Table of contents

Things that caught our attention

Story Mode and the Lower-Tier Market

Support long-form videos and creators

Integration of the e-commerce business department

Restructuring the organization

Things that caught our attention

Alibaba’s grocery arm Freshippo is expected to go public on the Hong Kong stock exchange as soon as mid-November, local media outlet HKET reported. (Source) A few weeks ago, we wrote about Redefining Fresh: Alibaba's Freshippo and the New Frontier in Grocery Business.

The Chinese authorities are said to be ending the rectification of Ant Group with a fine of nearly $1 billion. (Source)

Temu has launched in Japan. (Source) Check out our recent article on Temu's rise: Temu: from $0 to $3 billion in 10 months.

Alibaba is pledging 5 day global delivery through Cainiao and has also launched a local delivery service in Spain, where it is operating webshop Miravia. (Source, Source) Learn more about Cainiao in our recent deep-dive: Alibaba Cainiao: Delivering Innovation, Globally?

Key takeaways

Bilibili, though uniquely positioned in the market, struggles to turn a profit and has seen a decline in Monthly Active Users for two consecutive quarters, currently at 315 million.

The company's growth strategy is multi-screen, multi-scenario, with Story Mode as a new feature in the Bilibili community to complement existing live streaming and OTT scenarios.

Bilibili aims to avoid direct competition with Douyin and Kuaishou, focusing on high-quality long-form video content and a comprehensive ecosystem. The Story Mode of Bilibili competes with Xiaohongshu in the long term, with a goal to achieve a DAU count of 50 million and eventually surpass Xiaohongshu.

Bilibili will shift from displaying the number of video plays to the total minutes played, which may encourage the spread of longer videos.

The platform plans to introduce new monetization methods to support content creators financially.

After China resumed approval of gaming licenses in 2022, Bilibili plans to concentrate on Role Playing Games development and discontinue underperforming projects.

Unlike Xiaohongshu, which focuses on brand advertising, Bilibili primarily employs performance-based advertising (accounting for half to two-thirds of its advertising business), with the remainder coming from brand advertising and resource exchanges with app stores.

Billy-who?

Bilibili is a video-sharing platform that's often compared to YouTube, but with a unique twist that sets it apart. Unlike other platforms, Bilibili is a melting pot of livestreaming, gaming, professional long-form video, and user-generated content. It's an ecosystem that has captured the hearts of millions of users, particularly the younger generation. This platform has captivated China's Gen Z with its community-focused approach, in the early days requiring users to pass a 100-question quiz to become full members, fostering a shared culture.

Established in 2009, Bilibili is no longer the "obscure company" primarily serving a niche audience of anime lovers that it once was. Thanks to its breakthrough campaign during the New Year's Eve gala in 2019, the company has managed to break out of its initial narrow circles and is now recognized by a much wider audience. In case you're not familiar with this company, we talked about it in our podcast in 2019 and wrote a follow-up article in 2020.

On June 1st, Bilibili (NASDAQ:BILI, HKEX:9626) released their unaudited financial report for Q1 2023. What better day to do it than Children's Day, a nice nod to their "Generation Z" audience?

Bilibili's unique positioning in the market is widely recognized, but turning a profit has always been a challenge. As Baidu spinoff iQiyi and Tencent-invested Kuaishou find ways to monetize and claw their way out of losses, the market is eagerly waiting for Bilibili to break even.

In Q1 of this year, Bilibili's total revenue was 50.69 billion yuan, a slight increase of 0.3% year-on-year. Net losses were 6.296 billion yuan, a decrease of 72% year-on-year. This reduction in losses was mainly due to Bilibili tightening its belt: operating costs were 40 billion yuan, down 6.6% year-on-year, and total operating expenses were 25 billion yuan, down 11% year-on-year.

On the user side, Bilibili managed to increase its daily active users (DAU) by 18% year-on-year to 93.7 million, despite significantly reducing its marketing expenses. This shows that the platform is continuously attracting new users as it expands beyond its initial circles. However, monthly active users (MAU) declined slightly to 315 million, marking the second consecutive quarter of a downward trend in MAU.

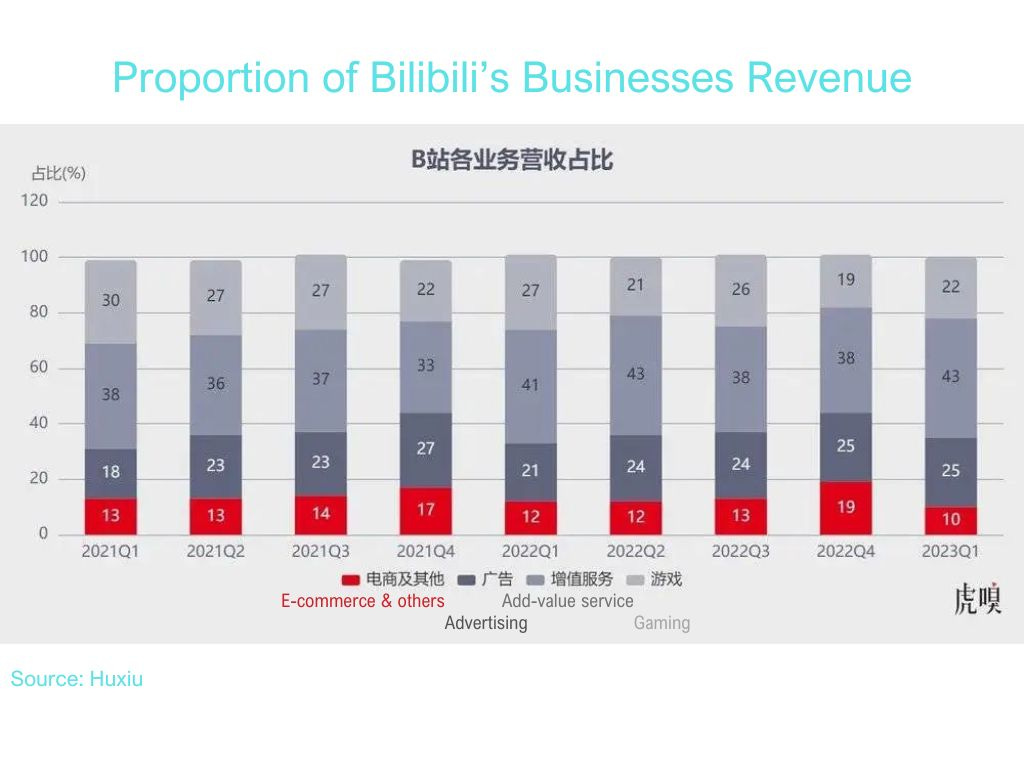

The main contributors to Bilibili's Q1 2023 performance were value-added services (like premium memberships), advertising, gaming, IP derivatives (like merchandise e-commerce), and other businesses.

Bilibili's value-added services, mainly premium memberships, brought in 2.16 billion yuan in revenue, a slight increase of 5% year-on-year. This was the most stable growth among the four main businesses.

According to Bilibili, premium members enjoy content privileges (like early access, free access, and discounts), decoration privileges (dress up your avatar and profile page etc.), identity privileges, and trial listening privileges. The current prices for regular and super memberships are 108 yuan/year (~$15) (148 yuan/year after the first year) and 178 yuan/year (~$25), respectively.

Bilibili's members are primarily paying for content. In terms of content operations, one of Bilibili's most important initiatives was the launch of the Story-Mode feature (a single-column information flow for short video content) in 2021.

Story Mode and the Lower-Tier Market

Bilibili's key strategy for user growth is multi-screen, multi-scenario. Story Mode, as a new function in the Bilibili community, complements the existing PUGV/OGV (Professional User-Generated Video / Occupationally Generated Video) live streaming and OTT (Over The Top) big-screen scenarios. The Story Mode vertical playback interface (which supports up and down scrolling, liking, commenting, and forwarding on the right side, and following and description at the bottom) is similar to the TikTok / Douyin interface (also adopted by YouTube Shorts and Instagram Reels). Some industry insiders believe that Story Mode, unlike Bilibili's typical longform anime and niche style, is more suited to the current "fast-food" short-video consumption era.

(Note: the section below is only available to paid Tech Buzz China subscribers)