Electrifying the Future: CATL and its Power Play

CATL's Innovative Journey and the Implications for the Global Battery Landscape

We would like to express our sincere appreciation to everyone who attended our Happy Hour at the Berkshire Hathaway Shareholder Festival in Omaha last weekend. It was truly a pleasure to see so many familiar faces at the event. We were thrilled to receive over 230 RSVPs, and we're delighted to report that at least 170 of you were able to join us. Please accept our apologies if we were unable to personally greet each of you; the turnout was tremendous, and the crowd was quite impressive. Thank you once again for your participation!

Things that Caught Our Attention

The Evolving Battery Landscape

CATL's Future: Qilin vs. Tesla-Designed 4680: A Battle of the Batteries

Shift in the Battery Industry's Competitive Landscape

Growth Opportunity: Laminated Technology

Things that caught our attention

Alibaba Cloud has officially launched Alibaba Cloud for Financial Services, which supports financial institutions in creating a new IT architecture. We wrote about Alibaba subsidiary in our Rain or Shine for Alibaba Cloud? piece not long ago.

Douyin has published standards and industry initiatives for content generated by artificial intelligence (AI). It mandates that all platform participants, including creators, live streamers, users, merchants, and advertisers, visibly label AI-generated content when using generative AI technologies on Douyin. This is aimed at helping other users distinguish between virtual and reality, especially in potentially confusing scenarios. We focused on Baidu’s LLM attempt, Ernie Bot, a few weeks back.

Data from Amazon Global Store shows that over the past three years, the number of Chinese brand sellers going global through Amazon has nearly tripled, and their compound annual growth rate over the past two years was 50% higher than that of non-brand sellers. One year ago, however, it didn’t look so rosy: Chinese Sellers are Leaving Amazon. What's Their Story?, but perhaps it just encouraged sellers to focus on building their own brand IP.

Li Auto's Q1 2023 earnings report revealed that the company delivered a total of 52,584 new vehicles in the first quarter, a YoY increase of 65.8%, marking their best single-quarter performance. For Q2, Li Auto forecasts a delivery volume of 76,000 to 81,000 vehicles, a YoY increase of 164.9% to 182.4%, and expects total revenues to range from CNY 242.2 billion to CNY 258.6 billion, a YoY increase of 177.4% to 196.1%. We highlight their performance because going forward, Li Auto is one of the first automakers to use CATL’s 15-minute quick-charge Qilin batteries, a major part of today’s post.

Leave a comment here or email team@techbuzzchina.com and let us know what topics you have an interest in learning more about China tech.

Key Takeaways

Qilin batteries, CATL’s new flagship product, only has an addressable market of about 15% of the domestic EV market at present due to its higher costs and market positioning in high-end vehicles with ranges exceeding 600 km. Besides reducing prices, what CATL really needs is to develop a market.

The Qilin battery is often compared to Tesla's new and advanced (often referred to as “game-changing”) 4680 battery cell. However, production of the 4680 has been negatively affected by the slow resolution of core technical issues, especially as related to folding and welding techniques, resulting in only a 60% yield rate.

Composite collectors are a core component of the Qilin battery’s affordability and performance. However, it’s been challenging to manufacture composite collectors due to the restricted availability of PET copper foil, which is itself primarily due to bottlenecks in mass production.

2025 will be a crucial year, as the semi-solid-state battery industry is expected to have matured and the competitive landscape will have shifted in favor of current incumbents, washing out second and third tier battery makers who will likely be priced out of the market. By then, CATL's capacity may exceed 700 GWh (versus 170GWh as of January 2023), solidifying its market leadership.

Laminated products, mainly used in square batteries that have better performance and increased life cycle compared to wound batteries, are potentially growing from currently less than 20% of the entire equipment market to over 60%, presenting an opportunity for manufacturers that are able to produce at scale.

Introduction

In this edition of our newsletter, we're focusing on CATL, a global powerhouse in the lithium-ion battery production industry. We're exploring how they have pushed boundaries with their innovative 'composite collectors' technology and setting new industry benchmarks. We'll dissect their acclaimed product, the Qilin batteries, and delve into CATL's cost advantages, drawing comparisons with Tesla's 4680. We'll scrutinize suppliers and shed light on CATL's strategic approach to a phased supplier transition. The impending price drop for CATL in 2023 is an inevitable consequence of two key dynamics - supply and demand for materials, and value-driven pricing. Looking ahead, we expect the battery industry's competitive arena will be dominated exclusively by automakers and elite battery manufacturers, with second and third-tier battery makers largely priced out of the market. We'll also investigate two growth opportunities within the supply chain, namely the laminating machine and structural components markets.

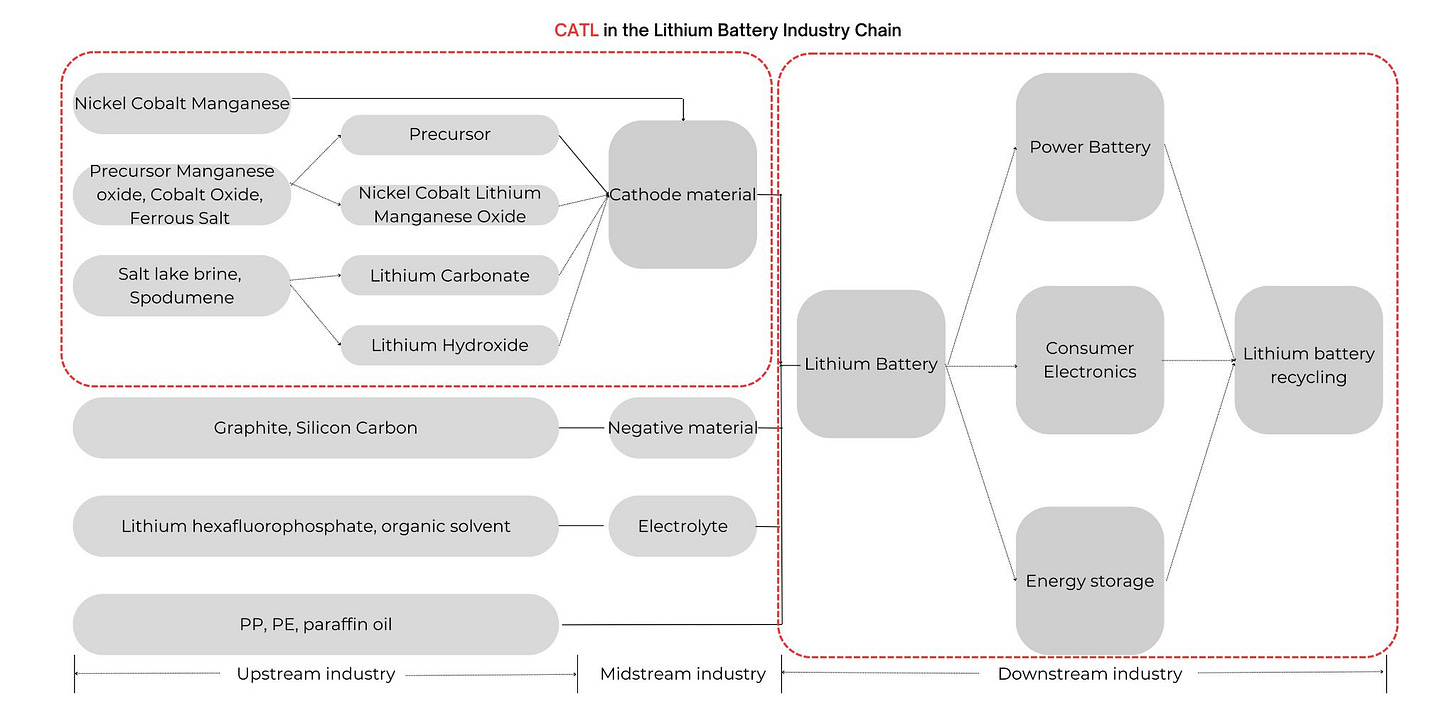

CATL has made significant strides since its IPO in 2018, carefully crafting its position across the supply chain, spanning from upstream lithium and sodium mining, to battery anode/cathode materials, manufacturing equipment, and even branching into auto-related components like chips and chassis. The company’s current business model is primarily oriented towards downstream activities, with three key sectors underpinning its business: power batteries, energy storage systems, and recycling. In 2022, power batteries, such as those used in electric vehicles, were the major revenue generator, accounting for 72% of the total.

The Evolving Battery Landscape

In the swiftly evolving power battery landscape, a window of opportunity is emerging between 2022 and 2024. This period will be a vital stepping stone for industry players to cement their roles from 2025 to 2030. It's an era where the command of power battery technology and cost management would dictate the competitive echelons, steering the industry's trajectory.

As we venture deeper into the age of electric vehicles, global penetration rates are witnessing a surge, exceeding the 10% mark. A critical result of this upswing is the gradual ascendance of second-tier domestic battery manufacturers. These firms, after a patient 2-3 year gestation period spent garnering customer loyalty and refining operational efficiencies, are starting to leave their imprint on the market. The domestic competition is thus intensifying, signaling a reshuffling of industry positions.

Adding another layer of complexity to this competitive matrix are the European and American battery factories. Expected to solidify their operational footprints between 2023 and 2024, they represent a new entrant category in this global race. Furthermore, the trend of automakers exploring in-house battery production opens another competitive front, ushering global battery manufacturers into a fresh and uncharted competitive cycle.

The power battery industry currently finds itself in a flux state, characterized by rapid technological advancements. The driving force behind the EV industry is witnessing a transformation, transitioning from being supply-driven to becoming demand-oriented. This change is amplifying the emphasis on cost-effectiveness and performance of power batteries, reaffirming the significance of technology and cost as the core competitive fulcrums.

On one side of this dynamic coin, we see domestic second-tier power battery manufacturers, who, after 5-7 years of high-speed growth, are beginning to see their technological capabilities mature. On the flip side, the burgeoning growth of EV manufacturers is paving the way for a broader market, leading to a bloom in the power battery industry. During this crucial cycle, second-tier battery enterprises are gradually integrating into the supply chains of mainstream automakers, resolving foundational issues like safety. This progress narrows the perceived gap between industry leaders and second-tier enterprises.

However, we ascribe to the belief that the power battery industry naturally favors those who get a head start. New technologies are subjected to extensive certification due to high safety requirements. The advent of technologies like sodium-ion batteries and solid-state batteries hasn't deviated from the incumbent electrochemical system. Industry leaders leveraging their extensive R&D inputs and years of accrued experience thus maintain a notable first-mover advantage.

CATL exemplifies this advantage. It leads the industry with iterative technological advancements and outpaces its competitors in terms of R&D investments. The breadth and depth of CATL's patent portfolio encompass the entire industrial chain, far exceeding its peers. From 2018 to 2021, the firm has accrued over 5000 patents, displaying a broad range of applications including upstream materials, equipment, and structural components. With a long-term strategic layout for emerging technologies such as sodium supplementation, anode-free batteries, and solid-state batteries, CATL's R&D expenditure in 2021 was a staggering 7.7 billion yuan, dwarfing the investment of second-tier competitors by 3-5 times. This financial commitment underpins CATL's continuous expansion of its technological advantage in this highly competitive industry.