issues. These included the car's system screen going black, overheating alarms from the battery during normal charging, and body vibrations, all of which significantly affected the driving experience. As a result, Leapmotor was forced to recall some of the S01 models due to software problems.

Since its launch, the S01's sales performance has been disappointing. In 2019, only about 1,000 units were delivered, and in the first nine months of 2020, just 915 units were sold. It lagged behind competitors like the similarly priced and timed GAC Aion S and the BAIC New Energy EX5. The failure of the S01 plunged Leapmotor into a slump, and at its most challenging point in 2020, company executives even considered quitting car manufacturing, according to insiders close to the company.

Cost Leadership - Old Man's Joyride

Ultimately, Leapmotor decided to adjust its strategy and chose to compete on cost-effectiveness by targeting the lower-tier market. Based on this, Leapmotor's second car model, the T03, was positioned as an A00 class all-electric compact car and launched in May 2020. In China, A00 class cars are commonly known as compact sedans, and this type of car is humorously referred to as "老头乐" (lǎo tóu lè), which roughly translates to "old man's joyride."

Compared to its competitors, the T03 stands out because it is equipped with Level 2 autonomous driving features and has a leading battery range of 403 km per the New European Driving Cycle (NEDC). Initially priced at just 69,800 yuan (about $9,600 USD), it earned the nickname "price butcher" and became Leapmotor's best-selling model. In 2020 alone, sales of the T03 reached 10,300 units, far exceeding the 1,125 units of the S01 model. The T03 was popular among consumers who needed a car for urban commuting.