Things that caught our attention

Organizational Transformation & Corporate Culture Shift

Things that caught our attention

One of the top EV brands in China, NIO, unveiled its first smartphone, NIO Phone, in three versions priced at ¥6,499, ¥6,899, and ¥7,499 for the Performance, Flagship, and EPedition editions, respectively. NIO's CEO also hinted at the development of a second-generation NIO Phone and upcoming NIO-branded headphones. However, there are no current plans for a NIO smartwatch or tablet. (Source) We deep-dived into this company not long ago: Taking a Power Swap - Charting NIO's Journey

Alibaba Group's subsidiary, Trendyol (Turkey's largest fashion e-commerce platform), announced Alibaba's plans to invest $2 billion in Turkey. According to the statement, Alibaba Group's President has expressed support for Trendyol's international expansion, emphasizing Turkey's potential as a leading cross-border e-commerce hub. Alibaba has already invested $1.4 billion in the country through Trendyol. (Source)

Cainiao Group, Alibaba's logistics arm, might submit its listing application to the Hong Kong Stock Exchange in the coming weeks. The company has opted not to comment on these reports. (Source) To learn more about Cainiao, read our recent article Alibaba Cainiao: Delivering Innovation, Globally?

Alibaba's overseas-oriented e-retailer AliExpress is teaming up with Cainiao to launch an international shipping service in the UK, Spain, The Netherlands, Belgium and South Korea. Customers in these five countries can receive packages from China within five working days. (Source) Our team member Ed Sander is sceptical about the news.

On September 27, Freshippo's first high-end supermarket, Freshippo Premier, made its debut in Shanghai. (Source) Over the past eight years, Freshippo has experimented with various business models. Read Redefining Fresh: Alibaba's Freshippo and the New Frontier in Grocery Business to know how the company uses big data, private labelling, and supply chain optimization to reshape the fresh produce business.

We hope you enjoy this new article, in which we continue our exploration of Chinese EVs. After several articles on this topic, we will return to the topic of grocery e-commerce in two weeks.

Freya Zhang, Ed Sander & Rui Ma

(click on the images above for information on the Tech Buzz China team)

Introduction

When you search for the meaning behind the name BYD (Biyadi 比亚迪), most results will tell you it stands for "Build Your Dreams." Originally, the company was named Yadi Electronics (Yadi Dianzi 亚迪电子) and was founded in Yadi Village (Yadi Cun 亚迪村) in Shenzhen. The name was chosen for ease of business registration. Later, to gain a better placement in alphabetical lists during trade shows and promotional events, the letter 'B' was added to the front of its name, transforming it into BYD Electronics. At that time, BYD didn't have a clear purpose; its survival was still uncertain.

The term "explosive growth" aptly characterizes BYD over the past two years. In 2020, BYD's sales couldn't crack the top 15 in the national automotive rankings as the company was in its second year of declining sales, plummeting to its lowest point since 2018. Fast forward to today, BYD has unseated Volkswagen to become China's top-selling passenger car brand. By the second quarter of last year, it even overtook Tesla to become the global leader in new energy vehicle sales—a position it continues to maintain.

Founded in 1995, BYD originated in mobile lithium battery business. Around 2003, Wang Chuanfu, CEO of BYD, commented at an entrepreneur forum that the "battery business would hit a ceiling within two years." In 2022, secondary rechargeable battery operations disappeared from BYD's annual report due to weakened demand, owing to a global decline in consumer electronics sales. Mobile components were retained due to their broader application in consumer electronics and smart homes, and high potential in "smart cockpit" - an advanced, centralized interface in vehicles that integrates functions like navigation, entertainment, driver assistance, and connectivity technologies.

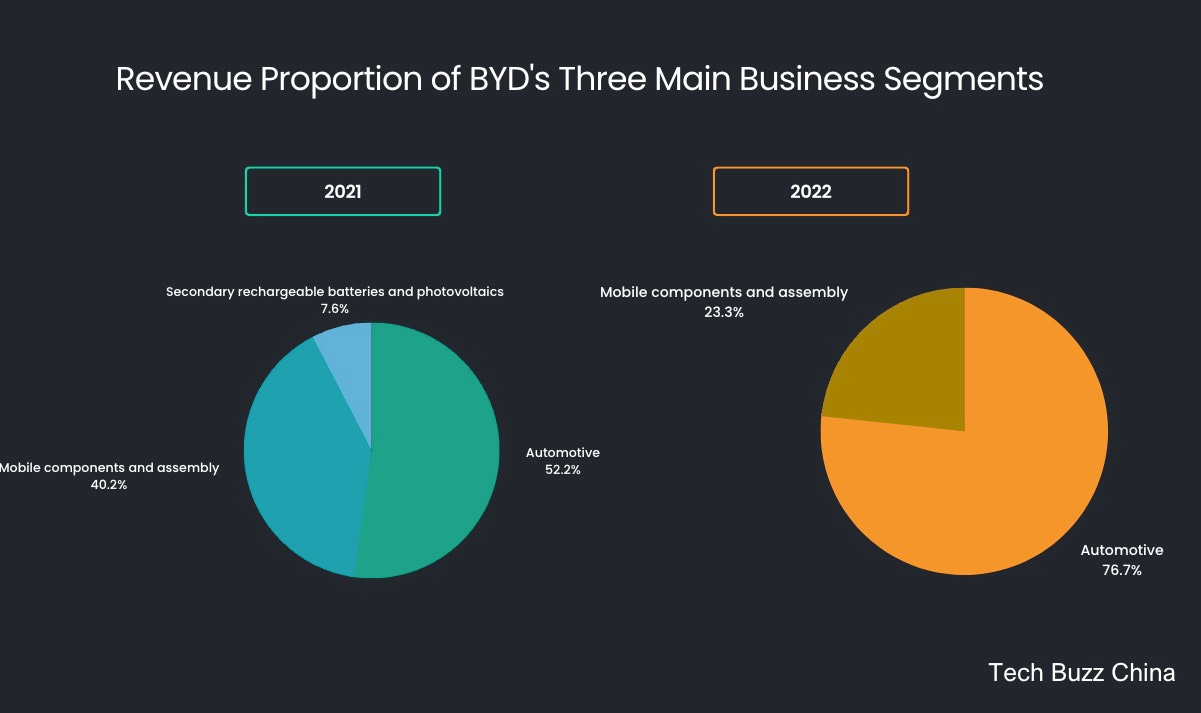

Now BYD's three main business segments are automotive, mobile components and assembly, and secondary rechargeable batteries and photovoltaics. In 2021, these segments generated revenues of 1.125 trillion, 865 billion, and 165 billion yuan, respectively, accounting for 52%, 40%, and 7.6% of total revenues. By 2022, automotive and mobile components contributed 76.6% and 23.3% to the revenue, constituting nearly 100%. The automotive sector alone contributed 100% of the revenue growth, solidifying its position as BYD's pillar industry.

To find a second growth curve, Wang Chuanfu was keen to identify an industry related to lithium batteries. New energy vehicles fit the bill perfectly; a vast market that could benefit from BYD's mobile battery tech expertise. Wang Chuanfu believes "it's all manufacturing; the experience can be replicated."